Argentina Wins Key IMF Support With Deal to Unlock $4.7 Billion

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- The International Monetary Fund gave President Javier Milei’s economic plans a vote of confidence by approving a review of Argentina’s $44 billion program that will likely unlock a larger-than-expected loan disbursement.

Most Read from Bloomberg

The deal, if backed by the IMF’s executive board, will give Argentina access to $4.7 billion, the Fund said in a statement late on Wednesday. That’s more than the $3.3 billion initially expected, and it buys Milei time to honor debt repayments to the Fund before deciding whether to continue with the current program brokered by his predecessor or negotiate a new one.

Among the conditions for the deal, Argentina will target a primary fiscal surplus of 2% of gross domestic product this year. Milei’s “ambitious stabilization plan,” including a 54% devaluation of the peso last month, is expected to boost net foreign reserves to $10 billion by year-end, the IMF added in the statement. About $2.7 billion of that amount has already been accumulated in the final weeks of 2023.

“We have plenty of confidence that the measures we are adopting will take us on the right path,” Economy Minister Luis Caputo told reporters following the announcement. He added that the IMF was open to exploring a new program but it was too early for Milei to consider that.

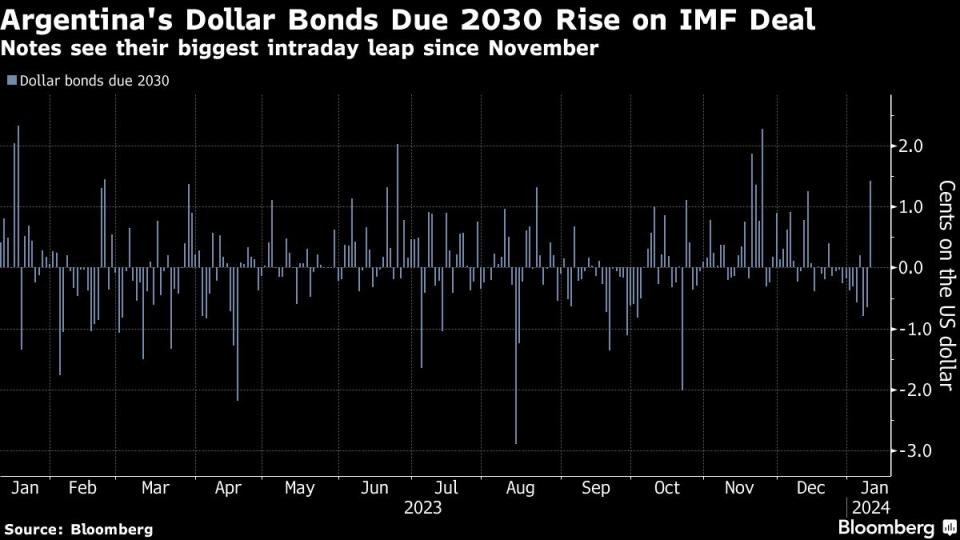

Investors, who had already driven Argentina’s bond prices higher on reports that a deal was coming by the end of the day, considered the agreement as a clear acknowledgment of Argentina’s fiscal efforts by the IMF.

“A good grade from the IMF staff but no extra cookie,” said Walter Stoeppelwerth, a senior strategist at Montevideo-based brokerage Gletir, referring to the fact that no new money was promised by the Fund. “This is a big deal. Demand destruction and the halt in deficit monetization combo is working for now.”

Read More: Argentina Readies $1 Billion Bond Payment Amid IMF Deal Rework

Comfortable Targets

Argentina is comfortable with the targets set by the IMF, Caputo said, adding that they will be reached with or without congressional approval of Milei’s presidential decree and omnibus bill package. The plans, now facing a testy debate in Argentina’s lower house, include higher taxes and sweeping deregulation measures.

Central Bank President Santiago Bausili said during the same news conference that the IMF is comfortable with Argentina’s monetary policy, even though inflation remains above the benchmark interest rates. Annual inflation likely surpassed 200% in December, according to private estimates, as Milei dismantles price controls amid the peso devaluation.

Bausili also promised to maintain the current crawling peg currency system that allows the peso to devalue 2% a month — a pace that economists consider insufficient to keep the official and the exchange rates not too far apart.

The staff-level agreement comes after senior IMF officials visited Argentina for negotiations, a symbolically positive development as previous talks were held almost entirely outside the country as tensions flared between President Alberto Fernandez and the Fund’s leadership.

Read More: Milei Pitches Banks $71 Billion Swap to Clean Up Argentina Debt

The IMF has a long history of stabilization programs that didn’t work as intended in Argentina. A record 2018 bailout failed to rescue the economy from a currency crisis and was eventually replaced in 2022 with another agreement with which the previous government routinely failed to comply.

But at least for now, Milei and the Fund are in a honeymoon phase. IMF Managing Director Kristalina Georgieva applauded the president’s first moves and and Milei went as far as to say that the Fund “sees us as heroes” because of his austerity measures.

While Milei enjoys support from Washington, his market-friendly recipe to fix Argentina’s economy implies severe pain ahead, and public pushback has already flared up. A general strike organized by labor unions is scheduled for Jan. 24, while scenes of Buenos Aires residents banging pots and pans in defiance of his austerity campaign are becoming routine.

--With assistance from Kevin Simauchi.

(Recasts story with comments from investor, Argentina’s economy minister and central bank chief)

Most Read from Bloomberg Businessweek

Trumponomics 2.0: What to Expect If Trump Wins the 2024 Election

US Is Weaponizing New Economic Tools to Slow China’s War Machine

©2024 Bloomberg L.P.