Amid spiking natural gas prices, city of Tallahassee says it avoided $53M in utility costs

The city of Tallahassee avoided more than $53 million in natural gas costs — and the possibility of huge electric bill increases — by locking into near-historic low prices over the past few years before they started surging.

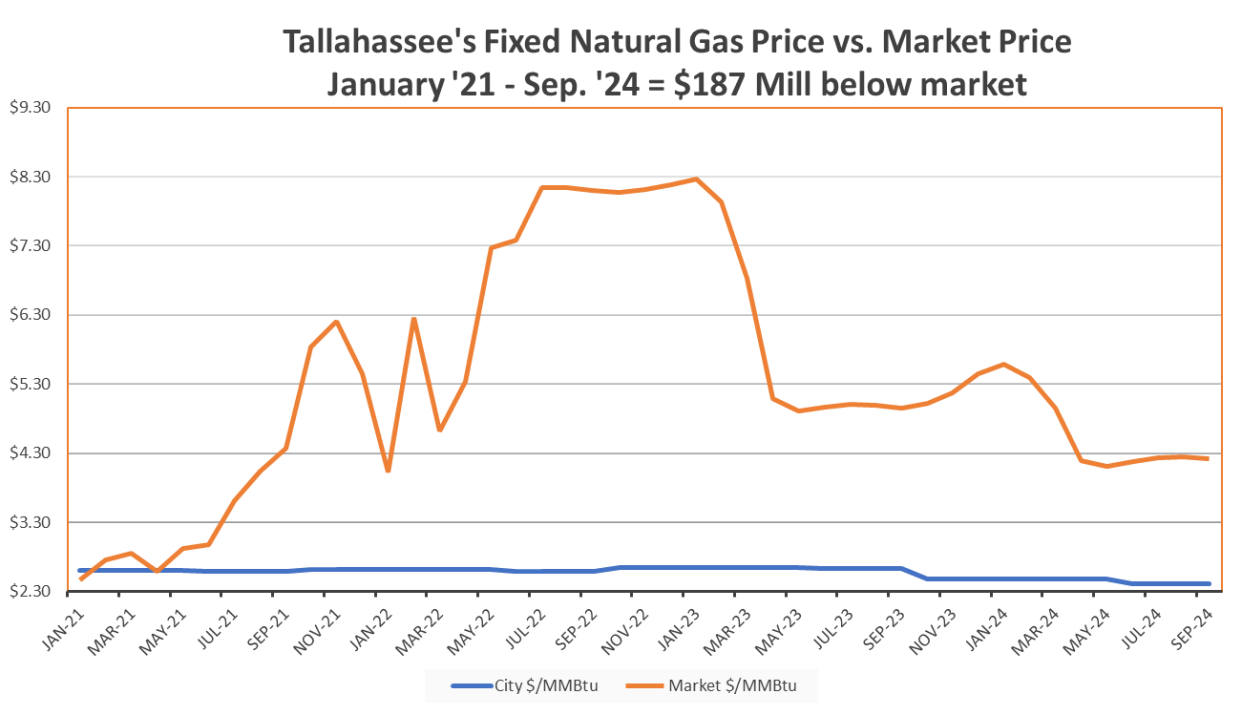

From October through June, the city spent $53.1 million less on natural gas by buying through long-term contracts executed when prices were low rather than on the open market, where prices have soared. What’s more, the city projects it will avoid another $134 million in natural gas costs through September 2024.

The city, through it’s fuel hedging program, buys natural gas at fixed prices that extend into the future — a strategy that pays dividends when market prices go higher. It affects electric bills and the customers who pay them because the city uses natural gas to generate much of its power.

City Manager Reese Goad said electric customers could have seen dramatic increases in their bills were it not for the success of the hedging program.

“This is great news and the reason why we have practices in place to bring about price stability for our businesses and residences,” Goad said.

Utility rates have crept up as fuel prices have skyrocketed

The city, which still buys 20% of its natural gas on the open market, has raised utility customers' electric rates twice over the past year, in part to keep up with rising prices.

The rates are made up of a fuel component, which pays the cost of natural gas, and a nonfuel component that covers all other expenses.

The adjustments amount to an estimated $7-a-month increase for average residential customers using 1,000 kilowatt hours, according to city officials.

The city raised the fuel component in October from 2.9999 cents to 3.329 cents per kilowatt hour and again in April to 3.519 cents per kilowatt hour, totaling a 17% increase. The city’s non-fuel component, which is adjusted annually for inflation, went from 7.438 cents per kilowatt hour to 7.631 cents per kilowatt hour, an increase of 2.6%.

Goad said that were it not for the hedging program, the city would have seen an estimated 100% jump in the cost of fuel and increases of $25 to $35 on monthly electric bills.

“The city has been able to avoid the significant increase in fuel price that other utilities around the nation have incurred,” Goad said, “and only had to adjust rates modestly to fully recover the inflationary costs and other fuel-related costs.”

How the hedge paid off

The city began locking into natural gas prices in 2018, when it bought at a historically low price of $2.60 per million British thermal units through the 2022 fiscal year. In 2020, the city locked into a price of $2.46 for natural gas through the 2024 fiscal year.

Since that time, prices on the market have spiked above $10. They’re forecast to remain above $4 through the fall of 2024.

“(Prices) were so low that historically 90% of the time, prices are higher than the level we locked in,” said David Ging, the city’s manager of energy trading. “So we thought this was a great chance to lock these prices in — it was so low, it could hardly go lower. And we knew it could potentially be double or triple.”

Domestic natural gas prices shot up in part because of a slowdown in production early in the pandemic followed by a higher-than-expected rebound in demand. Other factors include an unusually cold winter and hot early summer, export demands and amounts in underground storage.

The city, which spends roughly $70 million a year on natural gas, opted to hedge at a time when other utilities were relying on low market prices. Rate hikes have recently been announced from Jacksonville Beach to Gainesville and the Keys.

“A lot of people have not hedged in the past few years because prices have been low and very stable,” Ging said. “(They) just got kind of complacent and thought the low prices will be here forever.”

The city hasn’t always seen success with its fuel hedging program, which dates back to 2002. It beat the market in early years but racked up losses by 2010 around $50 million. Goad said the city, the only utility currently hedging in Florida, learned from that experience and waited for the right time to pounce on longer-term contracts.

Contact Jeff Burlew at jburlew@tallahassee.com or follow @JeffBurlew on Twitter.

Never miss a story: Subscribe to the Tallahassee Democrat using the link at the top of the page.

This article originally appeared on Tallahassee Democrat: Amid spiking natural gas prices, city of Tallahassee avoided $53M in utility costs