Augusta County homes sold for 60 percent over assessment in 'super hyper' market. What does it mean for taxes?

AUGUSTA COUNTY — Augusta County residents should keep their eyes open for their home's new assessment in the coming weeks.

The assessment is an integral part of how the county will calculate real estate taxes. The tax rate is currently 63 cents per $100 of the assessment — a property assessed at $100,000 would be taxed at $630, for instance — but the rate could be lowered or raised in the coming months by the Board of Supervisors.

The new Wampler-Eanes-calculated assessments will be mailed to residents in early February. The mailed forms will also have directions to appeal the assessment.

Augusta County Commissioner of Revenue George Price told The News Leader the county is on “a very tight schedule” and residents should keep an eye out for their new assessments.

“If you haven’t received your notice by Feb. 16, you might need to give us a call or give the assessors a call and see if we can get you a copy,” Price said. “Just because you don’t receive your notice does not mean you get a free pass [if you want to appeal].”

2023 sales were higher than the 2019 assessment

Homes in Augusta County sold in 2023 went for around 61% higher than their previous assessed value.

That figure comes from Wampler-Eanes Appraisal Group’s 2024 sales study for real estate in the county, using the 2019 Augusta County assessment and all property sales occurring between Jan. 1 and Dec. 31 in 2023.

“This has been a super hyper market that we’ve been in,” said Steven Wampler, president of Wampler-Eanes. “I know things have slowed down, but our values don’t indicate prices dropping anywhere in Augusta.”

These elevating values are not exclusive to Augusta County. Wampler explained his organization found “the same trends” in other places they evaluated “as we have here in Augusta.” He also noted the commercial market was not as strong as the residential market.

Deputy County Administrator Jennifer Whetzel told The News Leader those large differences are partly due to the time between the last assessments (2019) and sales four years later. Virginia State Code requires localities to conduct regular reassessments based on the population. Augusta County would be required to complete one every four years, but the legislature gave the county special permission to have up to a six-year cycle.

Both Staunton and Waynesboro conduct an assessment every other year.

"We're in a market where prices have gone up in the past five years," said Whetzel. "It's going to be a bigger increase, versus some of the localities that do it either annually or biannually, where they get these incremental increases or decreases. They do it more often."

But what are these numbers? what do they mean?

Two sales studies, comparing the actual sale prices for homes to the last assessment were completed for the 2024 reassessment. The first was in 2022. The data used here are from the second, 2023, sales study.

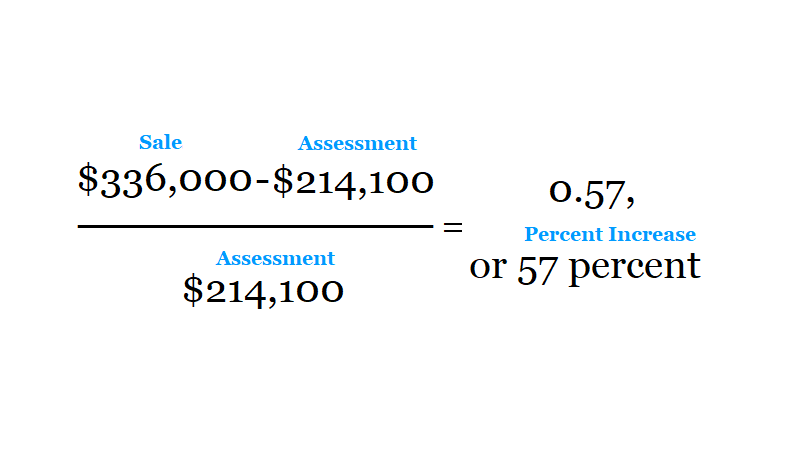

The percent increase is calculated by subtracting the assessment from the sale, then dividing the result by the assessment.

For example, one South River home was assessed as $214,100 in 2019. The home solid for $336,000 in September 2023.

This means it has a 57% percent increase.

