Aramark (ARMK): Hedge Funds Are Cashing Out

Is Aramark (NYSE:ARMK) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

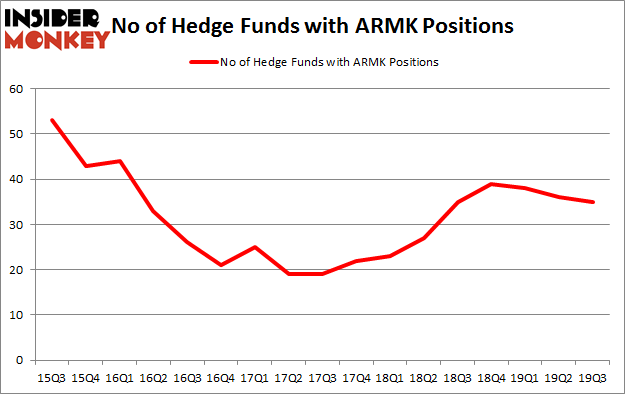

Aramark (NYSE:ARMK) investors should be aware of a decrease in hedge fund sentiment recently. ARMK was in 35 hedge funds' portfolios at the end of September. There were 36 hedge funds in our database with ARMK holdings at the end of the previous quarter. Our calculations also showed that ARMK isn't among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several indicators investors have at their disposal to assess stocks. A pair of the most innovative indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the best fund managers can outclass their index-focused peers by a superb amount (see the details here).

[caption id="attachment_735641" align="aligncenter" width="473"]

Michael Lowenstein of Kensico Capital[/caption]

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world's most bearish hedge fund that's more convinced than ever that a crash is coming, our long-short investment strategy doesn't rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds' buy/sell signals. Let's take a glance at the recent hedge fund action surrounding Aramark (NYSE:ARMK).

What have hedge funds been doing with Aramark (NYSE:ARMK)?

Heading into the fourth quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the previous quarter. On the other hand, there were a total of 35 hedge funds with a bullish position in ARMK a year ago. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Michael Lowenstein's Kensico Capital has the biggest position in Aramark (NYSE:ARMK), worth close to $349.1 million, corresponding to 6.7% of its total 13F portfolio. Sitting at the No. 2 spot is ExodusPoint Capital, led by Michael Gelband, holding a $152.6 million position; 5.3% of its 13F portfolio is allocated to the stock. Other peers with similar optimism comprise Daniel Sundheim's D1 Capital Partners, Seth Rosen's Nitorum Capital and Paul Hilal's Mantle Ridge LP. In terms of the portfolio weights assigned to each position Lionstone Capital Management allocated the biggest weight to Aramark (NYSE:ARMK), around 8.88% of its portfolio. Kensico Capital is also relatively very bullish on the stock, setting aside 6.68 percent of its 13F equity portfolio to ARMK.

Judging by the fact that Aramark (NYSE:ARMK) has experienced declining sentiment from the entirety of the hedge funds we track, it's safe to say that there exists a select few fund managers that elected to cut their entire stakes in the third quarter. It's worth mentioning that Robert Boucai's Newbrook Capital Advisors dropped the biggest position of the 750 funds followed by Insider Monkey, valued at an estimated $33.3 million in call options. Israel Englander's fund, Millennium Management, also dropped its call options, about $17.1 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 1 funds in the third quarter.

Let's go over hedge fund activity in other stocks similar to Aramark (NYSE:ARMK). We will take a look at Camden Property Trust (NYSE:CPT), Noble Energy, Inc. (NYSE:NBL), CF Industries Holdings, Inc. (NYSE:CF), and Sasol Limited (NYSE:SSL). This group of stocks' market caps resemble ARMK's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CPT,20,316246,1 NBL,28,602859,3 CF,39,956283,4 SSL,8,26026,0 Average,23.75,475354,2 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $475 million. That figure was $1297 million in ARMK's case. CF Industries Holdings, Inc. (NYSE:CF) is the most popular stock in this table. On the other hand Sasol Limited (NYSE:SSL) is the least popular one with only 8 bullish hedge fund positions. Aramark (NYSE:ARMK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ARMK wasn't nearly as popular as these 20 stocks and hedge funds that were betting on ARMK were disappointed as the stock returned 0.4% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

20 Simple Tinder Bios for Females

15 Easiest Medical Specialties in America