Australia’s Prime Minister Goes All-In on Tax to Revive Political Fortunes

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Australia’s Prime Minister Anthony Albanese has decided to take one of the biggest gambles of his political career.

Most Read from Bloomberg

Traders Line Up for ‘Once-in-a-Generation’ Emerging Markets Bet

Trump’s Cash Stockpile at Risk From $450 Million Dual Verdicts

In announcing his revised tax plan, he’s betting Australians will forgive him for breaking an election promise in return for tax relief for the vast majority of voters. Albanese said the reasons for doing so are clear: the economic situation has changed since they were legislated in 2019, with several on-going global conflicts and an unexpected surge in inflation.

On paper, the tax plan should be popular with many Australians. But there are economic and political dangers — ones that Albanese himself acknowledged, and tried to preempt.

Ahead of announcing the tax changes on Thursday, known as Stage 3, Albanese released modeling by Australia’s Treasury Department which showed Labor’s reforms would be largely revenue neutral despite greater tax benefit to middle class Australians. More importantly, they wouldn’t put more pressure on prices, according to the Treasury and some economists.

While price gains have moderated over the past year along with domestic demand, Australia has seen stubbornly prolonged levels of inflation. Repeated surveys of voter sentiment have found growing frustrations with the soaring price of rent, food and energy.

The Reserve Bank of Australia sees inflation returning to the target band of 2% to 3% only in 2025.

The economic impact of the tax cuts is divisive. Luci Ellis, chief economist at Westpac Banking Corp. and a former RBA assistant governor said “the changes do not materially affect the macroeconomic outlook.”

“By retaining the 37% bracket, the system is not flattened out as much as originally planned,” she said. “This means that more households will still face some fiscal drag, and fiscal policy retains more of its automatic stabilizing properties. The RBA would therefore not need to do as much in the face of strong income growth, should that emerge,” Ellis said.

She added that as the tax cuts wouldn’t begin until July 1, “by that stage, inflation is likely to be within striking distance of the RBA’s 2–3% target.”

But some economists said even if the tax changes didn’t worsen inflation, they were a lost opportunity at economic reform.

“There were better ways to help low to middle income earners in the current inflation cycle,” said Citigroup Inc. economist Josh Williamson, adding that he estimated Labor’s changes would only add a fraction to inflation overall.

Williamson said the government had conflated “the cyclical issue of inflation with the structural issue of tax bracket creep.”

“A better approach in our view would have been to temporarily extend or increase subsidies or rebates on essential household items such as energy, rents, childcare, healthcare and education,” he said. However with Albanese saying more cost-of-living measures could be expected in the May 2024 budget, those might still be on the table.

However if the economic picture appears challenging, the political landscape is even rockier.

The center-right opposition Coalition has already declared Albanese a liar and his decision on Stage 3 the “mother of all broken promises.”

The battle lines for the election, due in mid-2025, seem clear. In the past, broken election promises have proved so politically toxic they have toppled several Australian leaders, including Labor Prime Minister Julia Gillard and Liberal leader Tony Abbott. The opposition is hoping this move will sink Albanese as well.

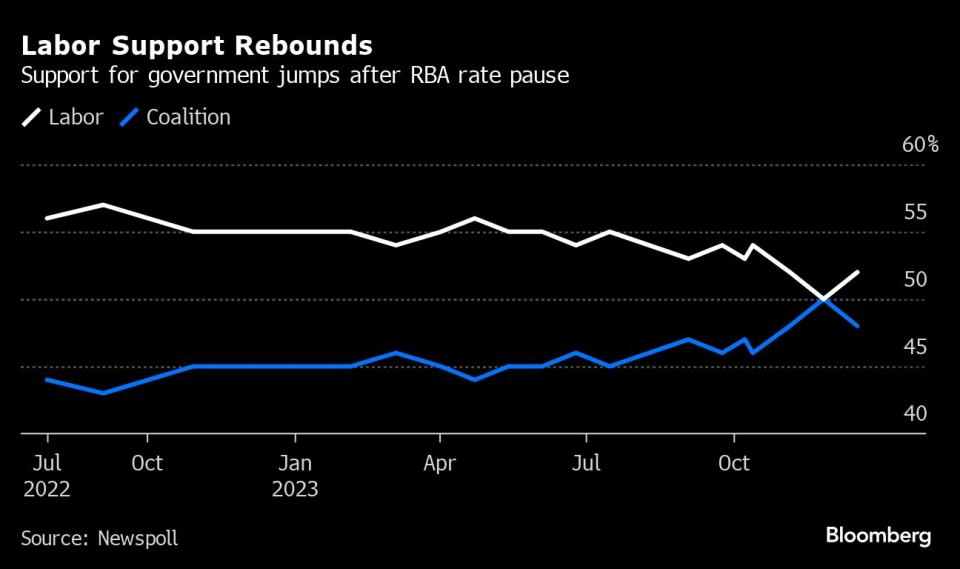

But, it is a gamble the center-left Labor had to take, according to Chris Wallace, a political observer and professor at the University of Canberra. With Australians facing a cost-of-living crisis, and Albanese’s approval ratings starting to slide, the government needed to show it was serious about tackling voters’ concerns.

“It had to do this,” Wallace said. “The prime minister was under incredible pressure.”

Wallace says Albanese’s success now depends on whether he can convince voters the financial gain was worth his backflip. “It will either win the political fight over equity or it won’t,” she said.

Most Read from Bloomberg Businessweek

How a Lucky Break Fueled Eli Lilly’s $600 Billion Weight-Loss Empire

AI Needs So Much Power That Old Coal Plants Are Sticking Around

How the West’s Favorite Autocrat Engineered Africa’s Most Dramatic Turnaround

American Workers Come Out Winners in a Clash Between Economists Over a Curve

©2024 Bloomberg L.P.