Atlassian (TEAM) to Post Q1 Earnings: What's in the Offing?

Atlassian Corporation Plc TEAM is scheduled to report first-quarter fiscal 2020 results on Oct 17.

Notably, the company’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.5%.

In the last reported quarter, the company’s earnings per share of 20 cents beat the Zacks Consensus Estimate of 16 cents. Meanwhile, the same came in line with the year-ago reported figure.

Moreover, Atlassian’s revenues surged 36% year over year to $335 million and outpaced the Zacks Consensus Estimate of $331 million as well.

Outlook and Estimates for Q1

For the fiscal first quarter, Atlassian anticipates revenues of $349-$353 million. The Zacks Consensus Estimate is pegged at $351.4 million, suggesting a surge of 31.5% from the year-ago reported figure.

On a non-IFRS basis (International Financial Reporting Standards), the company expects earnings per share to be 24 cents, indicating a 20% rise from the prior-year reported number. The Zacks Consensus Estimate of 24 cents has been stable over the past 30 days.

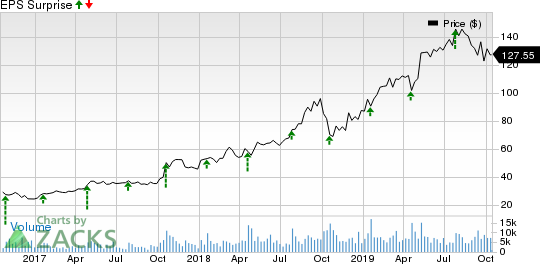

Atlassian Corporation PLC Price and EPS Surprise

Atlassian Corporation PLC price-eps-surprise | Atlassian Corporation PLC Quote

Let’s see, how things are shaping up prior to this announcement.

Factors to Consider

Atlassian’s first-quarter fiscal 2020 results are likely to have been driven by the growing adoption of its cloud-based solutions. Increasing demand for the company’s cloud products from new customers as well as the existing clients using on-premises products is a tailwind.

Healthy demand for core products like Jira and Confluence coupled with the rising uptake of new products like Jira Service Desk, Jira Ops and Bitbucket is expected to have remained a key driver.

Robust growth in the subscription revenues, aided by higher uptake of the company’s cloud service offerings, is expected to reflect on the company’s to-be-reported results as a consistent key catalyst.

What Our Model Says

The proven Zacks model shows that a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has maximum chances of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Atlassian currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, its Earnings ESP of 0.00% in the combination makes surprise prediction difficult for the stock this time around.

Stocks to Consider

Here are some stocks worth considering as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Arrow Electronics, Inc. ARW has an Earnings ESP of +0.60% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Avnet, Inc. AVT has an Earnings ESP of +2.68% and is Zacks #3 Ranked.

DHI Group, Inc. DHX has an Earnings ESP of +9.09% and is a #3 Ranked player.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DHI Group, Inc. (DHX) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research