Amped Up Options Activity Follows Surging Kroger Stock

Grocery store staple Kroger Co (NYSE:KR) is charging up the charts today, least seen up 2.6% at $35.49, in an effort to reclaim its mid-March peak of $36.84. The security is set to topple recent pressure near the $35 level, and notch its highest close in over three years, should these gains hold. Meanwhile, news that Adage Capital Partners GP dissolved its stake in Kroger, along with several other big names including Gilead Sciences (GILD) doesn't seem to be influencing any price action.

Kroger's climb higher is kicking up plenty of dust in the options pits. So far, 53,000 calls and 5,428 puts have crossed the tape -- eight times the intraday average with volume running in the 99th annual percentile. The September 45 call is the most popular, followed by the weekly 8/14 35.50-strike call. It appears positions are being bought to open at both of these contracts, suggesting these traders are speculating on even more upside for KR in the near future.

Today's activity echoes recent sentiment among option traders. This is per KR's 50-day call/put volume ratio of 3.71 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits in the 90th percentile of its annual range, suggesting a much healthier appetite for long calls of late.

Analysts have taken a much more bearish stance on Kroger however, which could invite some upgrades to the table. Just five of the 16 covering KR call it a "strong buy," compared to 10 "hold" ratings, and one "strong sell." What's more, the 12-month consensus price target of $36.22 is a slim 2.1% premium to current levels.

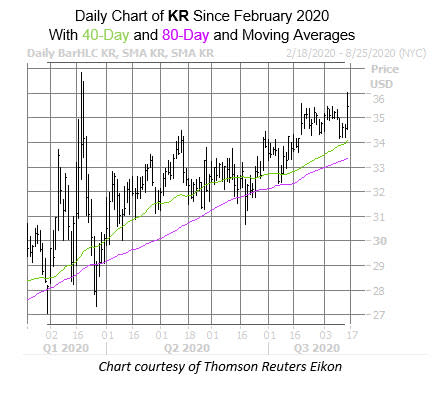

Just one month ago, founder and CEO Bernie Schaeffer pointed out a historically bullish signal with pretty good odds flashing on the charts. This signal -- the stock's 80-day moving average -- predicted a one-month return of 5.8% on average. The stock's one-month bounce was nearly as good. Kroger stock has tacked on roughly 5% during this time period, and now boasts a 22.2% year-to-date lead.

Kroger stock's 40-day moving average is another trendline that's worth mentioning. While pullbacks to this trendline don't boast the same returns as the 80-day, a study from Schaeffer's Senior Quantitative Analyst Rocky White shows KR coming within one standard deviation of this area four other times in the past year. The security was higher one month later 50% of the time, and averaged a one-month return of 1.8%.

With multiple layers of support in place, bulls would be remiss not to speculate on Kroger's next move with options, especially considering that these contracts can be had at a premium at the moment. Kroger's Schaeffer's Volatility Index (SVI) of 22% is higher than just 3% of readings from its 12-month range. This means near-term option traders are pricing in extremely low volatility expectations.