Affordable homes drive buyers outside Rutherford County: 'Our values are still going up'

Murfreesboro couple Ebby and Jake Bolden will soon be moving to their first home in more affordable Shelbyville.

"We’re paying $320,000," said Jake, who along with his wife will be closing on a 1,900-square-foot home on July 27. "The same house in Murfreesboro is around $400,000 to $450,000."

The couple will be moving from their 1,100-square-foot rental house with a "sweetheart deal" monthly rent of less than $1,000. But they'll be able to build equity on a 3-year-old house that sold for $280,000 in 2020, said Jake, who works as a construction manager for commercial projects in Middle Tennessee.

"The equity is going to grow tremendously," said Jake, who expects the Shelbyville home to increase in property value in 10 years after the price climbed by $40,000 in three years. "It was a smart move for us."

The Boldens are among the many families moving between the schools years at a time when home prices have risen in the first five months of this year. The Nashville nine-county area that includes Rutherford had a 5.5% increase in home prices from January to May, according to an article in The Tennessean.

Rising home prices: Rutherford County homebuyers face challenge in quest for affordable housing

Although faced with longer commutes, Ebby foresees great value in living in the couple's first home even if she has to drive 30 minutes instead of 15 minutes to arrive at her special education teaching position at Plainview Elementary School in the Christiana community south of Murfreesboro on the far southside of Rutherford County.

"We're excited to put our roots down somewhere new," said Ebby, who's worked at Plainview Elementary since the school opened August 2021. "It definitely fits us with the space and the yard and neighborhood we’re getting. We're still able to grow and start a family."

The Boldens worked with Joe Hafner, the founder of Hafner Real Estate in Murfreesboro, to find their home. The couple are among the many first-time home buyers having to purchase affordable homes farther away from fast-growing Nashville and the nearby suburbs to communities such as Shelbyville, Manchester, Tullahoma, Woodbury and McMinnville, Hafner said.

"Right now, Nashville is the 'it' city in America," Hafner said. He advises buyers that finding an affordable home even if this means being farther from Nashville is worth it for the potential equity in their homes.

"Equity builds," Hafner said.

The typical 5.6% gain in property value annually over the past 25 years that functions like a savings account will more than cover the wear and tear on cars and gas costs with longer commutes, Hafner said.

What's ahead for Clari Park? Mixed-use development offers place 'to live, work and play'

Blackman community hottest area for Rutherford housing market

Home prices continue to rise in Rutherford County and Nashville area as many families seek houses before next school year in early August.

