Affordable housing crisis not easing in Southwest Florida, wages not keeping up

The affordable housing crisis isn't letting up.

The crisis persists in Florida – especially in Southwest Florida. In some ways, it's getting worse.

A series of housing indexes and recent research reports shed light on the situation local renters and buyers are facing, as they deal with across-the-board hikes in living costs, with little relief in sight. Here are some of the main points:

Rent growth slowing

The latest Waller, Weeks and Johnson Rental Index shows most larger metros saw rents grow at or below the national rate in August.

Of all metros included in the study, Orlando had the smallest increase over the year – at 1.10%.

That compared to 3.25% nationally.

In Florida, all of these metros had smaller increases: Jacksonville (+1.31%), Lakeland (+2.08%), Palm Bay (+2.33%), Tampa (+2.69%), Miami (+2.83%), and Deltona (+2.99%).

Meanwhile, metros in Southwest Florida still saw rents rise faster than the national rate: North Port (+4.02%), and Cape Coral (+6.9%).

The rental index is jointly produced by Florida Atlantic University, the University of Alabama and Florida Gulf Coast University in south Fort Myers.

While the latest index suggests rent growth may be returning to normal, it's not enough to move the needle on affordability, said Ken H. Johnson, a housing economist with Florida Atlantic University's College of Business.

"We are entering a new normal where overall rents are high, and renters are left with a prolonged affordability crisis," he said.

Income hasn't kept up with rent hikes

Not only do rents remain high, but incomes haven't kept up with the rent hikes over the last few years.

"Wages tend to be sticky. In economic terms, it's they just adjust slowly," said Shelton Weeks, a real estate professor and director of the Lucas Institute for Real Estate Development & Finance at FGCU.

In Miami, the typical household must earn $111,914 to avoid being "house poor," or paying more than 30% of their income on rent. The required income is $94,817 in North Port, $90,916 in Cape Coral, $86,659 in Tampa and $83,486 in Orlando, according to the researchers.

Those income numbers are conservative, as they don't factor in other monthly expenses, such as electricity, Weeks said.

In Southwest Florida, he said, it's harder to predict what might happen with rents, with the high demand for housing driven by growth only exacerbated by the damage caused by Hurricane Ian a year ago.

According to the CoStar Group, the hurricane destroyed more than 5,000 homes, and severely damaged another 30,000 in the Cape Coral metro – or essentially Lee County. Over the next few years, the same firm estimates that 7,000 new rentals will hit the market in the county.

The influx of new apartments should put downward pressure on rents.

"That will give us some relief," Weeks said. "The question is just how much that allows prices to soften."

The impact of more apartments could be diminished, he said, if they're quickly filled by new residents – or by current residents who are doubling or tripling up in tight quarters because nothing else is available right now in Southwest Florida.

If vacancies rise, landlords could offer incentives, such as one month of free rent, or a reduction in the security deposit, rather than actually discounting rents, Weeks emphasized.

With construction costs so high, it's tough to make new rental communities work financially at less than the current rental rates in Southwest Florida, he said.

In case you missed it: Collier County has a housing crisis 'times two' thanks to Hurricane Ian

More like this: Hurricane Ian one year later: How has it affected beach, inland real estate in SWFL?

