Australian Budget Seen Almost in Balance This Year, Debt to Drop

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Australia’s budget update showed the government’s books are in better shape than anticipated due to persistent strength in commodity prices and a tight labor market, though global risks are clouding the outlook.

Most Read from Bloomberg

JPMorgan Is in a Fight Over Its Client’s Lost $50 Million Fortune

Argentina’s Milei Devalues Peso by 54% in First Batch of Shock Measures

COP28 Nations Reach First-Ever Deal to Move Away From Fossil Fuels

Goldman Trader Paid $100 Million Since 2020 Is Stepping Down

The deficit is forecast at A$1.1 billion ($722 million) in the 12 months through June 2024, or 0% of GDP, a significant improvement from the May budget’s estimated A$13.9 billion shortfall, the Mid-Year Economic and Fiscal Outlook released by Treasurer Jim Chalmers and Finance Minister Katy Gallagher showed on Wednesday.

The improvement extends into fiscal 2025 with the shortfall seen at A$18.8 billion, or 0.7% of GDP, almost half the May forecast. The following year is closer to earlier estimates at just 0.1 percentage point of GDP better than the budget.

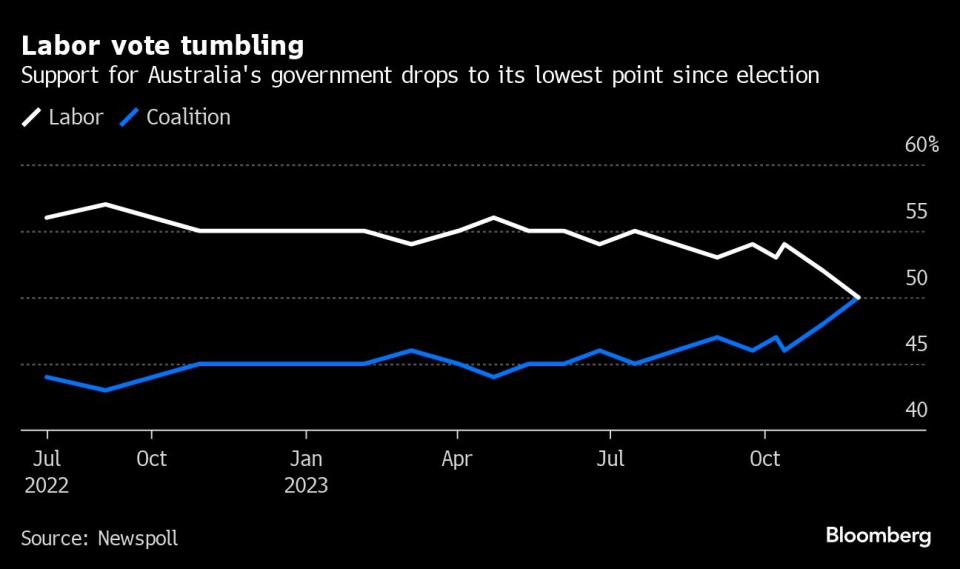

Australia’s center-left Labor government is trying to bolster its credentials in managing the nation’s finances and overcome perceptions that the conservative opposition is a superior economic manager. Chalmers delivered the first budget surplus in 15 years in 2022-23 and the government is now trying to arrest a decline in its approval rating amid elevated inflation and rising interest rates.

“The economy is expected to regain momentum in 2024–25 as inflation subsides and growth in household disposable incomes improves,” the update showed. “With inflation moderating, positive annual real wage growth is expected to return in early 2024 and will support real household disposable incomes.”

The government is due to hold an election by mid-2025.

The budget update showed a lower debt profile through the forecast horizon. As a share of GDP, gross debt is now estimated to peak 1.1 percentage points below the May forecast at 35.4% of GDP in 2027–28.

“The significant budget improvement is the result of the government’s fiscal restraints,” the update showed. “The government continues the task of budget repair from the last two budgets.”

The government warned that interest payments will rise in the medium-term, reflecting the Reserve Bank’s 4.25 percentage points of monetary tightening since May 2022. Last week, the central bank left its benchmark rate at a 12-year high while signaling that further hikes may be needed to tame prices.

The RBA will welcome the update that shows the government is working to consolidate its books to help align fiscal and monetary settings. Even so, S&P Global Ratings last week described as “relaxed” the approach of Australia’s various levels of government to fiscal consolidation, warning it is likely dulling the effectiveness of the RBA’s policy tightening.

The government’s forecasts show headline inflation will slow to 2.75% by mid-2025, a more optimistic assessment than the RBA’s estimates released last month that had CPI only easing to the top of its 2-3% target by the end of 2025.

That is partly explained by the jobless rate which is seen peaking 4.5% in fiscal 2025 — slightly higher than than the central bank’s 4.25% estimate.

Australia’s employment growth has been powerful, with the update highlighting that the jobless rate, currently at 3.7%, has “seen the longest consecutive run below 4% since monthly records began.”

Yet the report also sounded a warning about the international backdrop against which the forecasts were compiled.

“Russia’s invasion of Ukraine, the Hamas-Israel conflict, the ongoing adjustment in China’s property sector and the lagged effects of sharp global monetary tightening all pose downside risks,” it said.

The mid-year economic and fiscal outlook also showed:

The government will spend A$5 billion to improve housing supply and affordability and A$3 billion toward critical minerals projects and clean energy; it also earmarked A$6.8 billion for current infrastructure projects

Net debt is seen at A$491 billion, or 18.4% of GDP, at mid-2024; then climbing to A$533.3 billion the following year to peak at A$623.9 billion by 2026-27 — all lower than the May budget

Iron ore spot price is assumed to decline to $60/ton from a September quarter 2023 average of $105/ton while the metallurgical coal spot price is assumed to slip to $140/ton from $264/ton

The wage price index is forecast to peak at 4% by mid-2024 before declining to a 3.25-3.5% range in the following years

Net overseas migration is forecast to slow to 375,000 in 2023-24 from an estimated 510,000 in the year-ended June 2023. It is then seen slowing further to 255,000 in 2025–26 and 235,000 in 2026–27

The government will commence issuing green bonds from mid-2024 to provide financing or refinancing for specific government programs

Most Read from Bloomberg Businessweek

SBF’s Lawyer Says His Client Was the ‘Worst’ Ever Under Cross Examination

Vanguard Is Closer Than Ever to Ending BlackRock’s ETF Reign

Rate-Cut Pivot Can’t Come Soon Enough for Debt-Strapped Companies

How the Biggest Boutique Fitness Company Turned Suburban Moms Into Bankrupt Franchisees

©2023 Bloomberg L.P.