Amazon (AMZN) Boosts AWS Portfolio With Lookout for Equipment

Amazon’s AMZN cloud computing arm Amazon Web Services (“AWS”) has made its new service, which offers abnormality detection solutions, Amazon Lookout for Equipment, generally available.

Powered by Machine Learning (“ML”) technology, the service is well-equipped to detect anomalies in machine equipment on the back of predictive maintenance.

Notably, Amazon Lookout for Equipment builds ML models and automatically analyzes sensor data and patterns.

With the help of this, the service detects early warning signs of machine failure by leveraging real-time data streams from customer’s equipment.

We believe that the latest move is likely to help AWS gain strong traction among industrial and manufacturing customers as the underlined service helps in monitoring their machinery efficiently and avoiding any type of malfunction by taking action before machine failures occur.

Clientele to Grow

We note that customers using the new service will have topay for the amount of data ingested, the number of inference hours used and the compute hours used to train a custom model, without any upfront payment.

This along with the above-mentioned benefits is likely to bolster the adoption rate of Amazon Lookout for Equipment.

Notably, customers like Siemens Energy, Cepsa, Embassy of Things, RoviSys, Seeq and TensorIoT have already shown interest in the new service.

We believe that the growing customer momentum will continue to drive AWS’ top line. Moreover, strengthening clientele will continue to aid its competitive edge against its peers like Microsoft MSFT, Alphabet’s GOOGL Google and Alibaba BABA.

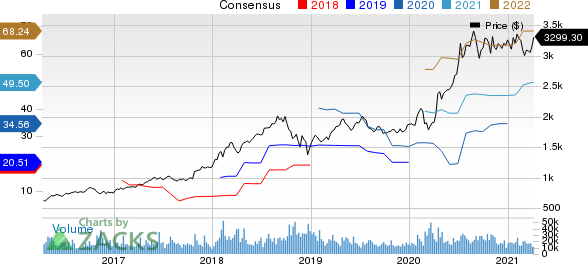

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Expanding Portfolio

The latest move bolsters the portfolio of AWS services and products.

Apart from Amazon Lookout for Equipment, AWS announced the general availability of Amazon Lookout for Metrics. Backed by ML technology, the service is well-equipped to detect anomalies in business metrics such as revenues, active users, transaction volume, web page views and mobile app installations automatically.

Further, the company recently made Amazon Lookout for Vision generally available. Notably, the new service is well-equipped to process several images in an hour to detect defects and anomalies in manufactured products, using computer vision and ML capabilities.

Further, AWS unveiled One Zone storage classes for Amazon Elastic File System or Amazon EFS, which provides lifecycle management and integration with computing services like Amazon Elastic Kubernetes Service, AWS Fargate, Amazon Elastic Container Service and AWS Lambda.

Additionally, the company made X2gd instancesfor Amazon Elastic Compute Cloud or Amazon EC2 generally available. This has expanded the instance offerings of Amazon EC2.

We believe that the expanding AWS portfolio will continue to strengthen Amazon’s dominance in the booming cloud market.

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research SherazMian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research