ArcelorMittal (MT) Ends Second Buyback Program, Begins Third

ArcelorMittal MT recently announced the completion of its second share buyback program which was announced on Mar 4, 2021. ArcelorMittal had repurchased 17,847,057 million shares for a total value of roughly €468,812,110.90 (or $569,999,745.42) at an average price of around €26.27 per share as of Jun 17.

The company also announced the commencement of a third share buyback program. This buyback will be for an aggregate amount of $750 million. The proceeds of this sale will be returned to ArcelorMittal’s shareholders through the buyback program.

The share buyback program is expected to be wrapped up by Dec 31, 2021. The acquired shares are intended to meet ArcelorMittal’s obligations under debt obligations exchangeable into equity securities and/or to reduce its share capital.

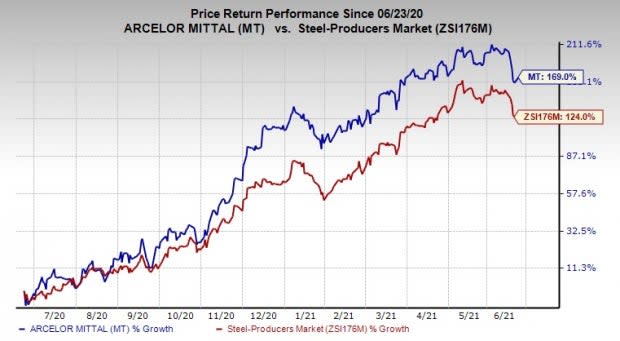

Shares of ArcelorMittal have surged 169% in the past year compared with 124% rise of the industry.

Image Source: Zacks Investment Research

ArcelorMittal, in its last earnings call, stated that it envisions global apparent steel consumption (“ASC”) to increase 4.5-5.5% in 2021. The figure suggests an improvement from a contraction of 1% in 2020. The global steel industry is now benefiting from a favorable supply-demand balance and a low inventory environment, the company noted. ArcelorMittal expects ASC to grow year over year in 2021 in all of its core markets.

The company also revealed its priorities for the rest of the year, which include maintaining a competitive cost advantage to strategically grow through high-return projects in high-growth markets. It also intends to leverage existing infrastructure to develop its iron ore resources, consistently return cash to shareholders through a defined capital return policy as well as carry on sustainable development.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Other Key Picks

ArcelorMittal currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Nucor Corporation NUE, Olin Corporation OLN and Cabot Corporation CBT.

Nucor has a projected earnings growth rate of around 344.9% for the current year. The company’s shares have surged 127% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 506.7% for the current year. The company’s shares have skyrocketed 278.5% in the past year. It currently sports a Zacks Rank #1.

Cabot has an expected earnings growth rate of around 126% for the current fiscal. The company’s shares have surged 55.5% in the past year. It currently carries a Zacks Rank #2.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research