Andreas Halvorsen Sells Disney, Buys Bank of America

- By Margaret Moran

Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors recently released its portfolio updates for the first quarter of 2021, which ended on March 31.

Connecticut-based Viking Global Investors considers fundamentals and management to be some of the most important factors when identifying investment opportunities. The firm also takes positions based on broader cyclical and industry trends. Halvorsen is one of the so-called "Tiger Cubs" who were taught by Julian Robertson (Trades, Portfolio) of Tiger Management.

Based on its investing criteria, the firm's top buys for the quarter were Bank of America Corp. (NYSE:BAC) and O'Reilly Automotive Inc. (NASDAQ:ORLY), while its biggest sells were JPMorgan Chase & Co. (NYSE:JPM) and The Walt Disney Co. (NYSE:DIS).

Bank of America

The firm established a new holding of 31,312,416 shares in Bank of America (NYSE:BAC), which had a 3.61% impact on the equity portfolio. During the quarter, shares traded for an average price of $34.49.

Bank of America is a U.S. global bank major headquartered in North Carolina. With approximately $2.61 trillion in total assets, it provides a wide range of traditional, corporate and investment banking services and other financial services.

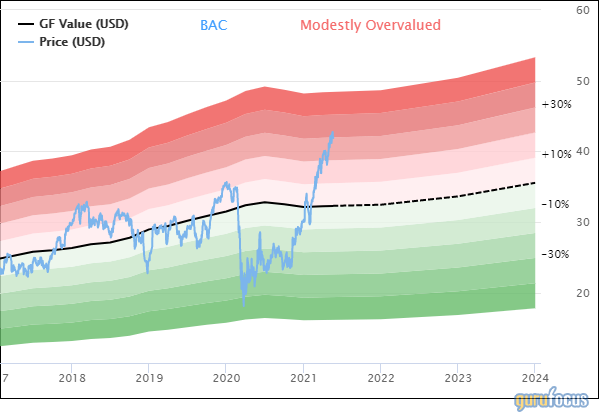

On May 20, shares of Bank of America traded around $41.89 for a market cap of $358.97 billion and a price-earnings ratio of 17.99. According to the GuruFocus Value chart, the stock is modestly overvalued.

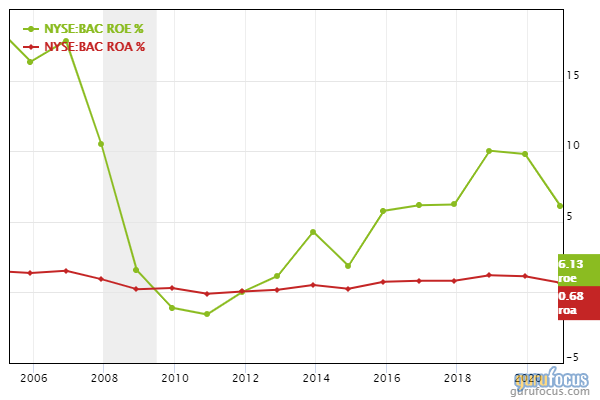

The company has a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. The equity-to-asset ratio of 0.09 is only slightly lower than the industry median of 0.10, while the debt-to-equity ratio of 1.00 is underperforming 66% of companies in the banks industry. The return on equity of 6.13% and return on assets of 0.68% are both below their industry medians.

O'Reilly Automotive

The firm also invested in 1,066,676 shares of O'Reilly Automotive (NASDAQ:ORLY), impacting the equity portfolio by 1.61%. Shares traded for an average price of $464.17 during the quarter.

O'Reilly Automotive is the company that owns the O'Reilly Auto Parts retail chain, which sells automotive aftermarket parts, tools, supplies, equipment and accessories to both professional service providers and do-it-yourself customers through more than 5,400 locations in the U.S.

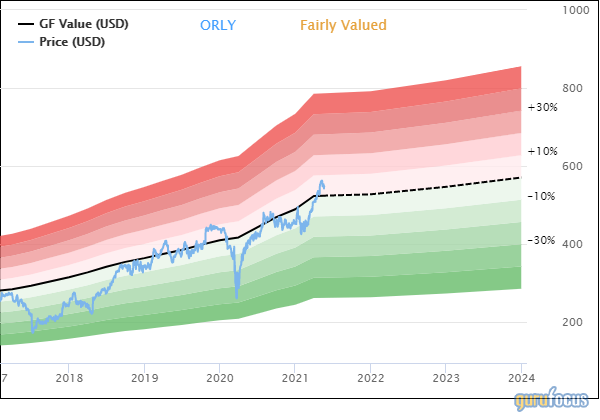

On May 20, shares of O'Reilly Automotive traded around $548.38 for a market cap of $38.26 billion and a price-earnings ratio of 20.57. According to the GF Value chart, the stock is fairly valued.

