Asian Hotels (West) (NSE:AHLWEST) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Asian Hotels (West) Limited (NSE:AHLWEST) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Asian Hotels (West)

How Much Debt Does Asian Hotels (West) Carry?

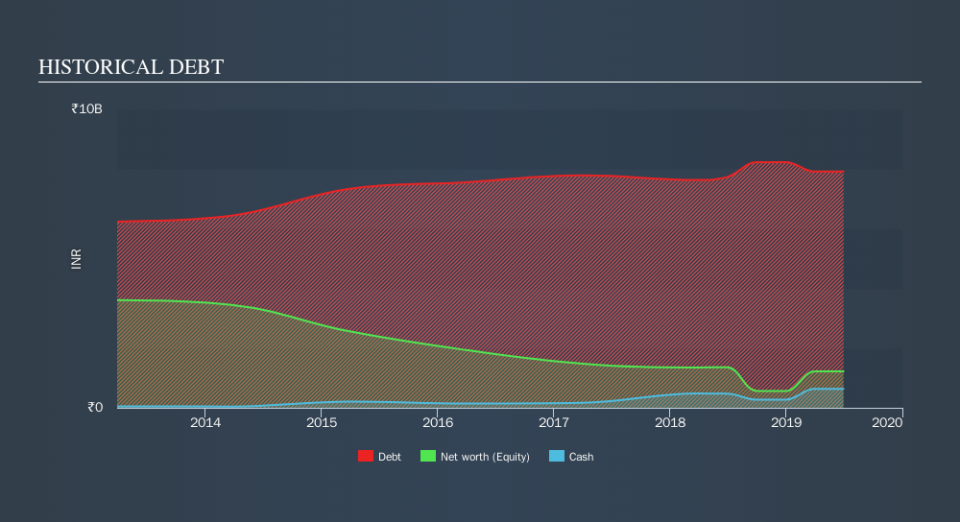

As you can see below, Asian Hotels (West) had ₹7.91b of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. However, it also had ₹631.6m in cash, and so its net debt is ₹7.28b.

How Healthy Is Asian Hotels (West)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Asian Hotels (West) had liabilities of ₹952.1m due within 12 months and liabilities of ₹8.95b due beyond that. On the other hand, it had cash of ₹631.6m and ₹208.9m worth of receivables due within a year. So its liabilities total ₹9.06b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₹3.64b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt At the end of the day, Asian Hotels (West) would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Asian Hotels (West)'s debt to EBITDA ratio (4.2) suggests that it uses some debt, its interest cover is very weak, at 1.4, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Looking on the bright side, Asian Hotels (West) boosted its EBIT by a silky 43% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Asian Hotels (West) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Asian Hotels (West) actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We feel some trepidation about Asian Hotels (West)'s difficulty level of total liabilities, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Asian Hotels (West) is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. Given our hesitation about the stock, it would be good to know if Asian Hotels (West) insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.