Update: Akash Infra-Projects (NSE:AKASH) Stock Gained 13% In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Akash Infra-Projects Limited (NSE:AKASH) share price is 13% higher than it was a year ago, much better than the market return of around 0.8% (not including dividends) in the same period. That's a solid performance by our standards! Akash Infra-Projects hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Akash Infra-Projects

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Akash Infra-Projects actually saw its earnings per share drop 41%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 0.8% dividend yield is doing much to support the share price. Unfortunately Akash Infra-Projects's fell 33% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

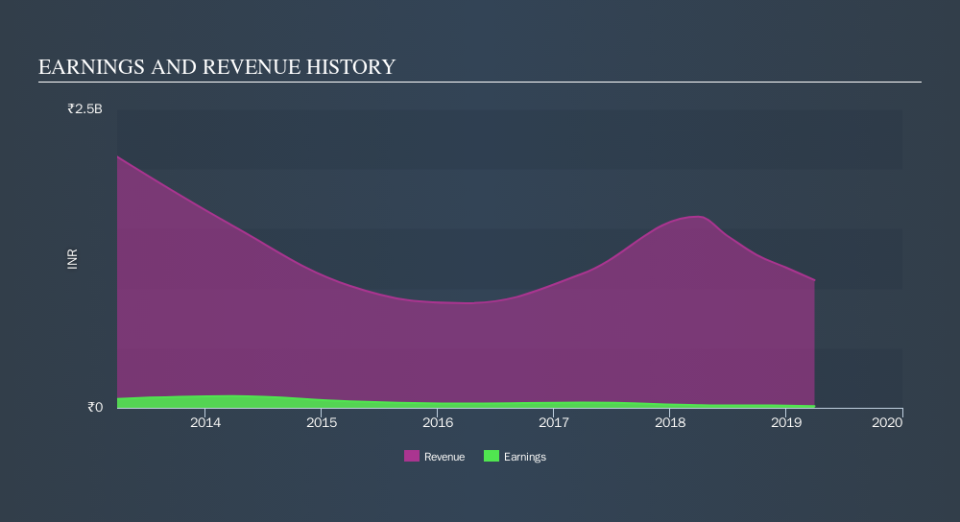

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Akash Infra-Projects's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Akash Infra-Projects shareholders have gained 14% over the last year , including dividends . We regret to report that the share price is down 5.9% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. Before forming an opinion on Akash Infra-Projects you might want to consider these 3 valuation metrics.

Of course Akash Infra-Projects may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.