Homes are still expensive

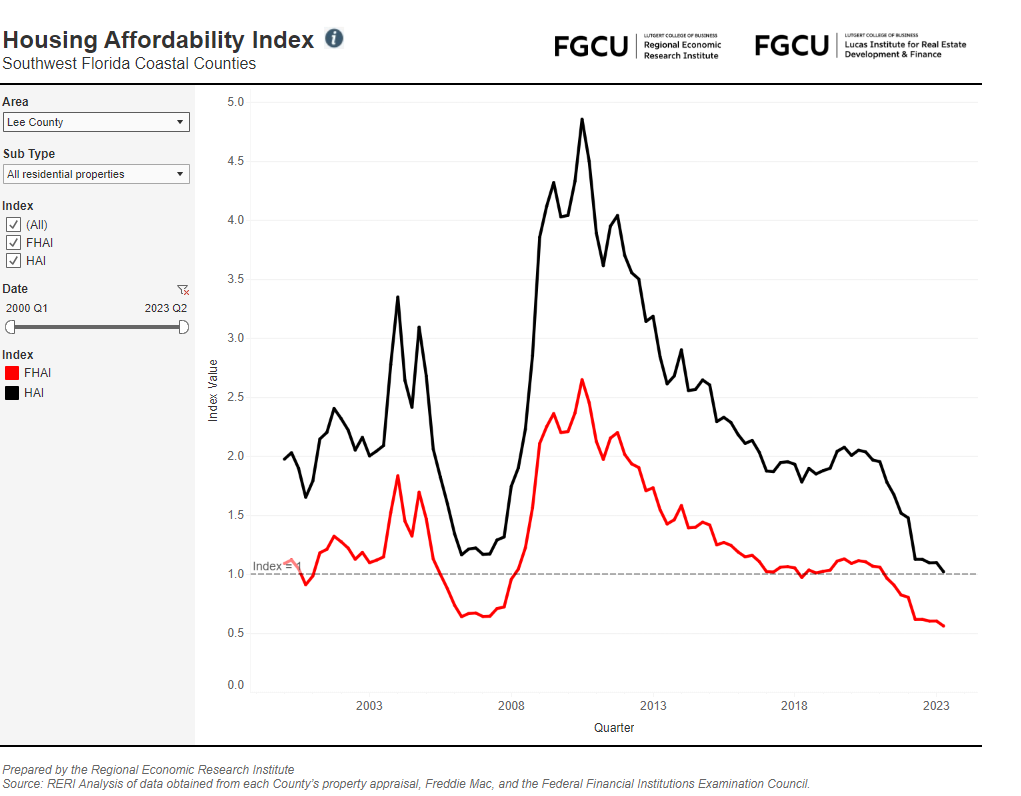

Through another index, the Regional Economic Research Institute at Florida Gulf Coast University tracks the affordability of homes in the coastal counties of Southwest Florida, and the latest report isn't rosy.

The report for the second quarter shows in Charlotte and Lee County, home affordability has reached its lowest levels since 2000, and in Collier County, it's at its lowest point since 2005.

The index compares the relationship between the median family income and the median home price. The median is the middle value between the lowest and highest.

Purchasing a home is particularly difficult for first timers, in part because of the higher interest rates, which have caused mortgage rates to climb, translating to higher monthly payments.

Currently, the average interest rate for the benchmark 30-year fixed mortgage is at more than 7.8%, according to Bankrate.com.

The regional affordability index shows the median income for first-time buyers in Lee County is 40% lower than the required income to purchase a median priced home. In Collier, it's 33% and in Charlotte it's 30% lower.

While higher interest rates play a role, the researchers for the index concluded that "skyrocketing home prices" have been "the major factor decreasing housing affordability" in Southwest Florida.

Home affordability started to decline in the three counties when interest rates were still low, and the median family income was on the rise. So, the researchers determined that higher wages alone could not solve the persistent problem.

Over the last three years, housings prices have increased 52%, versus a 20% increase in wages, in the region, according to the report.

"Decreasing housing affordability is a major concern," the researchers noted. "As households spend more on housing, and their income doesn’t increase proportionately, they will spend less in other areas, ultimately affecting the broader economy."

Home prices in flux

Cape Coral – one of the more affordable places to live in Southwest Florida – recently appeared on a Top 10 list of "Where Sellers Are Slashing Prices Right Now – and Where Homebuyers Can Score a Bargain," compiled by the Realtor.com data team.

To come up with their list, the team looked at the percentage of listings on Realtor.com with price reductions in July 2022 compared to July 2023 in the country's 150 largest metros. It then limited the list to one metro per state to "achieve geographic diversity."

Cape Coral ranked at No. 8, with a 15.8% increase in price reductions over the year in the month studied. The report noted the impact on the metro area from Hurricane Ian, resulting in fewer buyers flying in from other parts of the country to go "home shopping," in a time of recovery and rebuilding.

In July, the number of homes on the market in the area surged over the year.

In explaining the situation to Realtor.com, Nelson Rua, a local agent with Coldwell Banker Realty, attributed the rise in inventory to several factors, including a flurry of new construction and the desire by some residents to start over somewhere else in the aftermath of Ian.

"Price reductions were desperate people trying to get out of the area," he said.

