American Public (APEI) to Post Q4 Earnings: What's in Store?

American Public Education, Inc. APEI is slated to release fourth-quarter 2020 results on Mar 9, after market close.

In the last reported quarter, the company’s earnings and revenues topped the Zacks Consensus Estimate by 125% and 4.1%, respectively. For the third quarter, American Public reported adjusted earnings of 18 cents per share against a loss of 10 cents per share in the year-ago period. Total revenues of $79.1 million grew 16.6% from the year-ago period.

American Public’s earnings topped the consensus mark in two of the last four quarters, missed in one occasion and met the consensus mark in another, with the average being 53.7%.

Trend in Estimate Revision

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings has been unchanged at 38 cents per share over the past 60 days. The estimated figure indicates a 2.7% increase from the year-ago earnings of 37 cents per share. Also, the consensus mark for revenues is at $84.1 million, suggesting 13.1% year-over-year growth.

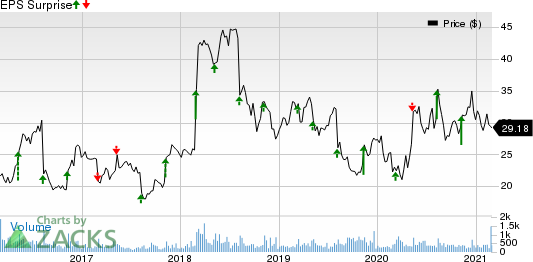

American Public Education, Inc. Price and EPS Surprise

American Public Education, Inc. price-eps-surprise | American Public Education, Inc. Quote

Factors to Note

Higher enrollment at both its segment — American Public Education segment or APEI and Hondros College of Nursing segment or HCN — is likely to have boosted the company’s fourth-quarter revenues. For the fourth quarter of 2020, the company expects total revenues to grow 10-14% year over year.

APEI, accounting for almost 88% of total revenues, is expected to have benefited from new course registrations, increased demand from students utilizing the U.S. Department of Defense tuition assistance as well as from ongoing technology transformation initiatives. The company has been making transformations and evolving its APEI segment by increasing investments in technologies. It is intended to improve the students and faculty experience and additional marketing to support the American Public University System, Inc. or APUS micro segmentation and affordability. The company expects net course registrations by new students at APUS to increase within 11-15% year over year for the quarter. Total net course registrations are likely to grow 6-10% year over year.

For HCN, continued strong demand for nursing education is likely to have influenced the segment’s performance. Also, benefits from new initiatives implemented in 2019, such as the direct entry ADN program and the implementation of institutional affordability grant in the first quarter of 2020, are expected to reflect on the quarterly performance. The company expects HCN’s new student and total student enrollment to grow nearly 34% in the fourth quarter from the prior year.

Overall, the company anticipates earnings within 41-46 cents per share, indicating growth from 37 cents reported in the year-ago quarter.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for American Public this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: American Public, which shares space with Adtalem Global Education Inc. ATGE, Grand Canyon Education, Inc. LOPE and Strategic Education, Inc. STRA in the Zacks Schools industry, currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.