Singles Day 2019: Here's what to expect from Alibaba's shopping extravaganza

It’s that time of year again: Millions of consumers, mostly in China, will be busy placing online orders and tuning in to a concert headlined by Taylor Swift — all in the name of celebrating Alibaba’s (BABA) Singles Day.

Singles Day — first created as an anti-Valentine’s Day in the 1990s — has since morphed into an online shopping bonanza that generates billions in sales and is now in its 11th year. Last year, Singles Day generated $30.8 billion in gross merchandise volume (GMV) for Alibaba, more than the popular U.S. shopping holidays Thanksgiving, Black Friday, Cyber Monday and the weekend in between are projected to make this year combined, according to Adobe estimates.

And the growth trajectory of the GMV number is likely to continue this year, as the presale started weeks leading up to the 24-hour event. Consumers can put in a deposit for certain products that will be on sale, and pay for the rest on Singles Day.

Tmall, Alibaba’s online store that started Singles Day as a “50% off” promotion, said 64 brands reported presales of more than 100 million yuan ($14 million) by Oct. 31 this year. Estee Lauder, for example, pocketed 500 million yuan ($70 million) in the first 25 minutes after the presale kicked off, equal to whole-day sales in last year’s Singles Day.

“So far, we have achieved a very good user engagement for this upcoming shopping festival. So we are ready for that day, and we will do all we can do to make sure we have another success on that day,” Alibaba CEO Daniel Zhang said on an earnings call last week. Zhang, known as the mastermind behind the Singles Day promotion, took the helm from Jack Ma, Alibaba’s founder, in September.

First started as a shopping holiday by Alibaba, Singles Day is now used as a promotional tool by all major e-commerce players in China — including its major rivals JD.com and Pinduoduo. JD.com, similar to Amazon, is known for its fast delivery. Pinduoduo has become the runner-up to Alibaba in China’s ecommerce space, and the company has vowed to burn cash in aggressive promotions to expand its customer base during this year’s Singles Day.

The festival is also expected to be celebrated by consumers outside China as Alibaba expands its international footprint, through its Lazada and AliExpress platforms. 24% of U.S. retailers said they’re planning to run promotions for Singles Day, according to Adobe data.

Consumption fuels China’s economy

The 10-year boom of the shopping festival also highlights a shift in a consumption-driven Chinese economy. While the world’s second-largest economy’s GDP growth has hit a 30-year low, the retail sector is showing some resilience. Online e-commerce sales, particularly, are still growing at 17%.

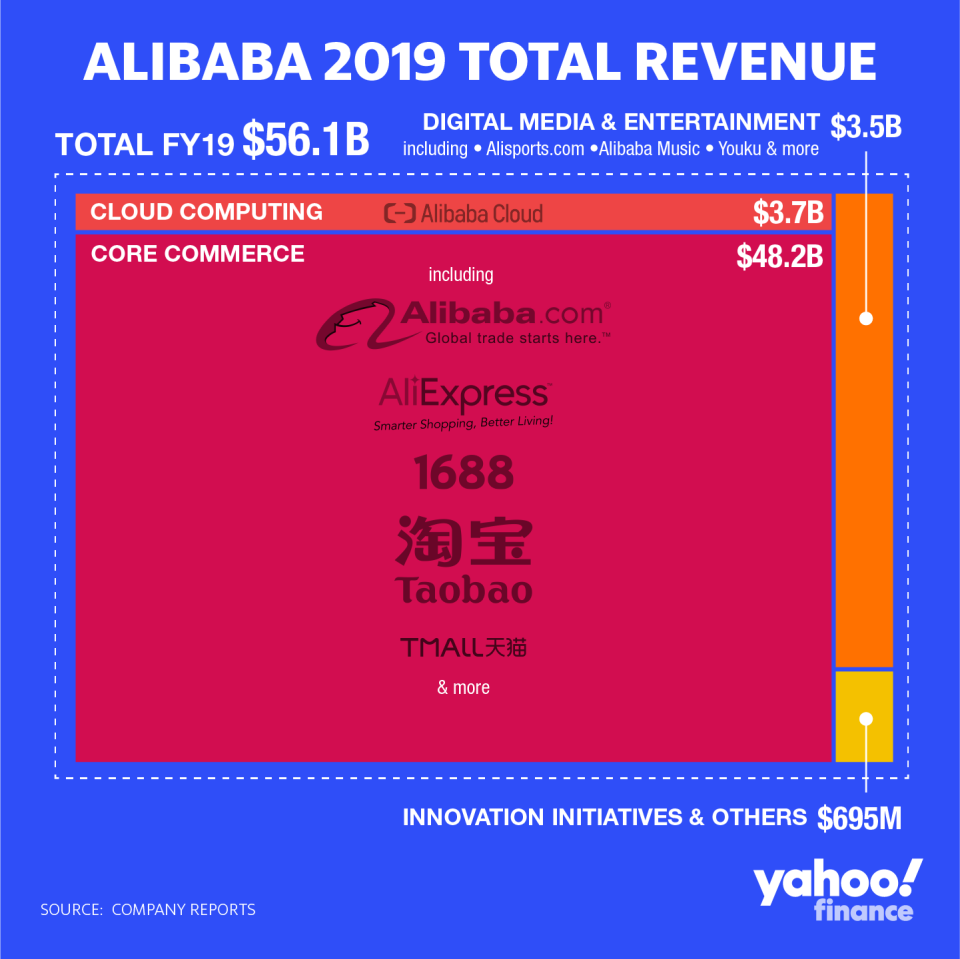

Alibaba says it’s well-positioned to navigate a macroeconomic growth slowdown. The 20-year-old company operates a line of core commerce platforms from marketplace Taobao and online store for brands Tmall. Unlike Amazon, which serves both a retailer and a marketplace for third-party sellers, Alibaba focuses on building infrastructure for businesses and make profits by commissions and advertising.

In recent years, it has heavily invested in local services including food delivery, especially in lower-tier cities that are less developed but still have a sizable digital fluent population. During last year’s Singles Day, 46% of the hundreds of millions of consumers who made purchases were under 28 and over 40% made purchases from international brands, highlighting a mobile-savvy younger generation of consumers with an appetite for foreign brands.

While the hefty investment could pressure its margin, Alibaba believes building a digital economy that covers both online and off-line commerce can help it capture the growth of China’s consumption needs. Singles Day, as a showcase, has been expanding from online shopping to discounts for online streaming, food delivery services, and grocery shopping in-store.

“We are able to do the cross-selling of additional services like local services and entertainment to our base of close to 700 million active consumers in the China retail marketplace,” said Joe Tsai, Alibaba’s co-founder and vice chairman, on a recent analyst call. “So these synergies are now starting to come through and that's also giving us an advantage over our peers.”

Krystal Hu covers tech and China for Yahoo Finance. Follow her on Twitter.

Read more: