Some Aspire Global (STO:ASPIRE) Shareholders Are Down 37%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Aspire Global plc (STO:ASPIRE) shareholders over the last year, as the share price declined 37%. That's disappointing when you consider the market returned 21%. We wouldn't rush to judgement on Aspire Global because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 30% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Aspire Global

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Aspire Global share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

We don't see any weakness in the Aspire Global's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

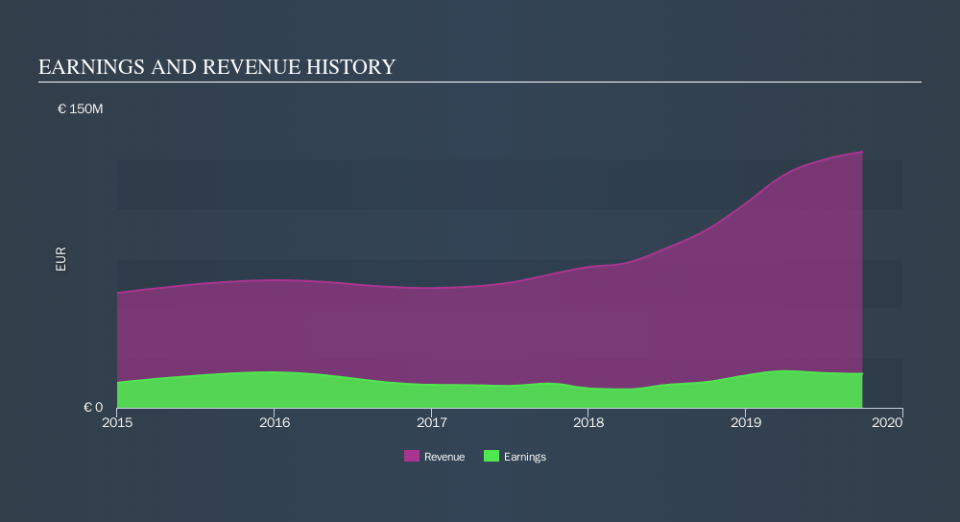

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Aspire Global has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Aspire Global in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 21% in the last year, Aspire Global shareholders might be miffed that they lost 36% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 30%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. If you would like to research Aspire Global in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.