The most recent data for Augusta County and Waynesboro showed the following average percent increases:

All 680 sales together in Augusta County averaged 60.9%

78 sales in Beverley Manor averaged 69.9%

93 sales in Middle River averaged 63.4%

94 sales in North River averaged 70%

84 sales in Pastures averaged 59.7%

88 sales in Riverheads averaged 48.3%

115 sales in South River averaged 61%

125 sales in Wayne averaged 56.5%

Three sales in Craigsville averaged 42.6 %, but Elizabeth Wampler with Wampler-Eanes noted that one of these was entered incorrectly and needed a revision.

Wampler-Eanes presented the raw data to the Augusta County Board of Supervisors on Jan 11.

This means my new assessment is going to be over 60% higher?

It could, but not necessarily. The sale/assessment percent increase is not the same as the change from the 2019 assessment to the 2024 assessment. The second cannot be calculated until after the new assessment data is released.

The sales data from one home is not directly used to determine the home's newly assessed value. Besides the increase in sales price over assessment, a special ratio is calculated.

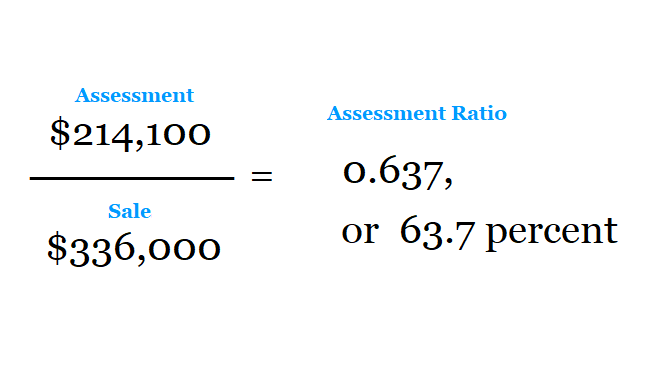

The ratio divides the assessment by the sales price. It's calculated for all homes sold over the sale study time period, then averaged.

The home mentioned above — assessed in 2019 at $214,100 and sold in 2023 for $336,000 — has an assessment ratio of $214,100 divided by $336,000, equaling .637 or 63.7%. That ratio for all houses sold is also averaged.

If this ratio value is over 70%, then the entire housing market passes as a fair market. If it's below — as it was for our example — it means the assessment has gotten too far behind the fair market sales prices.

So if that home is representative of the market as a whole — a 57% increase in its sales price over 2019 assessment, and a .64 assessment ratio (below .70) — what does it mean?

That means an upward adjustment is likely in your 2024 assessment.

The new assessments are partially calculated by elevating the assessments to match the newer sales, getting the ratio near 100%, or fair market value. However, this is not the only way the new assessments are calculated.

Every accessible property gets a visit from an assessor, who takes notes on any changes from the previous assessment. This includes new things, like new decks, additions, and sheds, or things that are now gone, such as homes lost in a fire. Public records, like building permits, are also examined.

“We really enjoy working with the communities we’ve been in,” Wampler told the supervisors on Jan. 11. “Of course, we had a few problems as we always do, but overall the citizenry has been great. We’ve been asked to leave on a few properties, but not many.”

Wampler-Eanes creates a new sketch of updated buildings, takes a photo, and enters this into Augusta County's records.

This 'equalizer' can still save your tax bill

What this means for property taxes remains to be determined. The current rate in Augusta County is 63 cents per $100.

If the assessments go up by more than 1%, the Augusta County Board of Supervisors would have to adjust the rate to stay revenue neutral. The tax rate that makes the county revenue neutral is called the equalized rate.

Real estate taxes are determined by multiplying the assessment by the tax rate. So:

If the tax rate goes up, your tax bill goes up.

If the tax rate remains the same, but the assessment goes up, your tax bill goes up.

If the tax rate remains the same, but your assessment goes down, your tax bill goes down.

If the tax rate decreases to the equalized rate and your assessment goes up, your tax bill remains the same.

If the tax rate decreases, but not to the equalized rate, and your assessment goes up, your tax bill goes up.

If the tax rate decreases below the equalized rate, your tax bill goes down.

A preliminary review of the data suggests upcoming assessments will be higher than the 2019 assessments. Wampler agreed, “It’s going to be considerably higher than the last one was.”

