Apple's Bungled Plans for Digital Streaming

- By John Kinsellagh

What does a company who feasted on revenue from brisk iPhone sales do when that market matures?

That is the question Apple Inc. (AAPL) has been forced to address recently, as iPhone sales are on a permanent downward trajectory. The company was slow to wean itself off its addiction to what has, for years, been its golden cash cow.

Warning! GuruFocus has detected 2 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL

One area for potential expansion and promising growth for Apple is the original content direct-to-consumer market. Despite the potential, Apple seems to have exhibited a rather cavalier and nonchalant attitude toward a business segment that could provide an enormous amount of revenue to supplant the dying smartphone market. Although it certainly has the cash to commit, the company has no definitive long-term business plan for targeting the enormous direct-to-consumer streaming market.

So far, Apple's entry into the market has been ham-handed and its relationship with Hollywood producers and directors, heavy-handed, leading to an enormous amount of frustration for those who are charged with producing content. To date, Apple has spent a pittance on original content production. Although it is slated to roll out its subscription-based content offerings shortly, the company's incessant intermeddling in production decisions has constantly led to delays. While the company fiddles and drifts aimlessly, other legacy media companies are allocating massive sums for developing their foray into the streaming business in order to catch up with Netflix Inc. (NFLX), the undisputed champ of original content delivery.

Apple is a novice and untested player in the original content business. Even though it's sourcing out its original content productions to established film companies, how the original content piece produced by these studios fits into Apple's overall digital streaming subscription services plan is somewhat unclear.

Given the recent bad news from iPhone suppliers and its unprecedented reduced revenue guidance in December related to dramatically declining iPhone sales, Apple's wishy-washy posture toward entering the original content area seems inexplicably guarded.

During recent meetings with Hollywood producers, one of the common gripes was Apple CEO Tim Cook's officious intermeddling in producers' offerings by insisting on producing only "family-friendly" shows. This is indicative of a company that currently is out of its depth in terms of being able to hit the ground running with compelling original content offerings. Has Cook ever watched Disney (DIS)? One wonders. Disney has been the king of family-oriented content production since before Cook was even born. It currently owns that market.

Last June, Cook indicated he was adopting a conservative approach to Apple's content production; he didn't want any movies that contained gratuitous violence, raw language politics or risque story lines that might risk the company's pristine brand image. The story lines Cook wants to avoid are precisely those that have been embraced by Apple's eventual competitors -- cable TV, Netflix and Amazon (AMZN). Netflix offers its subscribers a plethora of entertainment choices. The existing players in the direct-to-consumer streaming market don't share Apple's restrictive content compunctions.

Cook seems to be laboring under the misconception Apple can somehow inexplicably transfer its "brand" to the production of original content that would be the equivalent of a 21st century version of "Lassie." Someone ought to remind Cook the brand is not connected with the production of entertainment or movies; it is associated with manufacturing groundbreaking, innovative devices that have upended entire industries.

Apple may not have the luxury of entering the movie business by dipping its toe in the water. Netflix already has a commanding lead in the digital streaming media market and if Apple wants a piece of the pie, it is going to need to broaden its horizons in terms of offerings and go beyond its odd idea of producing only original content offerings consistent with its "brand."

Apple's irresolution and lackadaisical attitude toward the streaming business seems to imply it believes ut can control the timing and strategic direction for its original content business on terms it solely dictates. This belief is increasingly being exposed as fanciful and counterproductive.

Dan Ives, an analyst from Wedbush Securities, said it best when he commented on Apple's late arrival to the digital streaming party.

"In the streaming and content arms race, they've been on the outside looking in," he said. "Even though they've had some deals, it's been a rounding error."

Ives correctly noted the amount of resources Apple has invested is de minimis. "They're spending $1 billion on content, while Netflix, Disney, Amazon are spending $20 billion a year," he said.

Any current Netflix subscriber can attest to that company's aggressive rolling out of new, fresh content at staggering rate. Netflix will spend almost $12 billion on original content this year. By comparison, Apple is still dipping its toe in the original content area, tinkering with production ideas, while Netflix is busy increasing its subscriber base by offering compelling geographic-centric content.

Apple's belief it can take its time entering the rapidly growing streaming market is wishful thinking that is a bad omen for shareholders. The digital streaming market will shortly have a number of big players, such as Disney and AT&T (NYSE:T), who are aggressively rolling out definitive plans for offering consumers content-rich streaming options.

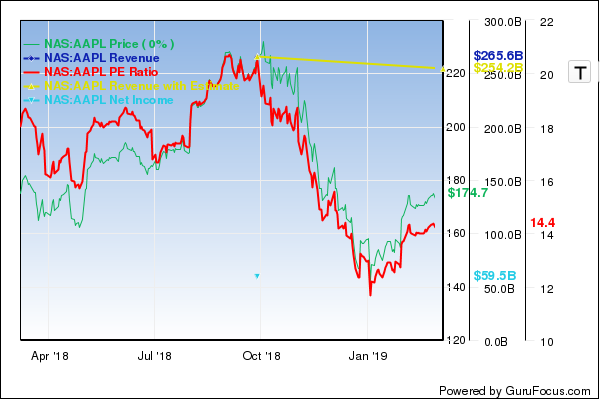

The difficulty for Apple, as the chart below foretells, is that if its iPhone sales decline at an accelerated clip, the company may not have the luxury of time in terms of finding its footing in a new line of business wholly unrelated to its traditional business operations. The more Apple remains indecisive and aimless in terms of rolling out a feature-rich streaming plan that will have appeal to existing streaming consumers, the more likely it will be viewed as a bit player.

Disclosure: I have no positions in any of the securities referenced in this article.

Read more here:

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL