The AGES Industri (STO:AGES B) Share Price Is Down 58% So Some Shareholders Are Wishing They Sold

While it may not be enough for some shareholders, we think it is good to see the AGES Industri AB (publ) (STO:AGES B) share price up 15% in a single quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 58% in that time. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

View our latest analysis for AGES Industri

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

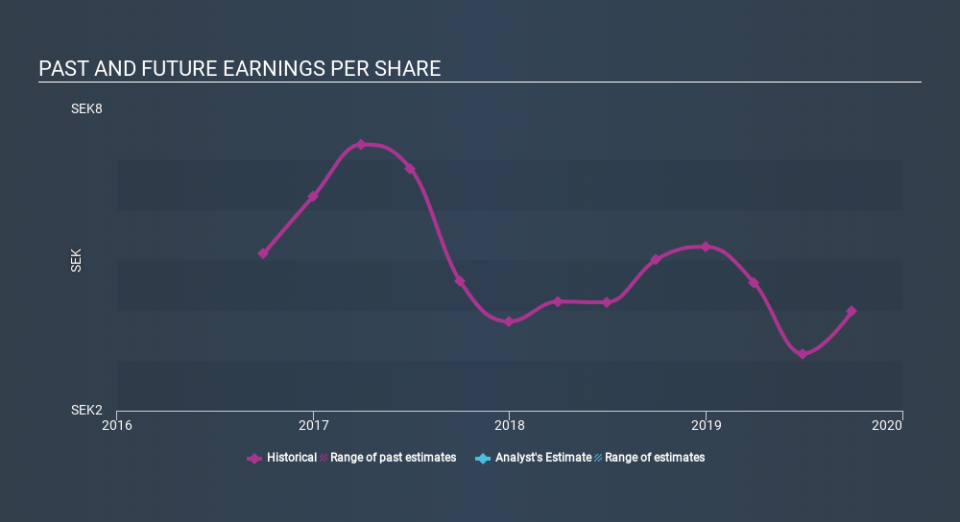

Looking back five years, both AGES Industri's share price and EPS declined; the latter at a rate of 3.2% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 16% per year, over the period. This implies that the market was previously too optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into AGES Industri's key metrics by checking this interactive graph of AGES Industri's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of AGES Industri, it has a TSR of -52% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in AGES Industri had a tough year, with a total loss of 26% (including dividends) , against a market gain of about 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - AGES Industri has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.