Denny Grimes, a long-time Realtor and local real estate market expert, with Keller Williams Realty, takes issue with the list and the methodology behind it, saying there hasn't been a "slashing of prices" anywhere in Lee County as suggested.

"My concern is when a buyer reads that their expectations are going to be that, you know, I expect to pay 50 cents on the dollar," he said. "That's not the case."

He added the local market isn't "like a Publix, where homes are BOGO, or buy one, get one free."

Home sales have cooled

Year-to-date, single-family home sales are down 15% over the year in Lee County, the county hardest hit by Ian.

In the city of Cape Coral, they're off by 20%, Grimes said.

However, he pointed out that in August, sales declined by 2% countywide, but rose by 10% in Cape Coral over the year.

"The number of homes for sale in the county as a whole is up 15% since last year," Grimes said. "It's up 14% in the Cape, so it's almost exactly the same."

As of August, prices were down 7% in the Cape from last year, compared to 4% countywide.

Now, it's more of a buyers' market in Lee County, which means more room for negotiating.

Recently, he said, a seller refused to accept $500,000 for his home – $25,000 below the asking price, then had to sell for $460,000, based on the next-best offer.

While prices have improved in Cape Coral, they're still up by 40% since August 2020.

"That's a whopping number," Grimes said.

The median home price in the Cape was $400,000 in August, down from $430,000 a year ago, but up from $285,000 just a few years ago, he said.

"We are going to see more downward pressure," Grimes said. "Inventory is rising."

In Lehigh Acres, another community known for its affordability in Lee County, the median home price was at $350,000 in August, up from $325,000 a year ago and $252,000 two years ago.

Through August, sales were down 10% in Lehigh over the year, with higher interest rates contributing to the decline, Grimes said.

While home inventory has been on the rise across Southwest Florida, prices in the Naples market remain historically high.

According to the Naples Area Board of Realtors, the median closed price in August increased 5.2% to $605,000 from $575,000 a year ago.

"In most market areas, property values remain stable or have returned to our long-term historical trend of 8% per year appreciation. I am searching daily for evidence of widespread market decline, but have yet to find it," noted Cindy Carroll, with Carroll & Carroll Appraisers & Consultants, in the monthly report.

Overvalued housing markets

In August, seven Florida metros ranked among the top 10 most overvalued housing markets in the country, based on another monthly index by researchers at Florida Atlantic University and Florida International University.

Cape Coral sat at No. 1, with buyers paying a nearly 48% premium on the typical home.

The rankings are calculated by comparing the current average prices to historical ones, expressed by a percentage. The higher the percentage increase, the more overvalued the market.

These Florida metros also made the Top 10 list for August:

At No. 3, Tampa, (42.81%)

At No. 4, Palm Bay, (42.6%)

At No. 6, Lakeland (41.9%)

At No. 7, North Port (41.7%)

At No. 8, Deltona (39.9%)

At No. 9, Orlando (39.8%)

Atlanta (45.7%), Detroit (42.5%) and Knoxville, Tennessee (39.3%) rounded out the list.

“Most cities around the country have seen prices come back in line with their local long-term pricing trends or have witnessed a slight cooling in prices over the last few months,” said Johnson, a real estate economist at FAU’s College of Business. “That hasn’t been the case in Florida as prices in the state have remained robust, causing premiums to rise throughout the state.”

Although interest rates have put a damper on the local housing market, high demand and low supply continue to heavily influence pricing, he explained.

While affordability remains a big problem, it could be worse.

“Without these higher interest rates, we would see Florida’s prices reaccelerate because there is so much demand relative to the supply of units,” said Eli Beracha, director of the Hollo School of Real Estate at FIU. “As well, the influx of high-income movers to Florida is putting upward pressure on prices. We are witnessing a transition in Florida’s economy and our housing markets around the state are experiencing growing pains from this transition.”

In Southwest Florida and most parts of the country, Johnson doesn't expect to see big shifts in pricing any time soon.

“The likelihood of a significant fall in prices or a dramatic increase is very small," he said. "There should be little risk if you purchase a property now and are planning to hold it for five to eight years. The strategy of trying to buy now and sell in 12 to 24 months to make a quick profit isn’t likely to work, however.”

This article originally appeared on Naples Daily News: Southwest Florida continues to struggle with affordable housing