Attorney for jobless claimants asks judge to stop Michigan from garnishing their wages

- Oops!Something went wrong.Please try again later.

A lawyer speaking on behalf of claimants who were told they were overpaid benefits during the pandemic argued Tuesday that the courts need to intervene and stop Michigan’s Unemployment Insurance Agency from garnishing wages and seizing tax refunds from those claimants.

David Blanchard, who is representing the claimants in a lawsuit against the agency, made the argument at a Michigan Court of Claims hearing Tuesday in Lansing.

Attorneys for the agency, meanwhile, told Court of Claims Judge Brock Swartzle that the UIA has procedures in place that allow the agency to stop collection activities and offer a claimant a refund if it turns out the agency has made an error.

Tuesday's hearing comes several months after the lawsuit — a class-action — was filed by the group of unemployment insurance claimants who were told they were overpaid benefits and are now having their wages garnished and tax refunds intercepted, among other collection activities.

The lawsuit argues that the agency acted outside the law by determining claimants weren't eligible for benefits more than a year after benefits were paid. The plaintiffs asked the court to suspend collection activities by issuing a preliminary injunction.

Swartzle heard arguments from Blanchard, along with Shannon Husband and Rebecca Smith, who are assistant attorneys general for the State of Michigan and represent the agency.

During the nearly three-hour-long hearing, Blanchard pointed to what happened with Kellie Saunders, one of the plaintiffs. Saunders was told she was overpaid, protested the decision and was waiting on a hearing. An administrative judge said it’s beyond a year, and the agency doesn't have authority to change the decision after that time. Therefore, she was eligible for the benefits.

But soon after, she got a bill from the agency for $6,000 and a notice that her tax returns and wages would be garnished if she didn't start paying the money back.

"There is no harm in putting a pause on the clawing back of money," Blanchard said. "On the other side, the harm is great to the individual subject ... it leads to other effects that can't be remedied by getting back the money later. It leads to people facing eviction and people that can't afford educational supplies for their children."

Swartzle said he will decide on the motion for a preliminary injunction within a few weeks.

Meanwhile, a U.S. Department of Labor-authorized pause on collection activity has expired. In April, the Michigan agency said it had paused "new" wage garnishments and interceptions of Michigan tax refunds for 398,000 claimants until at least May 7. But before that pause expired, only 55,000 claimants had received waivers who also were told they would get refunds if they had started paying back their overpayment.

Nick Assendelft, a spokesperson for the state unemployment agency, said the UIA will resume collections in certain overpayment cases.

"We continue to work with the U.S. Department of Labor on a potential second pause in collections and await their decision," he said.

The UIA has said it doesn't know how many claimants are still waiting on a waiver and when they can expect to receive one.

More: 55,000 Michigan unemployment claimants receive waivers for overpayment: What it means

More: Waivers for unemployment claimants who received overpayment letters may come this weekend

Separately, a state audit released Tuesday found the agency didn't limit access to sensitive information for certain workers, in line with findings from a prior audit in March. That audit found the agency failed to conduct proper background checks for temporary workers, giving some people previously convicted of fraud, embezzlement and similar financial crimes access to sensitive information.

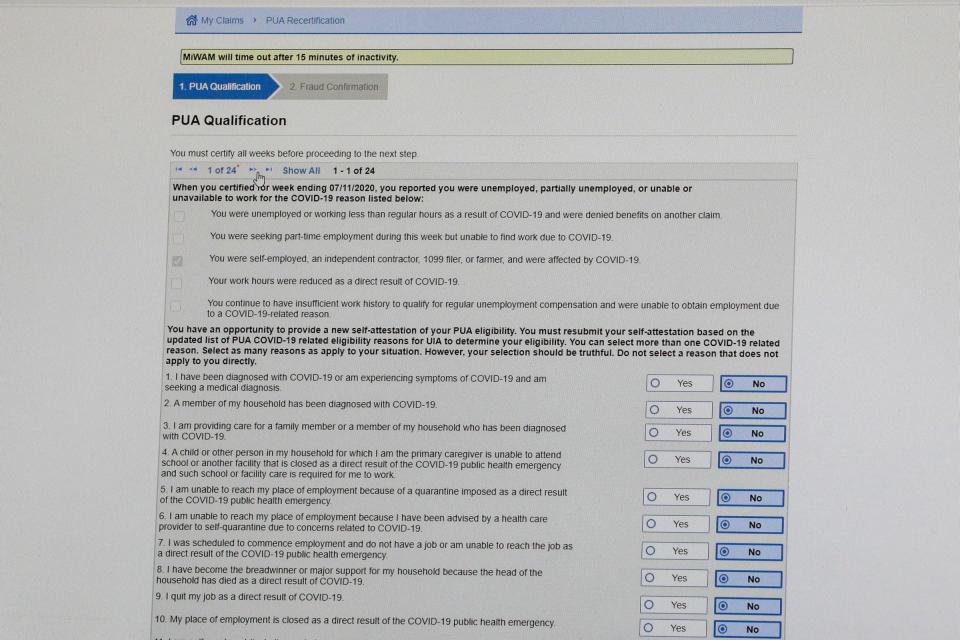

This is the third audit the auditor general has completed looking at the agency's handling of a massive influx in jobless claims during the pandemic. The first, released in November, found the agency "wasn't effective" in its implementation of the federal Pandemic Unemployment Assistance program and included four eligibility criteria that were not authorized by the U.S. Department of Labor.

Contact Adrienne Roberts: amroberts@freepress.com.

This article originally appeared on Detroit Free Press: Attorney: Courts need to stop collections on Mich. jobless claimants