Announcing: Jiayin Group (NASDAQ:JFIN) Stock Increased An Energizing 169% In The Last Year

It might be of some concern to shareholders to see the Jiayin Group Inc. (NASDAQ:JFIN) share price down 29% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 169% in that time. So it may be that the share price is simply cooling off after a strong rise. More important, going forward, is how the business itself is going.

Check out our latest analysis for Jiayin Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Jiayin Group actually saw its earnings per share drop 53%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Jiayin Group's revenue actually dropped 42% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

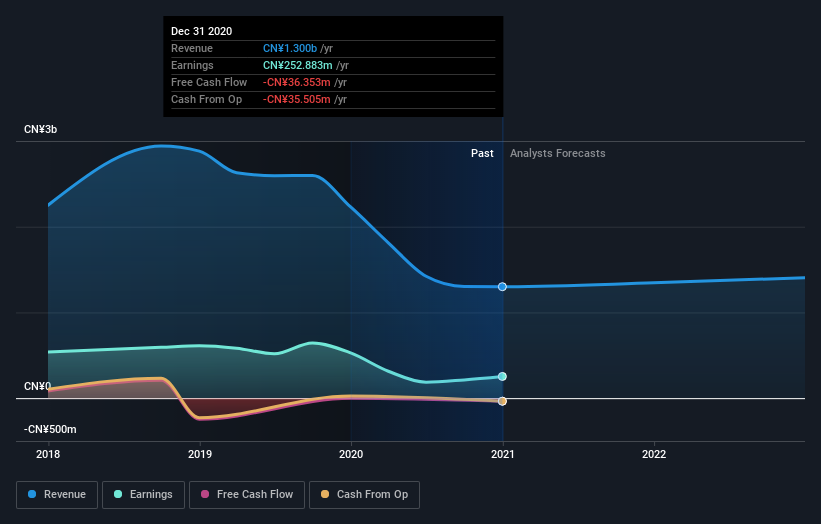

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Jiayin Group's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Jiayin Group shareholders have gained 169% over the last year. And the share price momentum remains respectable, with a gain of 69% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Jiayin Group (2 don't sit too well with us) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.