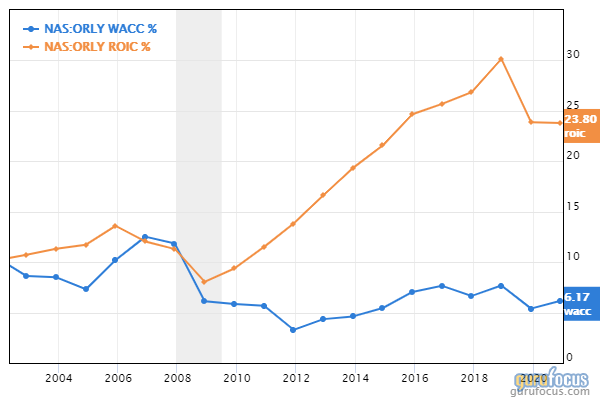

The company has a financial strength rating of 4 out of 10 and a profitability rating of 9 out of 10. The Altman Z-Score of 3.44 and Piotroski F-Score of 7 out of 9 indicate the company has a strong balance sheet. The return on invested capital is consistently higher than the weighted average cost of capital, which means the company is creating value as it grows.

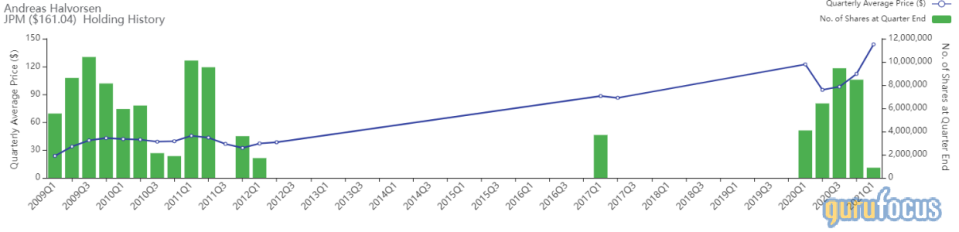

JPMorgan Chase

The firm cut its investment in JPMorgan Chase (NYSE:JPM) by 7,584,658 shares, or 89.66%, for a remaining holding of 874,417 shares. The trade had a -2.65% impact on the equity portfolio. During the quarter, shares traded for an average price of $143.83.

By assets, JPMorgan is the largest bank in the U.S. and the sixth-largest bank in the world. Based in New York, the company offers a full range of traditional and investment banking services to individual and corporate clients worldwide.

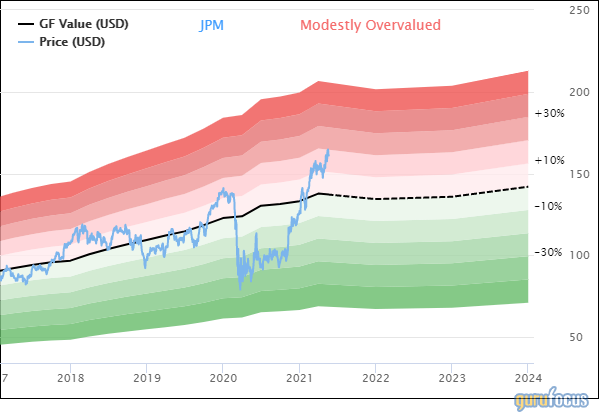

On May 20, shares of JPMorgan traded around $160.98 for a market cap of $487.31 billion and a price-earnings ratio of 12.79. According to the GF Value chart, the stock is modestly overvalued.

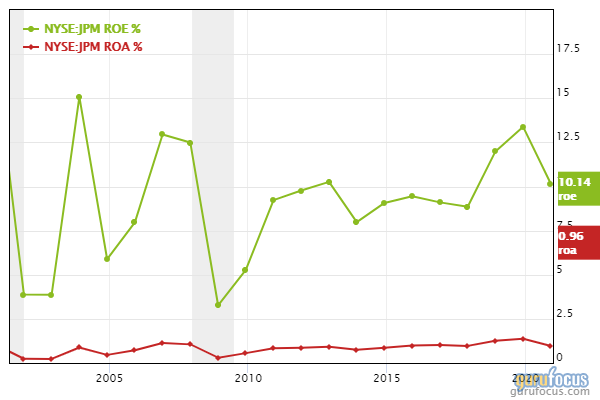

The company has a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. The equity-to-asset ratio of 0.08 is below the industry median of 0.10, while the debt-to-equity ratio of 1.66 is underperforming 80% of other companies in the banks industry. The return on equity of 10.14% and return on assets of 0.96% are both doing better than their respective industry medians.

