Update: Alleghany (NYSE:Y) Stock Gained 63% In The Last Five Years

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Alleghany share price has climbed 63% in five years, easily topping the market return of 41% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 19%.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Alleghany

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

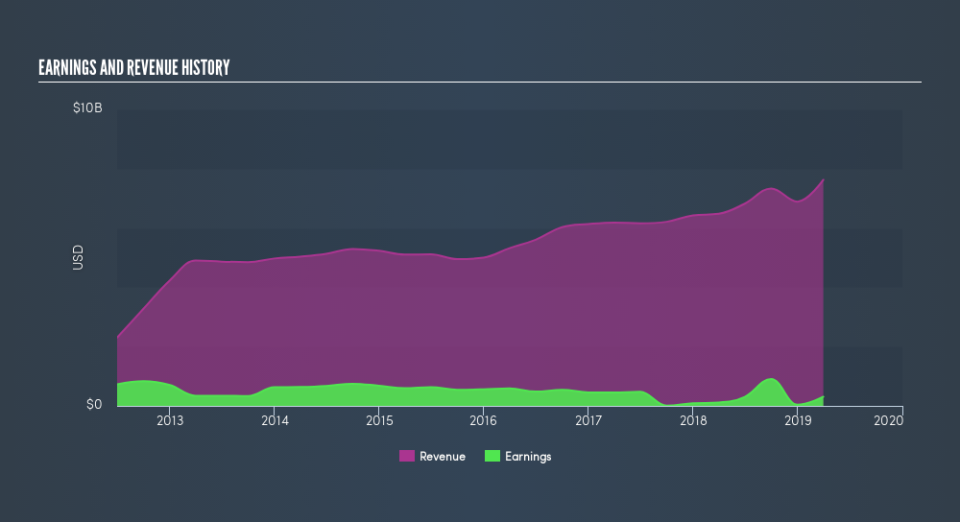

Alleghany's earnings per share are down 11% per year, despite strong share price performance over five years. This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 8.3% per year is probably viewed as evidence that Alleghany is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Alleghany will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

We've already covered Alleghany's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Alleghany hasn't been paying dividends, but its TSR of 66% exceeds its share price return of 63%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Alleghany shareholders have received a total shareholder return of 19% over the last year. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Alleghany by clicking this link.

Alleghany is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.