Amazon: Investors Can Expect Exponential Returns Over the Next 5 years

- By

Amazon.com Inc. (NASDAQ:AMZN) has reached its current size due to taking advantage of hypergrowth trends at their early stages. The company managed to fend off competition during its inception. Jeff Bezos was well connected to Wall Street and gathered the necessary financial backing to outmuscle everyone else.

After the company's e-commerce revolution, it managed to take advantage of the cloud-based boom.

The expansion into cloud proved that Amazon had a very swift manner of conducting business and became tremendously profitable.

The modern-day success of Amazon is all about asset accumulation. The company has gathered an array of businesses within the verticals of its supply chain and horizontals that tried to compete with the company. The company's conglomerate strategy is most notable where it acquires companies unrelated to the tech industry, such as Whole Foods in 2017.

Valuation

When considering the company's valuation, we first need to look at shareholder value.

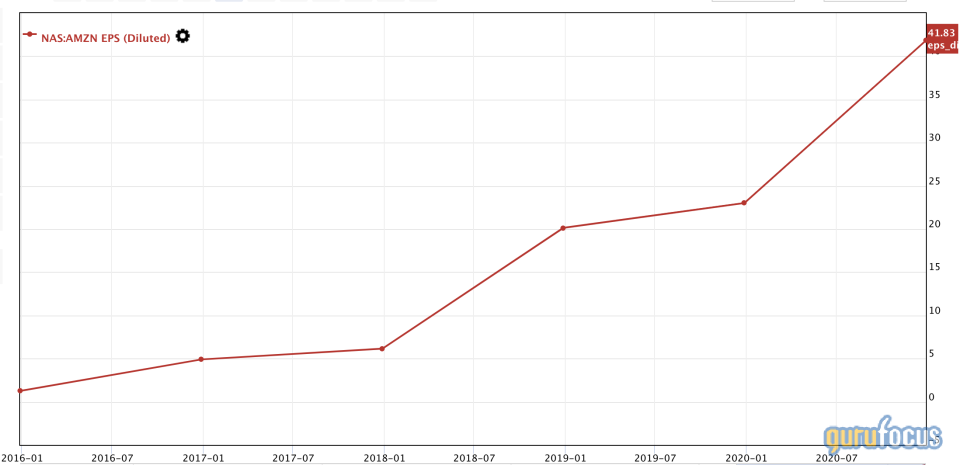

Amazon has been proven to have fantastic shareholder value. Its diluted earnings per share have not simply grown on increases in net income margins, but the fact the company's kept its shares outstanding low relative to its peers (504.32 million), which means investor worth has been maximized.

Another way to judge the worth of your investment is the free cash flow yield, which measures the free cash flow relative to shares outstanding. Yet again, strength in free cash flow has driven intrinsic value, but the low number of shares outstanding has made a real difference.

One of the ways to determine a price target for a stock that has traded on the market for a long time is by multiplying the price-earnings ratio of 65.58 by the expected earnings per share of $223.64. I personally consider Amazon a long-term investment and thus wanted to set a five-year price target.

Based on this calculation, the price target is $14,666.31 per share.

According to the metric, investors can expect a gain of roughly 301%. If you consider that Amazon has a beta of only 1.15 (riskier than the S&P 500), investors are in for a good deal.

Final word

Amazon has managed to adapt throughout its lifecycle. The company has innovated faster than competitors and utilized its capital toward asset acquisitions. The business strategy has resulted in a price target that will see investors beat the index year over year.

This article first appeared on GuruFocus.