Augusta residents might pay higher taxes... or might not; commission deadlocked over increase

- Oops!Something went wrong.Please try again later.

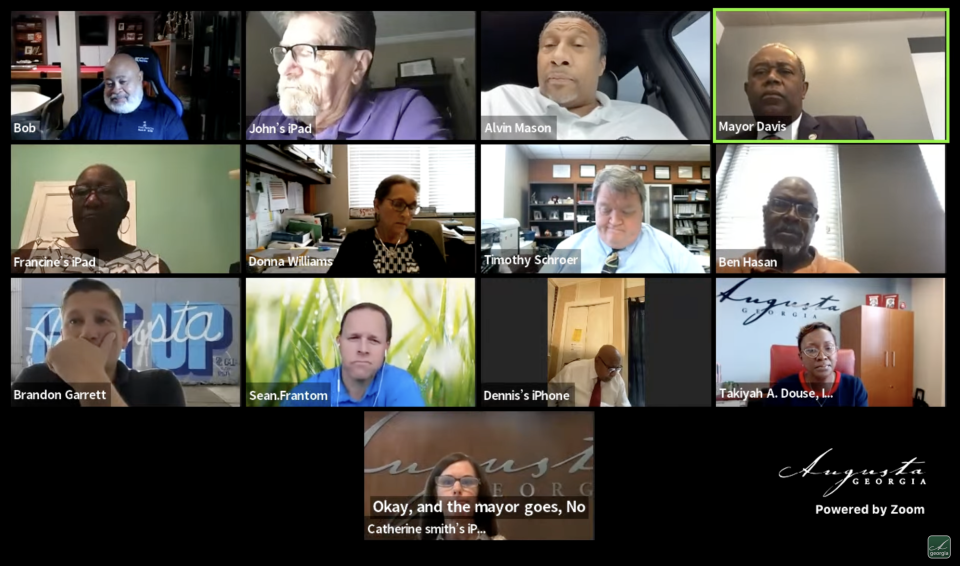

Augusta commissioners remain at a stalemate over setting tax rates, with Mayor Hardie Davis breaking a 5-5 tie Thursday to oppose an increase. The delay in approving a rate could force the hand of commissioners who support a tax hike, because adopting it could cause the city miss a Sept. 1 state deadline.

Despite the record-high food and fuel prices and skyrocketing property assessments that have impacted most residents, city staff and five commissioners so far favor the increase, which would go on tax bills typically mailed in September.

The higher rate being proposed is 8.411 mills, which will generate $2.1 million in new revenue for the government this year and raise taxes for most property owners. The lower rate is a rollback rate of 7.986 mills, which would keep city taxes flat for most.

More coverage: Augusta has rules against double-dealing; Sammie Sias case reveals they weren't enforced

This week in Augusta government: Claims of potential voter fraud, mapping property appeals, detours

The mill rate or "millage" is applied to each $1,000 of a property's taxable value, which is 40% of its assessed value. On a $100,000 home, for example, the rate is multiplied by 40. Augusta includes several other tax levies and service fees on tax bills.

The lower rate also eliminates a millage increase to 2.217 mills for fire protection, which would raise $2.3 million next year that Chief Antonio Burden said is needed to replace aging fire trucks. The expense, typically paid for with sales taxes, was omitted from the Sales Tax 8 package.

How much would my taxes go up?

The proposed increase would apply to the two-thirds of Augusta homeowners whose property was assessed at a higher amount this year. The average increase was around 18%.

A homeowner who lives in a $100,000 home that increased in assessed value by 18% to $118,000 would pay an additional $68-$78 on their Augusta tax bill, according to city Finance Director Donna Williams.

The same owner's total bill for Augusta government services would range from $479 to $590, depending on the home's location. But if the owner is among 35% whose properties were not assessed at a higher value, the bill will decrease by about $20, Williams said.

Why shouldn't Augusta raise taxes?

Supporters of the lower rate say the city should try to cut costs before raising taxes on citizens and businesses coping with inflation of up to 40% for gasoline and 10% for food as they continue to invest in the city.

"We really need to look at where we can sharpen the pencil on our end, before we go and put a tax increase on the taxpayers," Commissioner Sean Frantom said.

Frantom and commissioners John Clarke, Brandon Garrett, Alvin Mason and Catherine Smith McKnight voted to adopt the rollback millage Thursday. But Mayor Pro Tem Bobby Williams, who supported the increase, abstained, leaving a 5-4 vote that Davis couldn't break.

"Richmond County as of right now really can't take much more," McKnight said. "We need a total rollback."

