Amazon's New HQs: What We Know and What We Can Assume

Amazon has announced that rather than choose one city to host its second headquarters, it will instead split the prize – and its thousands of well-paid jobs and billions of dollars in reinvestment – between two locales: Crystal City, outside of Washington, D.C.; and Long Island City in Queens, New York.

Here's what we know and what we can assume may happen to the local economies and housing markets in coming weeks and months. We will update this post as new data come in.

………………………………

What the Decision Means, according to Zillow Senior Economist Aaron Terrazas:

…for the greater New York and Washington, D.C., housing markets:

The fact that two of the country's priciest housing and labor markets caught Amazon's attention suggest that the decision to look beyond its original Seattle home is less about low costs and more about room to grow. Both Washington, D.C., and New York have similar housing costs to Seattle, but have historically been quicker to build upward and outward to meet the housing needs of newcomers. While 25,000 new jobs is no joke for any region, they should be able to accommodate this growth. They also offer much more developed public transit infrastructure, deeper labor markets and better air accessibility. Given their size and more responsive housing supply, locals should not necessarily expect the same surge in rents and home values that Seattle has witnessed alongside its own Amazon boom.

…and for Seattle, home to Amazon's original headquarters and a city still grappling with the challenges and opportunities posed by the online retailer's rapid and immense growth over the past few years:

The fact of Amazon choosing a second (and third) HQ is less important for Seattle’s housing market than their pace of hiring in Seattle moving forward, particularly since they picked two markets that are arguably pricier than Seattle. That said, population growth in the Seattle area — from Amazon and everyone else — has been a big part of what’s driving this market. If fewer people are moving to the area, then we can expect less demand pressure in the area’s housing market. But just because Amazon slows hiring here, there are still lots of other sources of new demand. It also matters what kind of functions they have in each location – New York is a natural fit for sales and marketing, and DC is a natural fit for legal work. The fact that Amazon selected two of the country’s largest, most established regions for HQ2 underlines just how few truly viable alternatives there are for major tech hubs. Tech jobs are certainly growing beyond their traditional clusters, but the historically dominant plays clearly remain dominant.”

………………………………

D.C., NYC-Area Residents: Expect Even Faster Rent Growth

The estimated "Amazon effect" on local rental markets of adding 25,000 highly-paid jobs in a single city could be substantial. According to Zillow's calculations:

Those living in and around New York City should expect an additional 1.4 percentage point boost in annual rental appreciation, beyond what's already anticipated.

The Washington, D.C., area is expected to experience annual rental growth that is 0.6 percentage points higher than what is currently anticipated.

These latest estimates are unchanged for D.C., and up substantially for New York, from a prior Zillow analysis that estimated the "Amazon effect" for all 20 HQ2 finalist cities. These latest data points were calculated using slightly different assumptions:

Roughly 250-500 new people move to the Northern Virginia and New York City areas per quarter

Each area will eventually play host to 25,000 Amazonians, instead of the initially assumed 50,000

Run with an additional year's worth of Zillow rental data, federal job-flow data and federal employment and wage data.

That initially reported data is in the map below, for reference:

………………………………

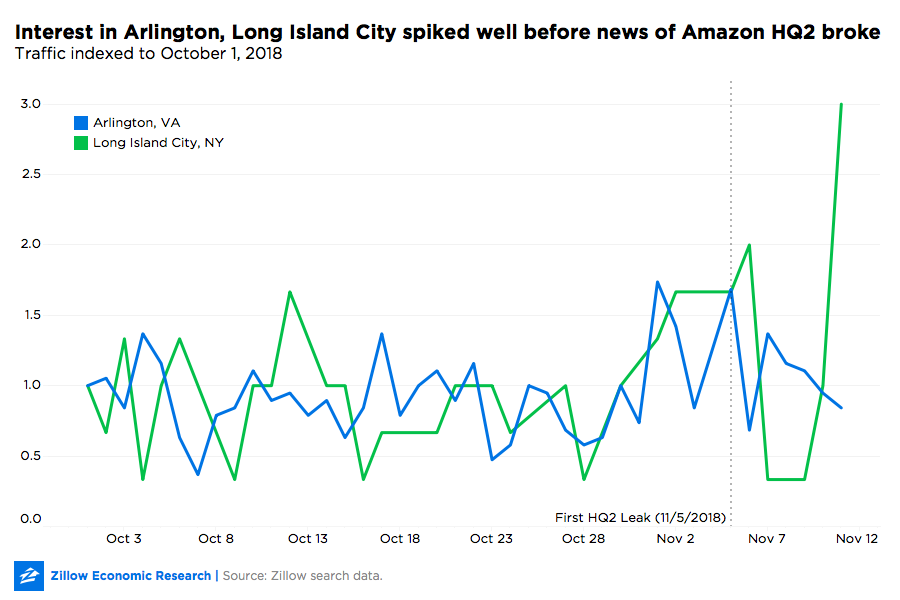

Home Searches in Arlington, Long Island City Spiked Before Rumors Became Public

Zillow site traffic to homes located in Arlington, Va., and Long Island City, N.Y., increased sharply over the past week, including a record-breaking jump in traffic to homes in Long Island City on Sunday, Nov. 11. However, the increase in traffic began before rumors surfaced last week of Amazon selecting the cities as locations of their new headquarters.

After months of courting and speculation, news that the online retail giant would be dividing their new main office between two cities began to trickle out November 5. However, Zillow's search data shows that each of the two locales saw a significant uptick in traffic in the week prior to that date. The increase was most pronounced in Long Island City, which was perhaps the more surprising of the two announced cities and has now seen record search traffic since the news was made official.

Long Island City (LIC) traffic was 300 percent higher November 11 than on October 1

LIC traffic grew consistently from October 28 through November 2, and remained 60 percent higher than October 1 levels for three days leading up to the first leak

Arlington's increases were less pronounced, but four days prior to first-reported rumors, traffic spiked to levels 74 percent higher than those on October 1.

Arlington traffic increased consistently from November 3 to November 5, the day of the first leak.

A steady majority of the traffic came from inside each city's respective metro areas, with little of it coming from Seattle, Amazon's main headquarters.

The post Amazon's New HQs: What We Know and What We Can Assume appeared first on Zillow Research.