Is Aspira Women's Health (NASDAQ:AWH) Using Debt In A Risky Way?

- Oops!Something went wrong.Please try again later.

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Aspira Women's Health Inc. (NASDAQ:AWH) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Aspira Women's Health

How Much Debt Does Aspira Women's Health Carry?

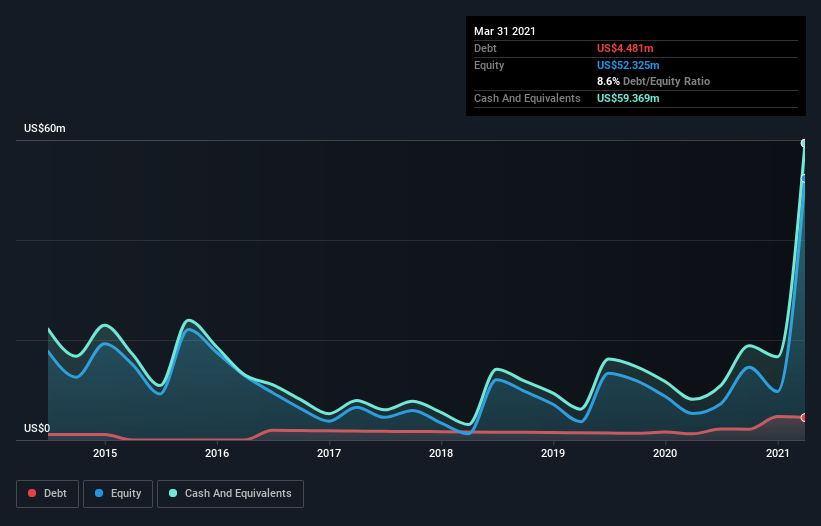

You can click the graphic below for the historical numbers, but it shows that as of March 2021 Aspira Women's Health had US$4.48m of debt, an increase on US$1.24m, over one year. However, it does have US$59.4m in cash offsetting this, leading to net cash of US$54.9m.

How Strong Is Aspira Women's Health's Balance Sheet?

We can see from the most recent balance sheet that Aspira Women's Health had liabilities of US$6.15m falling due within a year, and liabilities of US$3.82m due beyond that. Offsetting this, it had US$59.4m in cash and US$952.0k in receivables that were due within 12 months. So it can boast US$50.3m more liquid assets than total liabilities.

This surplus suggests that Aspira Women's Health has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Aspira Women's Health boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Aspira Women's Health can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Aspira Women's Health's revenue was pretty flat, and it made a negative EBIT. While that hardly impresses, its not too bad either.

So How Risky Is Aspira Women's Health?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Aspira Women's Health lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$15m of cash and made a loss of US$20m. With only US$54.9m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Aspira Women's Health has 4 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.