Announcing: Chasen Holdings (SGX:5NV) Stock Increased An Energizing 183% In The Last Three Years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For instance the Chasen Holdings Limited (SGX:5NV) share price is 183% higher than it was three years ago. That sort of return is as solid as granite. And in the last month, the share price has gained 12%.

See our latest analysis for Chasen Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Chasen Holdings moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

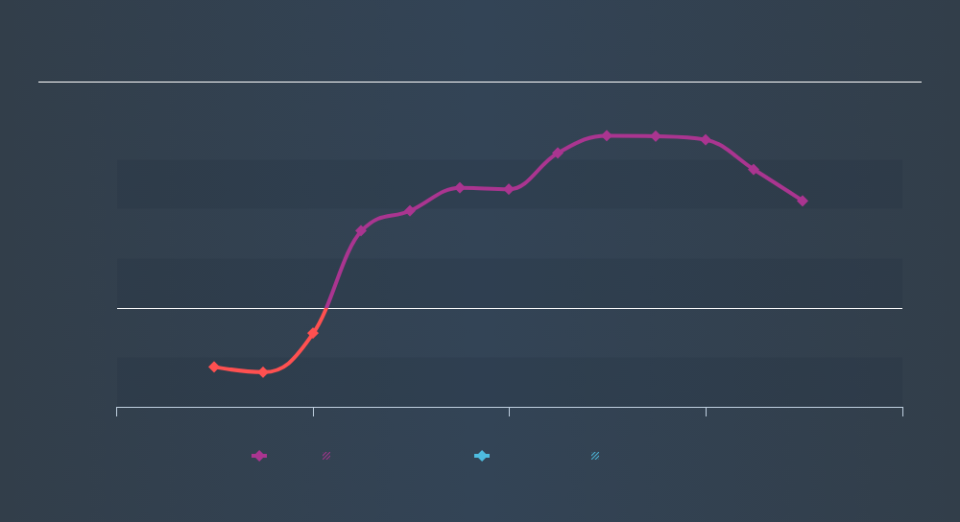

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Chasen Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Chasen Holdings the TSR over the last 3 years was 215%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Chasen Holdings shareholders have received a total shareholder return of 22% over one year. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 9.8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Importantly, we haven't analysed Chasen Holdings's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Chasen Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.