Alexandria (ARE) Q2 FFO Beats on Solid Rental Rate Growth

Alexandria Real Estate Equities, Inc. ARE reported second-quarter 2021 funds from operations (FFO) as adjusted of $1.93 per share, up 6.6% from the year-ago quarter’s $1.81. The figure also surpassed the Zacks Consensus Estimate of $1.89.

This year-over-year improvement resulted from the 16.6% year-over-year top-line improvement to $509.6 million. Results reflect decent internal growth. The company witnessed continued healthy leasing activity and rental rate growth during the quarter.

Though the company revised the 2021 outlook, it kept the mid-point of its FFO as adjusted per share guidance unchanged at $7.75.

In addition, management noted that the company’s tenant collections have been consistently high, with 99.4% of July 2021 billings collected as of Jul 26, 2021. Also, as of Jun 30, 2021, the tenant receivables balance was $6.7 million and this marked its lowest balance since 2012.

Behind the Headline Numbers

Reflecting robust demand for its high-quality office/laboratory space, Alexandria’s total leasing activity aggregated to 1.93 million rentable square feet (RSF) of space during the June-end quarter. It marked the highest leasing activity in a single quarter and the second highest rental rate growth in the company’s history. Lease renewals and re-leasing of space amounted to 1.47 million RSF. Leasing of development and redevelopment space was 256,328 RSF.

The company registered rental rate growth of 42.4% during the reported quarter. On a cash basis, rental rate increased 25.4%.

On a year-over-year basis, same-property NOI was up 3.7%. It climbed 7.8% on a cash basis. Occupancy of operating properties in North America remained high at 94.3%.

As of second-quarter 2021, investment-grade or publicly-traded large-cap tenants accounted for 53% of annual rental revenues in effect. Weighted-average remaining lease term of all tenants is 7.5 years. For the company’s top 20 tenants, it is 11.1 years.

During the April-June period, the company completed acquisitions in its key life science cluster submarkets totaling 5.5 million SF, 4.7 million RSF of value-creation opportunities, and 0.9 million RSF of operating space, for a total price of $1.1 billion.

Moreover, the company entered into a definitive agreement in June to expand its Alexandria Center on the Kendall Square campus through the acquisition of a 100% interest in One Rogers Street and One Charles Park for a purchase price of $815 million. This acquisition is expected to complete in December 2021 and would offer a major expansion to Alexandria’s mega campus strategy in the Cambridge submarket.

During the reported quarter, the company placed into service development and redevelopment projects totaling 755,565 RSF, which are 100% leased across five submarkets.

Liquidity

Alexandria exited second-quarter 2021 with cash and cash equivalents of $323.9 million, down from the $492.2 million seen at the end of first-quarter 2021. The company had $4.5 billion of liquidity as of the end of the reported quarter. Net debt and preferred stock to adjusted EBITDA was 5.8x and fixed-charge coverage ratio was 4.9x for second-quarter 2021 annualized.The company has no debt maturities prior to 2024 and its weighted-average remaining term of debt as of Jun 30, 2021 is 12.5 years.

Outlook

Alexandria also revised the 2021 outlook, guiding FFO as adjusted per share in the range of $7.71-$7.79 compared with the $7.70-$7.80 estimated earlier, keeping the mid-point unchanged. The Zacks Consensus Estimate for the same is currently pinned at $7.77.

The company’s current-year guidance is backed by anticipations for occupancy in North America (as of Dec 31, 2021) in the band of 94.3-94.9%, rental rate increases for lease renewals, and re-leasing of space of 31-34%, and same-property NOI growth of 2-4%.

Alexandria currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

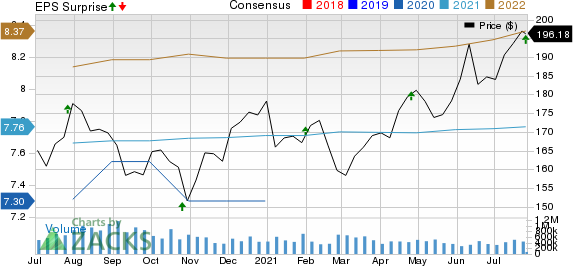

Alexandria Real Estate Equities, Inc. Price, Consensus and EPS Surprise

Alexandria Real Estate Equities, Inc. price-consensus-eps-surprise-chart | Alexandria Real Estate Equities, Inc. Quote

We now look forward to the earnings releases of other REITs like AvalonBay Communities AVB, Duke Realty DRE and Equinix, Inc. EQIX scheduled for Jul 28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Duke Realty Corporation (DRE) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research