American Tower Posts 4th-Quarter Earnings Beat

Before the market opened on Feb. 25, American Tower Corp. (NYSE:AMT) released its earnings results for the fourth quarter and full year of 2019.

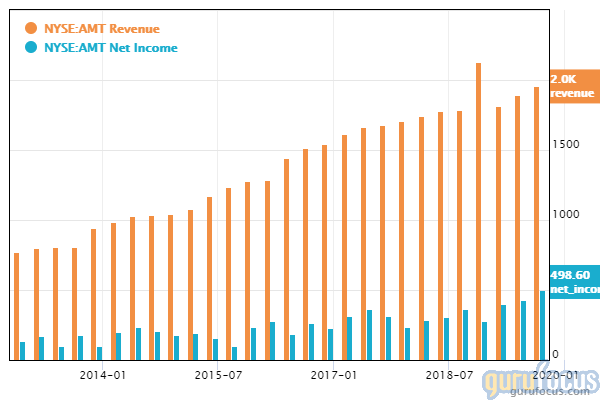

For the quarter, revenue came in at $1.92 million (down 9.8% year over year), while net income increased 94.5% to $529 million and GAAP diluted earnings per share increased 103.2% to $1.26. Non-GAAP earnings were $1.95 per share. Analysts were expecting revenue of $1.94 billion and non-GAAP adjusted earnings of $1.86.

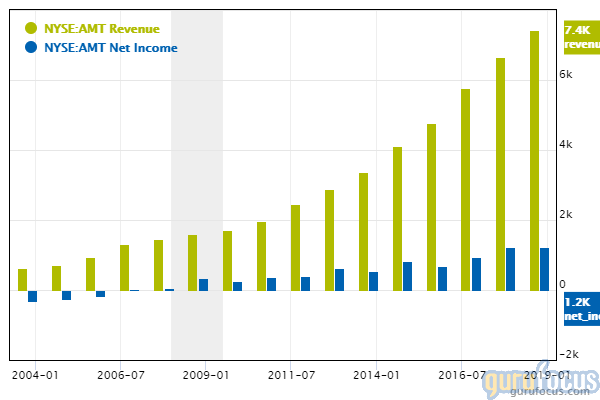

The full year brought in revenue of $7.58 billion (up 1.9% from 2018), net income of $1.91 billion (up 51.5%) and GAAP diluted earnings of $4.24 per share (up 53.9%).

In midday trading following the earnings results, the share price of American Tower was up 2.11% to $250.27 for a market cap of $110.72 billion and a price-earnings ratio of 69.65.

Contributors to growth

Operating officially as a real estate investment trust headquartered in Boston, American Tower owns and operates wireless and broadcast communications infrastructure in several countries around the world. Due to regulations surrounding the building of such structures, this basically gives the company a monopoly over the areas that its towers provide service to.

American Tower has benefitted from the expansion of 5G networks in 2019, as the REIT owns many of the locations that wireless companies need 5G coverage for. This tailwind contributed to more than 7% organic growth in tenant billing income in the U.S and is expected to create further profits for the company in the coming years as 5G networks roll out in full force.

The company added nearly 14,000 new communication sites to its portfolio during the year, increasing its footprint to more than 180,000 sites. The most growth was recorded in Asia, Latin America and Africa.

Valuation

GuruFocus has given American Tower a financial strength rating of 3 out of 10, a profitability rating of 9 out of 10 and a valuation rating of 1 out of 10.

As a REIT, it inevitably has a low cash-debt ratio of 0.05 and interest coverage of 2.93%, both of which are average for the industry.

The return on capital of 15.94% is lower than 72.93% of REITs, but the return on equity of 29.96% is higher than 96.27% of competitors. The three-year revenue growth rate of 14.2% and three-year Ebitda growth rate of 12.9% show strong growth in recent years.

At a price-earnings ratio of 69.65, it is undeniable that the stock is trading at a high valuation. However, according to the price at median price-earnings without non-recurring items, shares have an intrinsic value of around $205.88, since the stock has historically traded with a high price-earnings ratio.

2020 outlook

For full-year 2020, American Tower guides for net income between $1.95 billion and $2.05 billion and total property revenue between $7.97 billion and $8.12 billion.

In terms of acquisitions, the company plans to increase new sites in the U.S. by less than 0.5%, focusing instead on international growth, for which it aims for a 13.5% increase in new sites.

CEO Jim Taiclet said the following in the earnings report:

"In 2020, we expect to make sustained progress in each of the key elements of our Stand and Deliver strategy to advance the Company's vision of making wireless communication possible everywhere. By pursuing a broader leadership role in the industry, innovating for a 5G future, driving efficiency both internally and for our tenants, and thoughtfully growing our asset base, we are confident in our ability to continue to deliver strong cash flow growth while expanding return on invested capital going forward."

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.