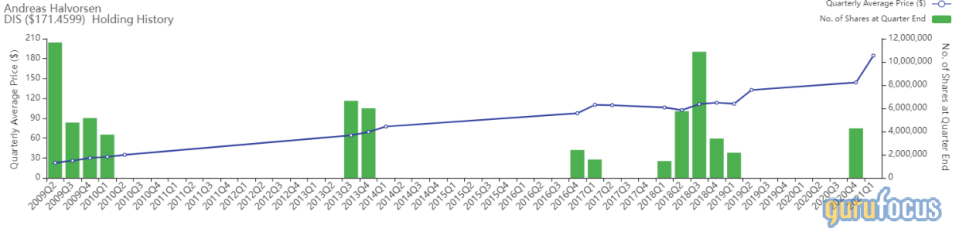

Walt Disney

The firm sold all 4,271,505 of its shares of The Walt Disney Co (NYSE:DIS), which had a -2.13% impact on the equity portfolio. Shares traded for an average price of $184.47 during the quarter.

The iconic mass media company is one of the largest producers of entertainment in the U.S. Based in Los Angeles, the multinational diversified media company produces movies and shows, owns and operates theme parks and provides streaming services such as ESPN+, Hulu and Disney+.

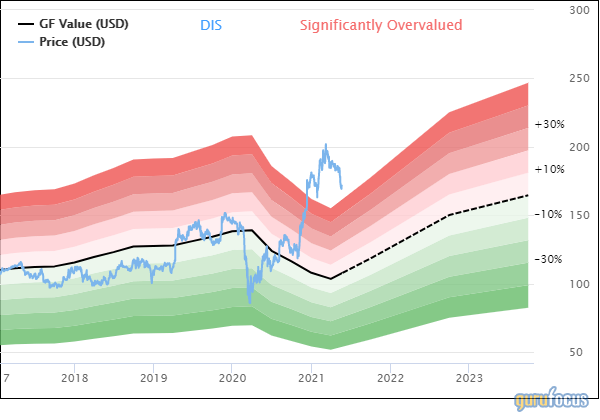

On May 20, shares of Walt Disney traded around $171.69 for a market cap of $311.57 billion. According to the GF Value chart, the stock is significantly overvalued.

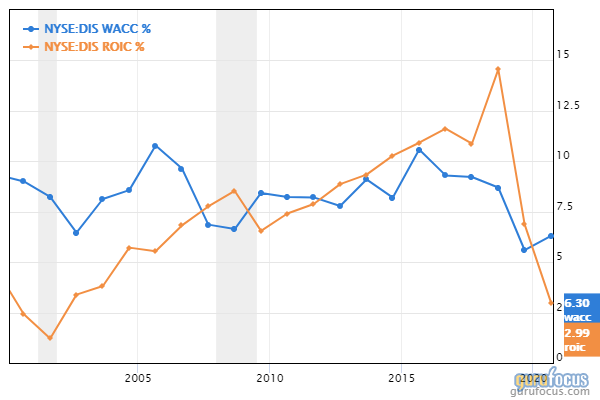

The company has a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The interest coverage ratio of 0.75 suggests the company is unable to meet the interest payments on its debt, and the Piotroski F-Score of 3 out of 9 also implies a poor financial situation. The ROIC has often fallen below the WACC in the past couple of decades, indicating struggles with growing in a profitable manner.

Portfolio overview

As of the quarter's end, the firm had 94 common stock positions valued at a total of $33.58 billion. The firm established 28 new positions, sold out of 29 stocks and added to or reduced several other positions for a turnover of 25%.

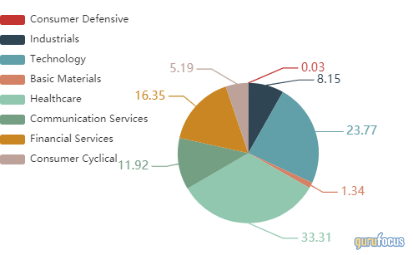

The top holdings were Microsoft Corp. (NASDAQ:MSFT) with 5.98% of the equity portfolio, BridgeBio Pharma Inc. (NASDAQ:BBIO) with 4.88% and Fidelity National Information Services Inc. (NYSE:FIS) with 4.02%. In terms of sector weighting, the firm was most invested in health care, technology and financial services.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.