How Do Athens Water Supply and Sewerage Company S.A.’s (ATH:EYDAP) Returns On Capital Compare To Peers?

Today we'll look at Athens Water Supply and Sewerage Company S.A. (ATH:EYDAP) and reflect on its potential as an investment. In particular, we'll consider its Return On Capital Employed (ROCE), as that can give us insight into how profitably the company is able to employ capital in its business.

First of all, we'll work out how to calculate ROCE. Then we'll compare its ROCE to similar companies. Then we'll determine how its current liabilities are affecting its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the 'return' (pre-tax profit) a company generates from capital employed in its business. In general, businesses with a higher ROCE are usually better quality. Ultimately, it is a useful but imperfect metric. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since 'No two businesses are exactly alike.'

So, How Do We Calculate ROCE?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Athens Water Supply and Sewerage:

0.034 = €51m ÷ (€1.5b - €63m) (Based on the trailing twelve months to December 2018.)

So, Athens Water Supply and Sewerage has an ROCE of 3.4%.

View our latest analysis for Athens Water Supply and Sewerage

Is Athens Water Supply and Sewerage's ROCE Good?

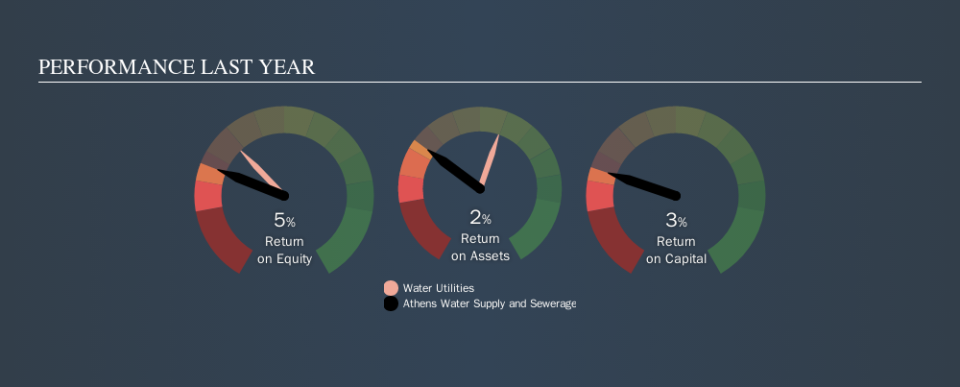

ROCE can be useful when making comparisons, such as between similar companies. We can see Athens Water Supply and Sewerage's ROCE is meaningfully below the Water Utilities industry average of 5.9%. This could be seen as a negative, as it suggests some competitors may be employing their capital more efficiently. Putting aside Athens Water Supply and Sewerage's performance relative to its industry, its ROCE in absolute terms is poor - considering the risk of owning stocks compared to government bonds. There are potentially more appealing investments elsewhere.

You can see in the image below how Athens Water Supply and Sewerage's ROCE compares to its industry. Click to see more on past growth.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. Companies in cyclical industries can be difficult to understand using ROCE, as returns typically look high during boom times, and low during busts. ROCE is, after all, simply a snap shot of a single year. Future performance is what matters, and you can see analyst predictions in our free report on analyst forecasts for the company.

What Are Current Liabilities, And How Do They Affect Athens Water Supply and Sewerage's ROCE?

Current liabilities include invoices, such as supplier payments, short-term debt, or a tax bill, that need to be paid within 12 months. Due to the way ROCE is calculated, a high level of current liabilities makes a company look as though it has less capital employed, and thus can (sometimes unfairly) boost the ROCE. To counter this, investors can check if a company has high current liabilities relative to total assets.

Athens Water Supply and Sewerage has total liabilities of €63m and total assets of €1.5b. Therefore its current liabilities are equivalent to approximately 4.1% of its total assets. Athens Water Supply and Sewerage has a low level of current liabilities, which have a negligible impact on its already low ROCE.

The Bottom Line On Athens Water Supply and Sewerage's ROCE

Still, investors could probably find more attractive prospects with better performance out there. But note: make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.