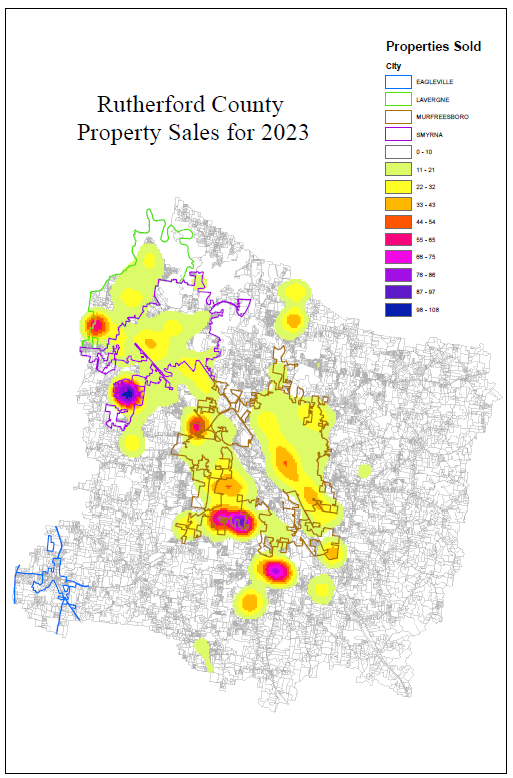

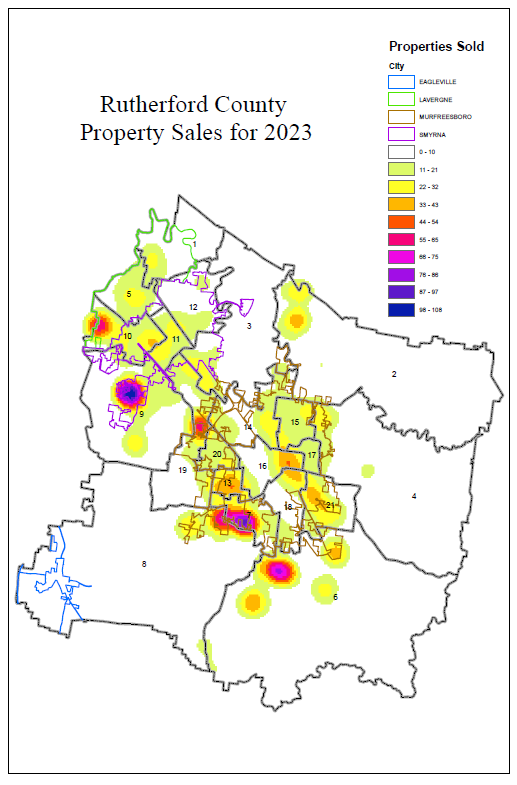

The higher demand appears to be southwest of Interstate 24, especially in the Stewarts Creek and Blackman schools areas, according to a heat map from Rutherford County Property Assessor Rob Mitchell's staff. The map shows where most 2023 property sales have taken place.

The average sale price for 536 homes closed in May within Rutherford County was $454,561 for an average house size of 2,149 square feet. That's up from May 2022 with an average price of $447,534 on 584 homes closed that averaged 2,055 square feet, according to Middle Tennessee Association of Realtors.

"Our values are still going up," Mitchell said. "They’re not stopping. I’m not afraid of a recession at this point in time. What I am afraid of is we’re going to make it more difficult for people to live here because of the tax burden."

The Rutherford County Commission recently agreed to a 16.1% property tax increase to help fund the higher cost of government and education services for the fast-growing county. This includes the county spending $156.3 million to expand and renovate overcrowded Riverdale, Smyrna and Oakland high schools.

County offers tax freeze and tax relief: 16.1% property tax hike won't apply to eligible tax freeze recipients who already applied

South Murfreesboro, Barfield and Rockvale areas also hot areas

The housing demand in the Blackman community also means homes there are becoming more expensive, said Scott Abernathy, president of Middle Tennessee Association of Realtors.

Blackman offers modern new housing, schools built this century and good access to Interstates 24 and 840, said Abernathy, who's also president of Property Management Inc. (PMI) Professionals. PMI includes a Murfreesboro office that manages 450 rental houses in Middle Tennessee. PMI also has operations in Memphis and Huntsville, Alabama.

South Church Street and the Barfield community in the south Murfreesboro area remain strong for home sales. The Rockvale area along state Highway 99 (New Salem Highway/Salem Pike) and southwest of Murfreesboro and I-24 also is a higher housing demand area, Abernathy said.

The northside of Murfreesboro remains a strong real estate area even though it's not as convenient for commuters heading out of the city, Abernathy added.

Condos with an atrium view? Fountains at Gateway phase 2 a 'trend setter'

Move-in ready townhomes in Murfreesboro start at $280K

The rising prices for the housing market also means families have a harder time finding a home that's affordable.

"It’s difficult to find anything under $250,000," said Mitchell, the county's elected property assessor. "If you have a piece of property that’s $250,000, it’s going to sell awfully quick if it’s inhabitable."

Hafner, the real estate broker who helped the Bolden family find their Shelbyville home, would put the starter home price for a townhouse in Murfreesboro at closer to $300,000.

