AMC Call Options Red-Hot After Analyst Bull Note

The shares of AMC Entertainment Holdings Inc (NYSE:AMC) just toppled the $10 mark for the first time in nearly a month, up 6.7% at $10.26 after Credit Suisse initiated coverage on the movie theater concern with an "outperform" rating and an $18 price target -- roughly a 90% premium to last night's close. The analyst predicted that a stronger film slate for the second half of the year, paired with recent price increases will boost AMC stock, and sees industry box office growth during the next three quarters boosting sentiment among investors.

This bull note comes at the same time as Disney's (DIS) much-buzzed about Lion King release, which will undoubtedly generate revenue for AMC over the weekend. Considering all the buzz surrounding the stock, a surge in call contracts should come as no surprise. So far, 7,366 calls have exchanged hands, five times the intraday average, and 10 times the number of put contracts. Plus, this call volume is pacing in the 100th annual percentile of its annual range.

The July 10 call, which expires later today, is most active, and it's possible traders are purchasing the options to open for a volume weighted average price of $0.26. This means traders will profit if the underlying stock holds above $10.26 (strike plus premium paid) through the close tonight. The September 10 call is seeing some action, too, with contracts potentially being sold to close here.

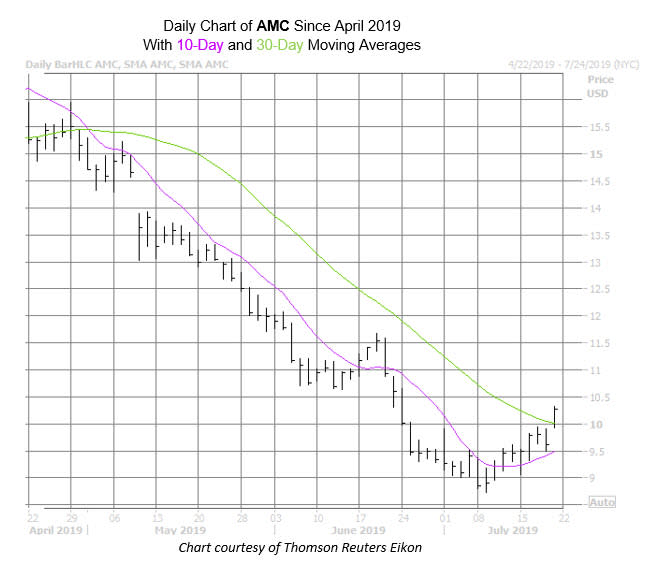

Taking a quick look at the charts, AMC has rallied hard off its all-time low of $8.73 earlier this month, up roughly 17% since bottoming out. The equity has found recent support atop its 10-day moving average, and, for the first time since late April, is back above its 30-day trendline, too.

Should the stock continue to rally, additional analyst bull notes might be in the cards for AMC. Right now, four of the nine brokerages in coverage call it a "hold." The consensus 12-month target price of $16.58, on the other hand, is a 60% premium to current levels.

Echoing that, an unwinding of shorts could put some wind at the security's back, too. Even as bearish bets began to trickle out during the last reporting period, the 11.82 million shares sold short still represent a hefty 23.3% of the stock's available float. At AMC's average pace of trading, it would take over a week to cover these pessimistic positions, leaving plenty of room for more short covering.