Australian Strategic Materials (ASX:ASM) shareholders are still up 247% over 1 year despite pulling back 5.7% in the past week

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Australian Strategic Materials Ltd (ASX:ASM) share price had more than doubled in just one year - up 246%. Also pleasing for shareholders was the 15% gain in the last three months. Australian Strategic Materials hasn't been listed for long, so it's still not clear if it is a long term winner.

Although Australian Strategic Materials has shed AU$105m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Australian Strategic Materials

Australian Strategic Materials recorded just AU$1,709,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Australian Strategic Materials will find or develop a valuable new mine before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as Australian Strategic Materials investors might know.

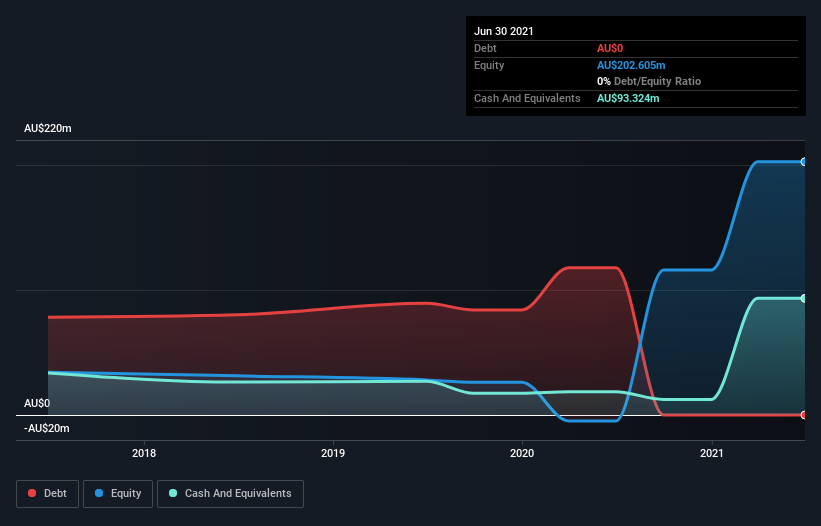

When it last reported its balance sheet in June 2021, Australian Strategic Materials could boast a strong position, with cash in excess of all liabilities of AU$67m. That allows management to focus on growing the business, and not worry too much about raising capital. And given that the share price has shot up 66% in the last year , it's fair to say investors are liking management's vision for the future. You can see in the image below, how Australian Strategic Materials' cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

Australian Strategic Materials boasts a total shareholder return of 247% for the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 15%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Australian Strategic Materials , and understanding them should be part of your investment process.

Australian Strategic Materials is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.