Announcing: Xenia Hotels & Resorts (NYSE:XHR) Stock Increased An Energizing 158% In The Last Year

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Xenia Hotels & Resorts, Inc. (NYSE:XHR) share price has soared 158% return in just a single year. On top of that, the share price is up 20% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Zooming out, the stock is actually down 18% in the last three years.

View our latest analysis for Xenia Hotels & Resorts

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Xenia Hotels & Resorts saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Xenia Hotels & Resorts' revenue actually dropped 77% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

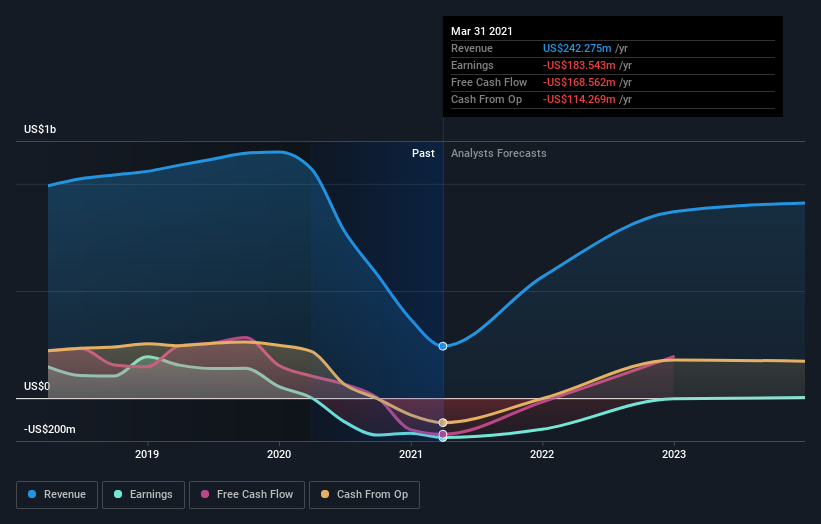

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Xenia Hotels & Resorts stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Xenia Hotels & Resorts has rewarded shareholders with a total shareholder return of 158% in the last twelve months. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Xenia Hotels & Resorts better, we need to consider many other factors. For example, we've discovered 2 warning signs for Xenia Hotels & Resorts (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.