"If you’re looking at something that’s move-in ready, you are probably looking at $280,000 or more," Hafner said. A single family detached starter home is at least $335,350 in Murfreesboro unless buying an older house or one that needs some work, he added.

'It's a steady, stable market': What June real estate numbers say about Nashville

So families are looking at either buying a town home with no garage or backyard, or buying more affordable houses farther from Nashville, Hafner said.

"Many of my young families who bought in Woodbury, Manchester or Shelbyville did so because they couldn’t afford the house they needed in Murfreesboro," Hafner said.

The average May home sales price on 65 closings in Bedford County in the Shelbyville area, for example, was $346,229 − a decrease of $108,332 compared to home sale prices in Rutherford County for same month. Bedford's average square feet on the May sales was 1,872, a reduction of 277 square feet from Rutherford's average.

Buying less expensive homes in more remote locations, however, may not lead to savings for people if they're buying older drafty houses and spending more on gas and wear and tear costs on their cars, said Abernathy, president of Middle Tennessee Association of Realtors.

People buying older houses in areas farther from Nashville also could pay more for utilities, maintenance and home owners insurance because firefighting protection is not as strong as in larger cities, Abernathy said.

Downtown development plan: Keystone project proposal includes hotel, condos and apartments built by Murfreesboro City Hall and Linebaugh Library

Incomes not keeping pace with rising home prices

Another issue is incomes not rising at the pace of housing, said Abernathy, who has 30 years experience in real estate.

One factor that's driving up costs is a lack of housing inventory to keep pace with demand from people moving to Rutherford County and other Middle Tennessee counties, Abernathy said.

Homes becoming unaffordable can mean an increase in the homeless population, Abernathy said.

The rise in interest rates by the Federal Reserve in response to inflation the past couple of years have convinced many people to stay in their homes purchased with lower interest rate loans rather than seek another house, Abernathy said.

"They're trapped in a mortgage at 2.87%," Abernathy said.

The potential equity earnings, however, should be viewed as a worthwhile reason to buy a desired home even if interest rates are higher, Hafner said. He recommends home buyers seek cost benefit analysis with the help of real estate professionals to learn affordable mortgage options to buy homes.

Property tax and impact fee issues: 7 TN lawmakers annoy Mayor Carr with letter saying his proposed property tax hike unneeded

Seller's market during pandemic ends

The current housing market following the rise in interest rates on mortgages have returned to pre-pandemic levels with homes being on the market from 30 to 90 days before closing, Hafner said.

In the two years prior to July 2022, the average period for houses on the market was 10 days, and sometimes a home could even reach a price agreement for purchase on the same day as the listing, Hafner said.

Now home sellers to speed up the process might be willing to cover closing costs, which can range from $6,000 to $12,000 on a $400,000 home, Hafner said.

Although property sellers may be getting less than their asking price, real estate remains a profitable investment, said Mitchell, the property assessor for Rutherford County.

"People who have property they bought within the last five years are selling for more than than they paid," Mitchell said.

The Nashville area also has been a hot market with people and corporations moving to Middle Tennessee from other states such as California with higher taxes and real estate costs, Hafner said.

People may move from other states for political reasons. The pandemic also has led to people working from home and deciding they can live in states such as Tennessee with no income tax rather than remain in high-tax states, Hafner said.

HQ leaves California for Tennessee: Icee to bring 200-plus jobs, headquarters to La Vergne

Rise of homes converted to rental properties

Part of what's contributed to rising costs is that national real estate investment trusts have purchased nearly 10% of Rutherford County's 95,000 homes to convert into rental properties, Mitchell said.

"They can impact the market in such as way that they make it more difficult to find affordable housing," Mitchell said.

A real estate investment trust has available cash to buy a home and make necessary repairs. A family, however, typically must go through the mortgage loan process and wait on inspection before closing on a house, Mitchell said.

The real estate trusts may tack on fees in addition to rent, and these costs can make financial conditions more difficult for families to save up to buy their own homes without having to move out of the county to a less expensive community, Mitchell said.

