Big Tech Earnings Whipsaw QQQ in Late Trading: Markets Wrap

(Bloomberg) -- A $201 billion exchange-traded fund tracking the Nasdaq 100 (QQQ) whipsawed in late hours as Microsoft Corp. climbed, while Google’s parent Alphabet Inc. dropped after reporting earnings.

Most Read from Bloomberg

Apple Plans AirPods Overhaul With New Low- and High-End Models, USB-C Headphones

Trump Ally Mike Johnson Elected House Speaker, Shifting GOP Further Right

Israel Is Losing Support as Fury Grows Over Its Strikes on Gaza

The results came after the end of a session marked by a rebound in stocks, with the S&P 500 halting a five-day slide. Also after the closing bell, Texas Instruments Inc. gave a disappointing revenue forecast and Visa Inc. reported profit that beat Wall Street estimates. Treasury 10-year yields edged lower. Oil declined below $84 a barrel. Bitcoin briefly topped $35,000.

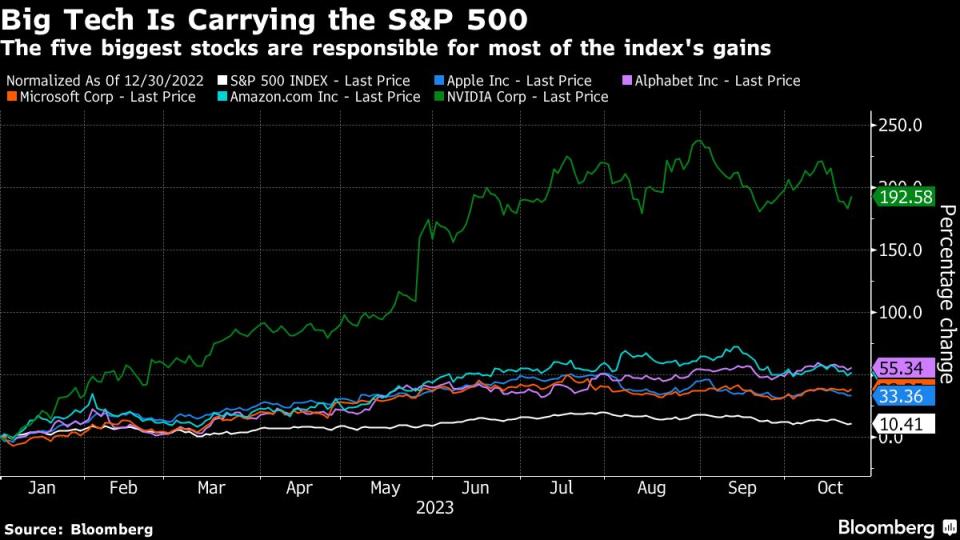

Investors looking to the earnings season for a dose of good news are hanging their hopes on big tech. The five largest companies in the S&P 500 account for about a quarter of the benchmark’s market capitalization. Their earnings are projected to jump 34% from a year earlier on average, according to analyst estimates compiled by Bloomberg Intelligence.

“As these big tech stocks go, so does the overall market,” said David Trainer, chief executive officer of New Constructs. “If big tech companies blow their numbers out of the water and provide strong guidance for future earnings, then we could see the stock market rally strongly through the end of the year.”

Rising rates have made already stretched big tech valuations look increasingly expensive, with the group remaining the most-crowded trade among fund managers, according to Bank of America Corp.

The pain in long-duration growth stocks, fueled in recent weeks by a relentless surge in Treasury yields, is finally on the verge of subsiding. That is, at least, if the so-called Taylor Rule is anything to go by.

The equation, posited by Stanford economist John Taylor in 1993, has become a way to measure how the Federal Reserve can use its overnight bank lending rate to tame inflation or stimulate the economy. Now, it’s approaching a critical inflection point for the US equity market by signaling that the central bank has finally normalized rates.

In economic news, US business activity picked up in October after back-to-back months of stagnation, helped by a rebound in factory demand and an easing in service-sector inflation

“The US economy is generating growth, but it still must digest the ‘last mile’ of policy tightening in our view,” said Don Rissmiller of Strategas. “We would be more convinced that the growth we are seeing was high-quality or sustainable growth if the labor market was re-balanced (with labor demand equal to supply). Until then, the risk remains that continued restrictive monetary policy becomes too restrictive.”

Elsewhere, Chinese President Xi Jinping stepped up support for the economy, issuing additional sovereign debt, raising the budget deficit ratio and even making an unprecedented visit to the central bank. Bank of Japan officials are likely to monitor bond yield movements until the last minute before making a decision on whether to adjust the yield curve control program at a policy meeting next week, according to people familiar with the matter.

Corporate Highlights:

Verizon Communications Inc. posted third-quarter earnings that broadly beat analysts’ estimates.

3M Co. boosted its full-year adjusted profit and cash flow targets as it reported third-quarter results that easily topped Wall Street estimates.

General Electric Co. raised its forecast for profit and free cash flow for the year as rebounding demand for air travel drives growth in its increasingly critical aerospace business.

RTX Corp.’s profit topped Wall Street expectations and the company announced a $10 billion share-buyback program as it works to contain fallout from a costly quality lapse in its marquee engine for commercial aircraft.

General Motors Co. can no longer say if it will make up to $14 billion in profit this year because a United Auto Workers strike, now in its sixth week, has made the company’s financial future too difficult to predict.

Meta Platforms Inc. was sued by California and a group of more than 30 states over claims that its social-media platforms Instagram and Facebook exploit youths for profit and feed them harmful content.

Barclays Plc lost as much as $2.7 billion in market value on Tuesday after inaugurating the reporting season for UK banks by lowering its forecast for lending profitability.

Key events this week:

Australia CPI, Wednesday

Germany IFO business climate, Wednesday

Canada rate decision, Wednesday

US new home sales, Wednesday

IBM, Meta earnings, Wednesday

European Central Bank interest rate decision; President Christine Lagarde holds news conference, Thursday

US wholesale inventories, GDP, US durable goods, initial jobless claims, pending home sales, Thursday

Intel, Amazon earnings, Thursday

China industrial profits, Friday

Japan Tokyo CPI, Friday

US PCE deflator, personal spending and income, University of Michigan consumer sentiment, Friday

Exxon Mobil earnings, Friday

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.7% as of 4 p.m. New York time

The Nasdaq 100 rose 1%

The Dow Jones Industrial Average rose 0.6%

The MSCI World index rose 0.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.7% to $1.0592

The British pound fell 0.7% to $1.2163

The Japanese yen fell 0.1% to 149.88 per dollar

Cryptocurrencies

Bitcoin rose 7.1% to $33,787.3

Ether rose 3.9% to $1,776.25

Bonds

The yield on 10-year Treasuries declined three basis points to 4.82%

Germany’s 10-year yield declined five basis points to 2.83%

Britain’s 10-year yield declined six basis points to 4.54%

Commodities

West Texas Intermediate crude fell 2.2% to $83.62 a barrel

Gold futures fell 0.2% to $1,984.10 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee and Jeran Wittenstein.

Most Read from Bloomberg Businessweek

X, One Year Later: How Elon Musk Made a Mess of Twitter’s Business

Venezuela’s Primary Sweep Puts Maduro and Biden in the Hot Seat

No One Understands Corporate Boycotts Like This Former Trump Researcher

Lululemon’s Founder Is Racing to Cure the Rare Disease Destroying His Muscles

Inflation Raging at 130% Is Pushing Argentina Down a Radical Path

©2023 Bloomberg L.P.