Do Alaska Communications Systems Group's (NASDAQ:ALSK) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Alaska Communications Systems Group (NASDAQ:ALSK). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Alaska Communications Systems Group

How Fast Is Alaska Communications Systems Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Alaska Communications Systems Group has grown EPS by 22% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Alaska Communications Systems Group reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

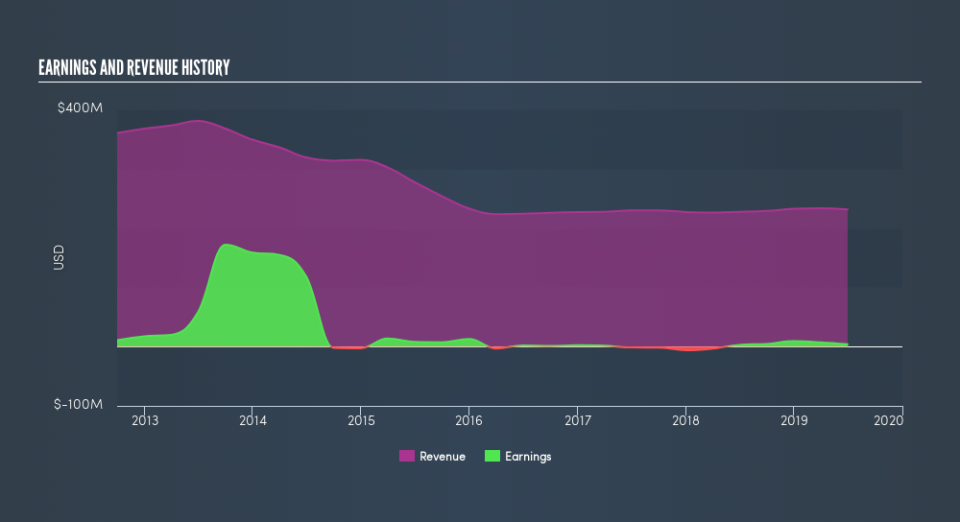

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Alaska Communications Systems Group isn't a huge company, given its market capitalization of US$94m. That makes it extra important to check on its balance sheet strength.

Are Alaska Communications Systems Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Alaska Communications Systems Group insiders refrain from selling stock during the year, but they also spent US$193k buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Karen Singer for US$188k worth of shares, at about US$1.71 per share.

Should You Add Alaska Communications Systems Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Alaska Communications Systems Group's strong EPS growth. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. So on this analysis I believe Alaska Communications Systems Group is probably worth spending some time on. Of course, just because Alaska Communications Systems Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Alaska Communications Systems Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.