Mitchell recommends that families seeking to rent homes use local businesses rather than real estate trusts that send the money out of state or even overseas.

"Shop local," Mitchell said. "If you have a problem, you know where they live."

Impact fee options divides council: 'We're going to be a city of have and have nots'

Rents rose while investors bought houses

Among the local businesses offering rental homes is Abernathy's PMI. The out-of-state private equity and hedge fund investors, which the property assessor calls real estate investment trusts, had been buying starter homes typically in the 1,500 to 1,800-square-foot range rather than larger homes. This trend, however, has slowed recently because the investors can make money in other ways with interest rates being higher, Abernathy said.

The low interest rates that came to stimulate a previous slumping economy during the Great Recession that started around 15 years ago influenced the hedge fund and private equity investors into to buying homes to earn income from rental properties and long-term equity from the real estate, Abernathy said.

The rising costs of houses in the Middle Tennessee market, however, combined with the higher interest rates are moving these investors of starter homes out, Abernathy said.

"Rents have stabilized of late and not gone up as much," said Abernathy, adding that starter-home sized rental houses are collecting a monthly rent ranging from $1,400 to $1,600. "What's not topped out is the house values and interest rates."

Rental property market: Decrease in apartment units draws planning commission approval in TDK proposal

First-time home buyers find price they can afford

People are still adjusting to interest rates returning to being above 5% after viewing the previous low rates as being normal, Hafner said.

"We went through a 10- to 15-year period," with "a generation of people" who think the lower interest rates were normal, Hafner said.

"We may not see below 5% again in my lifetime," Hafner said.

The return of interest rates above 5% can still work for first-time home buyers like the Boldens with the house they're buying in Shelbyville.

The couple's goal was "finding a price we could afford in a home we really like," Jake said.

While his wife was raised in Murfreesboro, Jake grew up in the smaller, rural Eagleville community on the far southwest side of Rutherford County and is familiar with a Shelbyville community with similar characteristics but farther south.

"The commute was never a worry for us," Jake said.

Who else is moving to Shelbyville? Uncle Dave Macon Days festival relocating to Shelbyville: 'We always wanted a wider reach'

Reach reporter Scott Broden with news tips or questions by emailing him at sbroden@dnj.com. Follow him on Twitter @ScottBroden. To support his work with The Daily News Journal, sign up for a digital.

Home sale data May 2022 and 2023

Rutherford County

Total homes closed May 2022: 584

Average square feet for closed homes May 2022: 2,055

Average sale price May 2022: $447,534

Total homes closed May 2023: 536

Average square feet for closed homes May 2023: 2,149

Average sale price May 2023: $454,561

Bedford County

Total homes closed May 2022: 67

Average square feet for closed homes May 2022: 2,170

Average sale price May 2022: $406,655

Total homes closed May 2023: 65

Average square feet for closed homes May 2023: 1,872

Average sale price May 2023: $346,229

Cannon County

Total homes closed May 2022: 19

Average square feet for closed homes May 2022: 1,910

Average sale price May 2022: $362,452

Total homes closed May 2023: 16

Average square feet for closed homes May 2023: 1,590

Average sale price May 2023: $332,369

Coffee County

Total homes closed May 2022: 98

Average square feet for closed homes May 2022: 2,053

Average sale price May 2022: $312,091

Total homes closed May 2023: 88

Average square feet for closed homes May 2023: 1,865

Average sale price May 2023: $342,075

Warren County

Total homes closed May 2022: 50

Average square feet for closed homes May 2022: 1,697

Average sale price May 2022: $271,618

Total homes closed May 2023: 50

Average square feet for closed homes May 2023: 1,737

Average sale price May 2023: $300,376

Source: Middle Tennessee Association of Realtors

This article originally appeared on Murfreesboro Daily News Journal: Affordable homes drive buyers farther from Nashville and Murfreesboro