"When people get their assessment notices [in February], that's about the value," Whetzel explained. "When we do the advertisement for the equalized rate and what tax rate the board would possibly propose [in April], that's when they would come speak about that. I think someone said it's like a see-saw. You have your assessment value and your tax rate, and that kind of equalizes the values in what people pay, from a fair market standpoint."

After the 2019 reassessment, Augusta County did not lower the tax rate, keeping it at 63 cents per $100. With no 'equalizer' in the form of a lower rate, the new higher assessments meant the final tax bills were higher. The initial hearing on the tax rate in April 2019 had no public input. This was the same when the proposed tax rate was approved, according to the minutes.

Here's the timeline for determining the tax rate:

The new, 2024 assessments will be mailed out in early February. The 2024 equalized rate will be advertised around the same time as the budget is advertised, after the initial assessments have gone out.

The supervisors will meet all day on March 25 to discuss the budget. After this, there will be an expected tax rate from the board.

Public hearings on the tax rate, the budget, and the equalized rate will all occur in April, according to Whetzel.

The budget is historically approved by early May, so tax bills can go out before taxes are due on June 5.

I have my reassessment. What now?

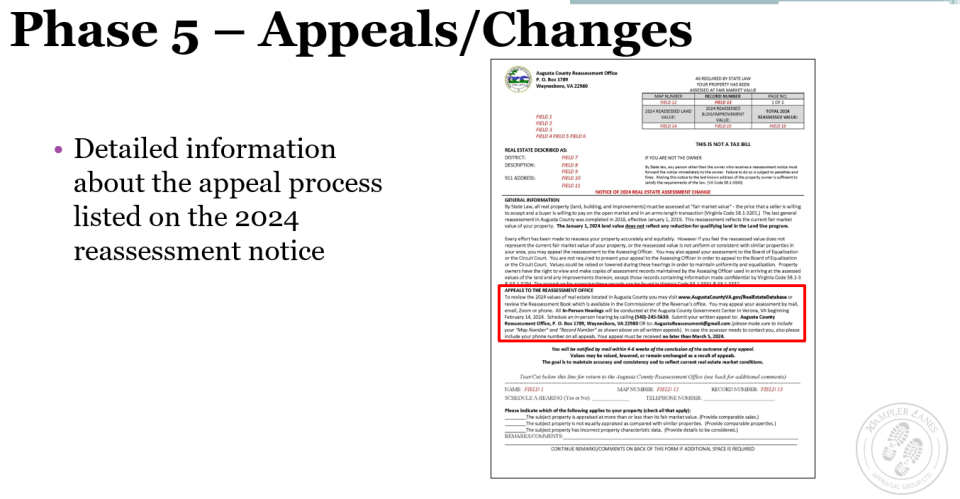

Residents that disagree with the outcome of their assessment can reach out to the assessor's office and file for an appeal.

In "most" of the counties where Wampler-Eanes conducts assessments, there is a one or two percent appeal rate, Elizabeth Wampler told the supervisors.

The 2019 Augusta County assessment saw 341 appeals, with about 80% being successful. Some successful appeals saw as much as an 81% reduction of the initial assessment, while others saw as little as a 0.02% percent. The average was 3%.

The Wampler-Eanes presentation listed five possible reasons for an appeal; an assessment that is too high or low, disparities in market value, changes in the property conditions, comparable sales, and clerical errors. These are the major reasons for an appeal, but it is not an all-encompassing list.

Those appealing would first meet with the assessor informally over Zoom, in person, mail, by phone, or by email.

“This is where we can do a lot of clean up,” said Elizabeth Wampler. “If there is something that was missed, or the property owner didn’t allow us there, or has other information, there could be any number of reasons.”

If there is a disagreement between the owners and the assessors, the appeal is taken to the Augusta County Board of Equalization, will convene sometime in the late in 2024. Further appeals would then go to the Augusta County Circuit Court.

The specific directions to file an appeal are included about halfway down the page on the reassessment form arriving in the mail.

Lyra Bordelon (she/her) is the public transparency and justice reporter at The News Leader. Do you have a story tip or feedback? It’s welcome through email to lbordelon@gannett.com. Subscribe to us at newsleader.com.

This article originally appeared on Staunton News Leader: 'Super hyper' Augusta County market means higher assessments. Will it mean higher taxes?