Is Allgeier SE (ETR:AEIN) A Strong Dividend Stock?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Dividend paying stocks like Allgeier SE (ETR:AEIN) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

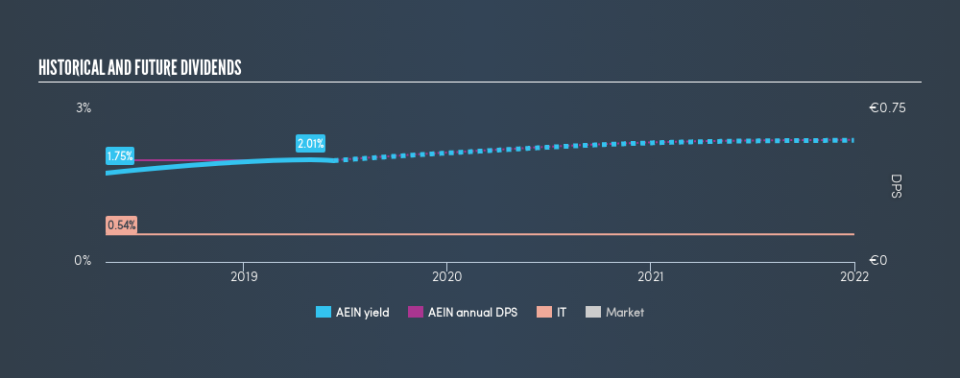

Some readers mightn't know much about Allgeier's 2.0% dividend, as it has only been paying distributions for a year or so. Some simple research can reduce the risk of buying Allgeier for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Allgeier!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 97% of Allgeier's profits were paid out as dividends in the last 12 months. This is quite a high payout ratio that suggests the dividend is not well covered by earnings.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Allgeier paid out 61% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. While the dividend was not well covered by profits, at least they were covered by free cash flow. Even so, if the company were to continue paying out almost all of its profits, we'd be concerned about whether the dividend is sustainable in a downturn.

Is Allgeier's Balance Sheet Risky?

As Allgeier's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A quick way to check a company's financial situation uses these two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures a company's total debt load relative to its earnings (lower = less debt), while net interest cover measures the company's ability to pay the interest on its debt (higher = greater ability to pay interest costs). Allgeier is carrying net debt of 3.29 times its EBITDA, which is getting towards the upper limit of our comfort range on a dividend stock that the investor hopes will endure a wide range of economic circumstances.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Net interest cover of 5.54 times its interest expense appears reasonable for Allgeier, although we're conscious that even high interest cover doesn't make a company bulletproof.

Consider getting our latest analysis on Allgeier's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was €0.50 per share, effectively flat on its first payment one years ago.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Over the past five years, it looks as though Allgeier's EPS have declined at around 2.6% a year. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're not keen on the fact that Allgeier paid out such a high percentage of its income, although its cashflow is in better shape. Earnings per share are down, and to our mind Allgeier has not been paying a dividend long enough to demonstrate its resilience across economic cycles. There are a few too many issues for us to get comfortable with Allgeier from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from costs or inflation. See if the 4 analysts are forecasting a turnaround in our free collection of analyst estimates here.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.