With the application for student loan forgiveness open, KY officials warn against scams

- Oops!Something went wrong.Please try again later.

The online application for federal student debt forgiveness is now live, meaning the more than 560,000 Kentuckians eligible can now apply for relief.

But as millions of borrowers seek debt relief, state and federal leaders are warning them to be alert for potential scams that could dupe them into giving their personal information through spoofed websites or to phony government representatives.

Here’s what to know about the application process, how you make sure you’re not falling prey to a scammer and what student debt relief will generally mean for Kentucky borrowers.

The Herald-Leader also wants to know what specific questions you want answered, let us know using this form.

Kentucky attorney general warns of student loan scams

Monday, as the online application went live, Kentucky Attorney General Daniel Cameron issued a consumer alert warning borrowers to be on their guard against potential scams.

“In light of the beta testing rollout of the federal student loan debt relief application, Kentuckians should watch out for scammers posing as the Department of Education or a loan provider,” Cameron said in a news release sent by his office.

“In these schemes, the scammer may offer help and ask the consumer to complete a fake debt relief application, which allows the scammer to access their personal funds or personally identifiable information that could be used for identity theft,” he continued.

Scammers may contact borrowers claiming, for example, to be affiliated with the U.S. Department of Education or a loan servicing provider and offer specialized repayment plans, access to quicker loan forgiveness or assistance with filling out the application, the office warned.

You might be directed to complete a fake debt relief application or confirm your personal loan information.

A dead giveaway is if the application includes direct deposit or power of attorney forms that allow scammers direct access to your bank account. In these schemes, scammers may also collect personal information to carry out identity theft.

Cameron’s office issued the following tips for borrowers:

Never pay anyone to help you apply for loan forgiveness. Nobody can get your loans forgiven faster, even if you pay them.

Never give unsolicited callers or emailers your student aid identification information, social security number, date of birth or credit card information.

Be suspicious of unsolicited calls or emails from anyone claiming to be affiliated with the U.S. Department of Education. If you’re not sure the “offer” is legit, hang up and contact your federal student loan servicer directly.

How to apply for student debt relief

You can find the beta application online at studentaid.gov. The government website allows eligible Americans to apply for up to $20,000 in student debt forgiveness.

Those who earn less than $125,000 as individual filers or less than $250,000 as a family qualify for $10,000 in loan forgiveness. If you received a need-based federal Pell Grant in college, that forgiveness amount is up to $20,000.

The application itself is available in English and Spanish and prompts borrowers to submit their first and last name, social security number, date of birth and contact information.

Borrowers submit basic identifying information and then verify they are the individual named in the application, provide proof of income and affirm they meet the income requirements.

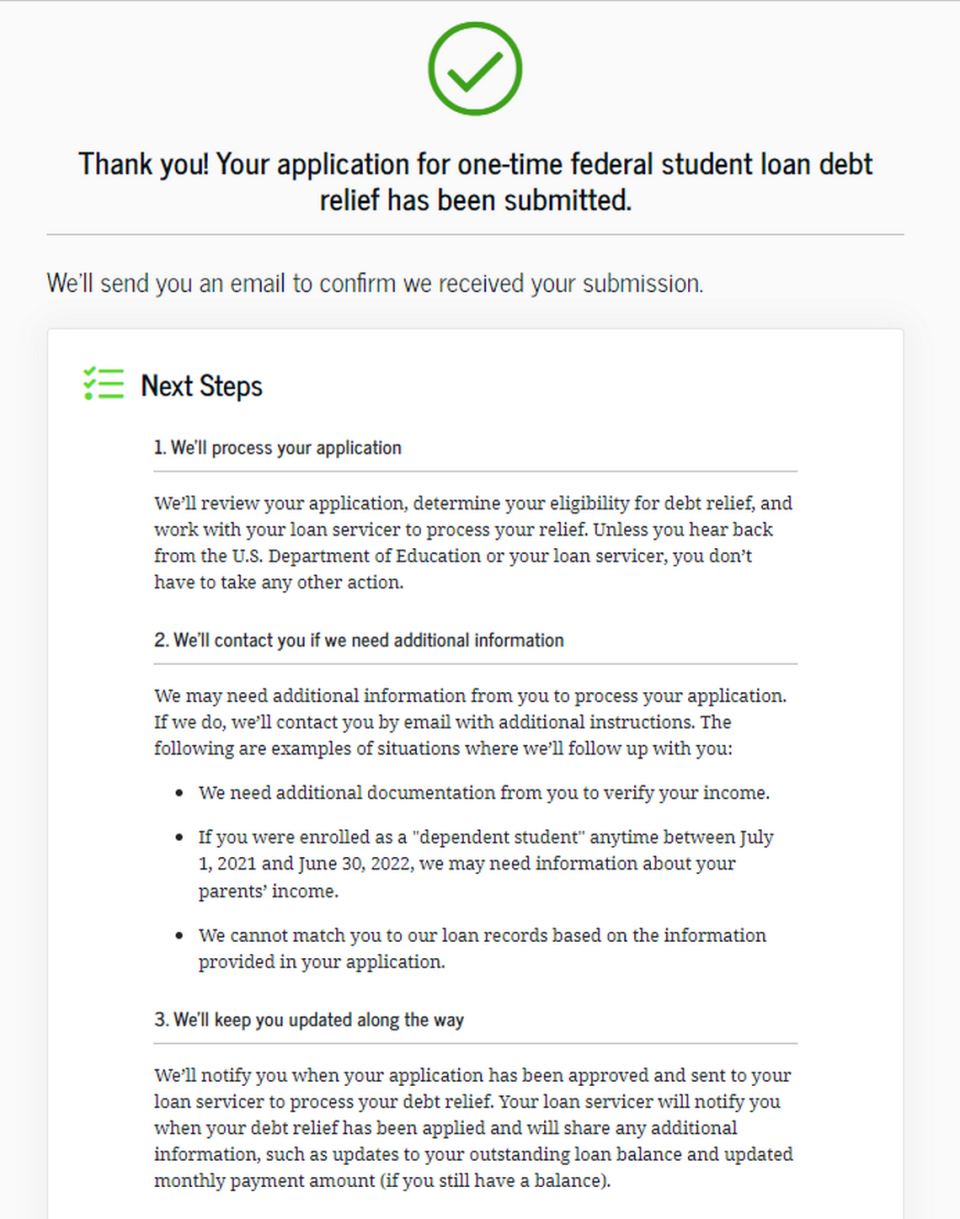

Once complete, you’ll get confirmation email that your application has been successfully submitted. The Department of Education will review your application, determine if you qualify for relief and work directly with your loan servicer to process it.

“Unless you hear back from the U.S. Department of Education or your loan servicer, you don’t have to take any other action,” the application reads.

That said, the department may follow up with you if it requires additional information to process your application. If it does, it will contact you via email, possibly to ask for the following information:

Additional information documentation to verify your income

If you were enrolled as a “dependent student” anytime between July 1, 2021, and Jun 30, 2022. In that case, the department will request additional information about your parents’ income

The department cannot match you to the loan records it has based on the information you provided through your application

If you’ve been approved for relief, you’ll be notified this has occurred and your loan servicer has been told to process your loan forgiveness.

“Your loan servicer will notify you when your debt relief has been applied and will share any additional information, such as updates to your outstanding loan balance and updated monthly payment amount (if you still have a balance),” per the online application.

If you submitted your application during the soft launch beta period over the weekend, you won’t need to resubmit, according to CBS News.

Unlike some other states, Kentucky won’t tax the forgiven student debt.

Student loan borrowers have until Dec. 31, 2023, to apply.

What does this mean for Kentucky’s student loan borrowers?

In Kentucky, more than half a million borrowers are eligible for student debt relief and as many as 209,400 state residents could see their loans forgiven entirely, a 2021 study from the Kentucky Center for Economic Policy determined.

Not all of them are millennials in their 30s, according to a sampling of borrowers who previously told the Herald-Leader what they plan to do after forgiveness.

“I have student loans that will outlive me (I’m 63 now),” Vickie Naylor wrote in response to a a previous poll. “It will be such a relief to get out from under this never-ending burden!”

Ashley Spalding, who directs research for the Kentucky Center for Economic Policy, described the opening of the application Monday as “a big day for hundreds of thousands of Kentuckians, who can now apply for life-changing debt cancellation.”

“Student debt cancellation will relieve enormous financial stress facing families in Kentucky, where Black students are more likely to have debt than white students and many with student loan debt have few economic resources with which to pay them back. While this policy doesn’t solve the problem, it’s a good first step that will help many whose lives and economic choices suffer under the weight of student debt,” Spalding said in a KCEP release.

Do you have a question about Kentucky for our service journalism team? We’d like to hear from you. Fill out our Know Your Kentucky form or email ask@herald-leader.com.