Al Gore's Generation Investment Management Buys 4 Stocks in the 4th Quarter

Generation Investment Management, the firm founded by David Blood and former U.S. Vice President Al Gore (Trades, Portfolio), disclosed last week that its four new holdings for the fourth quarter of 2019 were Baxter International Inc. (NYSE:BAX), Illumina Inc. (NASDAQ:ILMN), Penumbra Inc. (NYSE:PEN) and CBRE Group Inc. (NYSE:CBRE).

The London-based fund applies a long-term investment perspective, focusing on sustainability within markets with companies that strategically manage their economic, social and environmental performances. Generation seeks security investments using fundamental analysis and a bottom-up approach, investing in a variety of public equity markets on a global scale.

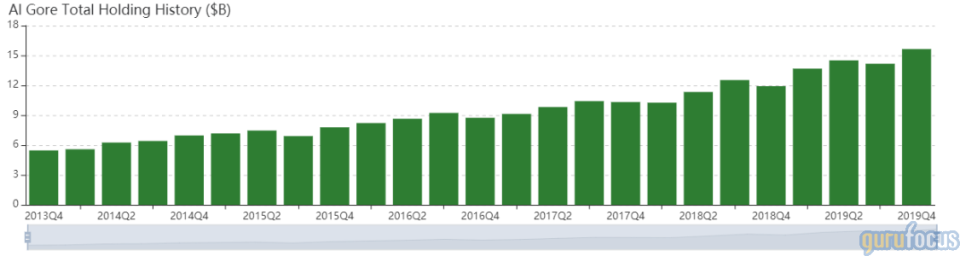

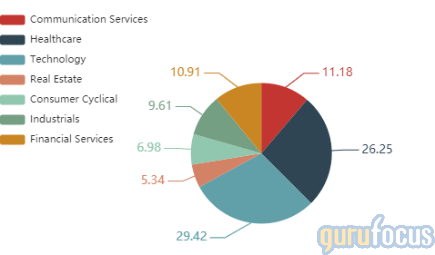

As of quarter's end, Generation's $15.64 billion equity portfolio contains 39 stocks, with turnover of 10%. The top three sectors in terms of weight are technology, health care and communication services, with weights of 29.42%, 26.25% and 11.18%.

Baxter

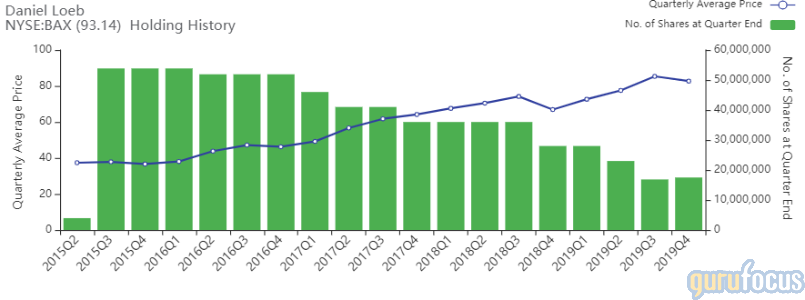

Generation purchased 6,817,806 shares of Baxter, giving the stake 3.65% weight in the equity portfolio. Shares averaged $82.72 during the quarter.

The Deerfield, Illinois-based company manufactures medical products across four major business segments: renal, integrated pharmacy solutions, fluid systems and surgical care. GuruFocus ranks Baxter's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a return on assets that outperforms 83.41% of global competitors and an operating margin that has increased over 20% per year on average over the past five years.

Third Point investor Daniel Loeb (Trades, Portfolio) owns 17.5 million shares of Baxter as of quarter-end.

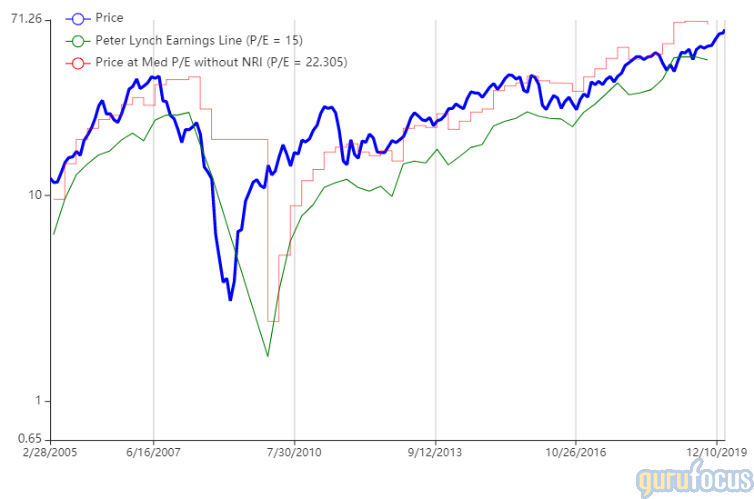

Illumina

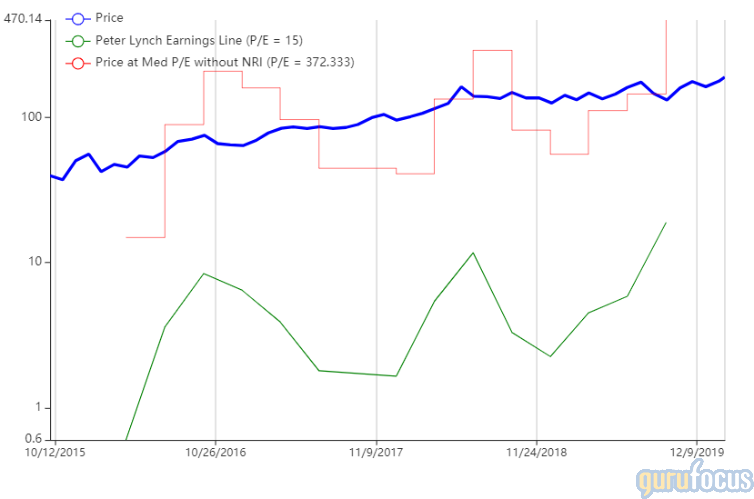

Generation purchased 585,247 shares of Illumina, giving the position 1.24% weight in the equity portfolio. Shares averaged $312.33 during the quarter.

The San Diego-based company manufactures tools for analyzing genetic material, including microarray and genome sequencing machines. GuruFocus ranks Illumina's profitability 10 out of 10 on several positive investing signs, which include a five-star business predictability rank, expanding profit margins and returns that are outperforming over 87% of global competitors.

Steve Mandel (Trades, Portfolio)'s Lone Pine and Philippe Laffont (Trades, Portfolio)'s Coatue Management also purchased shares of Illumina during the quarter.

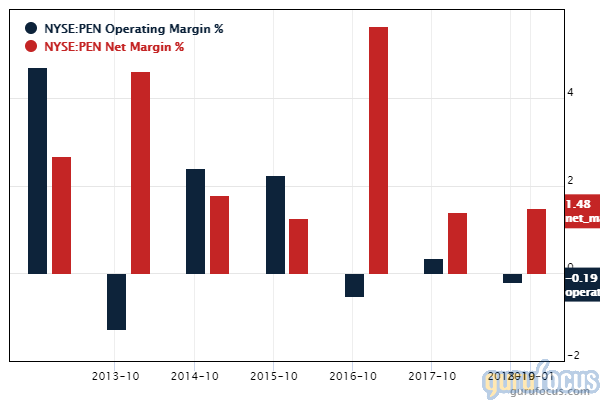

Penumbra

Generation purchased 412,309 shares of Penumbra, giving the holding 0.43% weight in the equity portfolio. Shares averaged $159.77 during the quarter.

The Alameda, California-based company develops and manufactures medical devices for the neurovascular and peripheral vascular markets. GuruFocus ranks Penumbra's financial strength and profitability 7 out of 10 on several positive investing signs, which include robust interest coverage, debt ratios and profit margins that outperform over 64% of global competitors.

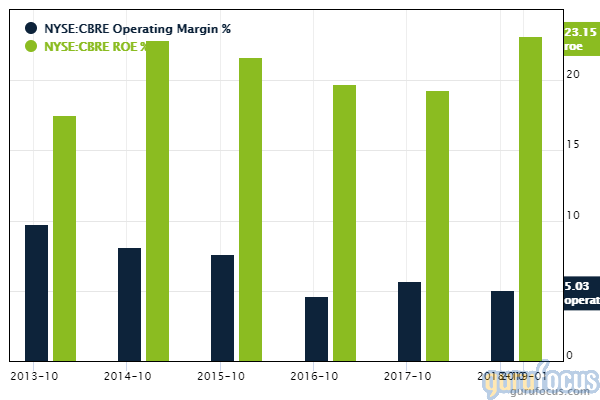

CBRE

Generation purchased 44,506 shares of CBRE, giving the position 0.02% weight in the equity portfolio. Shares averaged $55.56 during the quarter.

The Los Angeles-based company provides a wide range of real estate services to owners, occupiers and investors worldwide, including leasing, property, property management and capital markets. GuruFocus ranks CBRE's profitability 8 out of 10: Even though operating margins are underperforming 71.73% of global competitors, CBRE's returns are outperforming over 85% of global real estate service companies.

See also

The U.S. stock market is closed on Monday for President's Day, a day to honor all presidents who have served the U.S. Al Gore (Trades, Portfolio) was vice president under Bill Clinton from 1993 to 2001.

Disclosure: No positions.

Read more here:

Top 5 4th-Quarter Buys of George Soros' Firm

David Tepper's Top 5 Buys in the 4th Quarter

David Einhorn's Greenlight Buys DXC and Boosts 2 Holdings in the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.