Arvinas (ARVN), Pfizer Team up for Breast Cancer Therapy

Arvinas ARVN announced that it has entered into a global collaboration with Pfizer PFE to co-develop and co-commercialize its investigational breast cancer therapy candidate, ARV-471. Shares increased 8.97% following the announcement, as investors cheered the collaboration given Pfizer’s expertise in the targeted space.

The candidate is an oral PROTAC (PROteolysis TArgeting Chimera) estrogen receptor protein degrader.

The candidate is currently in a phase II dose expansion study for the treatment of patients with estrogen receptor (ER) positive/human epidermal growth factor receptor 2 (HER2) negative (ER+/HER2-) locally advanced or metastatic breast cancer.

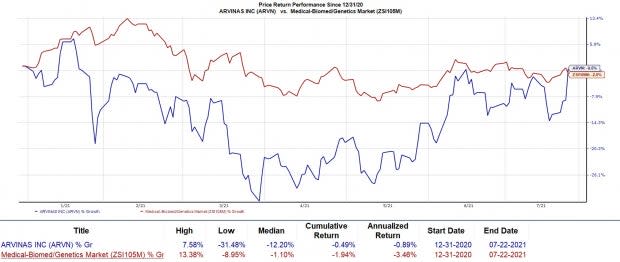

Shares of Arvinas have declined 0.5% so far this year in comparison with the industry’s 2% decrease.

Image Source: Zacks Investment Research

Per the terms of the agreement, Arvinas will receive an upfront payment of $650 million. It will also be eligible to receive a potential $1.4 billion in milestone payments. Both the companies will equally share worldwide development costs, commercialization expenses and profits. Separately, Pfizer will acquire approximately 7% equity stake in Arvinas for $350 million.

ARV-417 is currently being evaluated in a phase I dose escalation study for metastatic breast cancer, a phase Ib combination study with Pfizer’s Ibrance (palbociclib), and a phase II monotherapy dose expansion study, VERITAC. Interim data from phase I dose escalation study indicated that the drug promoted substantial ER degradation, and exhibited encouraging clinical efficacy and tolerability profile.

Both the companies seek to develop ARV-471 as the potential endocrine therapy of choice for patients and their physicians. Both Arvinas and Pfizer also anticipate starting phase III studies in 2022 across lines of therapy in metastatic breast cancer, including combinations with Ibrance, followed by pivotal studies in the early breast cancer setting.

In 2018, Arvinas announced a separate research collaboration and license agreement with Pfizer for the discovery and development of drug candidates using Arvinas’ proprietary PROTAC technology.

Apart from ARV-471, Arvinas is also developing ARV-110 for the treatment of men with metastatic castrate-resistant prostate cancer.

Zacks Rank & Stocks to Consider

Arvinas currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the biotech sector include Biomarin Pharmaceutical BMRN and 9 Meters Biopharma NMTR. While Biomarin sports a Zacks Rank #1 (Strong Buy), 9 Meters currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Biomarin’s earnings estimates for 2022 have increased from $2.33 to $2.35 per share in the past 60 days.

9 Meters’ loss estimates for 2021 have narrowed from $0.16 to $0.14 per share in the past 60 days while that of 2022 have narrowed from $0.15 to $0.10 over the same period. The stock has risen 37.4% in the year so far.

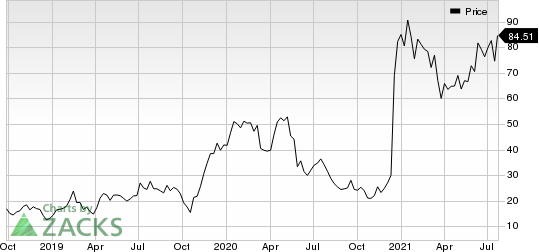

Arvinas, Inc. Price

Arvinas, Inc. price | Arvinas, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Arvinas, Inc. (ARVN) : Free Stock Analysis Report

9 Meters Biopharma, Inc. (NMTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research