Garrett said Augusta's business community is "very concerned" about the tax increase, which he said places a "burden on businesses that have invested here."

Clarke noted the additional fees and charges the city has added over the years for items once paid for with property taxes.

"The property owners in the city of Augusta are already heavily burdened with not only taxes but additional fees – the garbage fee, the streetlight fee, the stormwater fee," Commissioner John Clarke said.

Why not lower Augusta taxes?

Mason, who backed the lower rate, said the city should look at the millage rate "creatively" and "give something back" to tax-paying citizens and businesses. He noted the commission's recent decision to award cost-of-living adjustments and retention incentives to address massive staff turnover and vacancies.

"The optics of it does not look well," he said.

Commissioner Jordan Johnson, who did not oppose the increase, asked what can be done for people on limited, fixed incomes, such as homeowners in the Sand Hills area where valuations skyrocketed after years of not changing.

"When the value went up in Sand Hills, my phone rang for the entire week," Johnson said.

Bobby Williams, Johnson and commissioners Francine Scott, Ben Hasan and Dennis Williams voted for the higher tax rate. Bobby Williams said Augusta needs to raise taxes in order to grow.

"When I leave my subdivision and go down the roads in Richmond County, I don't want to see blight. I want to see improvements. I want to see new buildings. I want to see Augusta growing," he said. "Augusta can't grow if we stay in the same lane; if we don't increase taxes from time to time."

The remaining supporters didn't return requests for comment after the called meeting, which was conducted by video conference.

And while the rollback rate appears to generate $1 million in new revenue, it would actually cost the government a net $460,000, due to tax breaks it offers to taxpayers and developers, Williams said. Three Tax Allocation Districts, or TADs, divert approximately $680,000 in revenue to developers within each TAD, rather than back to local government operations, she said.

In addition, each year early payment discounts reduce the available property tax revenue by $450,000, she said. While around 2% of tax payments returned late may eventually be collected, it won't be in time to fully fund operations, she said.

Mayor breaks tie against increase

Davis argued earlier this week the city isn't "telling the full story" because breaks such as TADs encourage development, while early payment discounts induce owners to pay their ad valorem tax bill quickly.

In addition to the TADs, the Augusta Economic Development Authority abated nearly $9 million in ad valorem taxes last year due to the incentive packages it supplies to attract development, according to the city's 2021 annual financial report.

Davis noted Thursday that Augusta is ending the year with a surplus, is not in a deficit and that sales tax collections continue to be strong.

"I don't want the citizens of Augusta, when they hear certain things, assuming we're at a deficit or having cost overruns," Davis said.

Data from a commission budget retreat last week showed monthly sales tax collections – Augusta has four of them – are significantly exceeding 2020 and 2021 levels. With sales prices up due to inflation, collections of a single tax – the Local Option Sales Tax – they peaked in April at $5.3 million.

What else appears on Augusta tax bills?

In addition to the countywide millage and fire assessments are school system taxes and one or more service fees.

The largest number tends to be taxes levied by the Richmond County Board of Education, unless a homeowner obtained the full exemption. The school board recently set the tax rate at 17.65 mills, the lowest it has been in nearly 20 years, based on the reassessments and growth. The rate will reduce taxes for many but it is still considered a tax increase under state law.

On the house now valued at $118,000, school taxes would run around $745, an approximate $70 decrease from last year.

Alongside the countywide millage, the commission also sets mill rates for the Local Option Sales Tax credit used to offset the amount of property taxes billed. Proposed for both the rollback and increased rates are the rollback rate of 6.077 mills and the rollback rate of 5.46 mills in the urban services district. The district, located inside the old city limits, pays an additional assessment – up for consideration are 4.307 or 4.845 mills – but isn't billed the fire service millage.

Also on all bills would be a capital outlay levy, proposed at .637 or .722 mills.

Included on Augusta homeowners' tax bills are a fee of $310.50 for mandatory garbage and recycling pickup. There may also be a streetlight fee, depending on a home's location, of $85.

What's next?

If the commission approves the higher rate, it must publish advertisements announcing the tax increase, the dates of two public hearings and a five-year history of tax rates and property values.

The ad must run at least one week prior to the commission giving final approval to the rate. A third hearing is required a week later prior to final adoption of the increase. The approved rate must be adopted and submitted to the Georgia Department of Revenue by Sept. 1.

If the commission adopts the rollback rate, it does not have to conduct the hearings or run ads.

This article originally appeared on Augusta Chronicle: Will Augusta property tax rates rise or stay the same? City deadlocked