Auto Roundup: GM and F's China Sales Plunge in Q2 Grab Eyeballs

General Motors GM unveiled weak second-quarter vehicle sales data in China. The results were released less than a week after the legacy automaker issued a warning that its upcoming results would be materially impacted by the severe ongoing supply chain snarls. Close peer Ford F also reported its worst quarterly sales data in China since the onset of COVID-19 lockdowns in 2020. Nonetheless, the company bucked the trend of declining sales in the United States and posted a 1.8% uptick in deliveries in the second quarter of 2022.

Houston-based auto retailer Group 1 Automotive GPI exited Brazil and provided an update on its buyback activity. Transmission manufacturer Allison Transmission Holdings ALSN is set to offer propulsion solutions for the U.S. Army’s new M88A3 HERCULES prototype vehicle. The Italian-American carmaker Stellantis STLA made the headlines on trimmed annual production forecast in Italy amid growing supply chain issues.

While Group 1 presently sports a Zacks Rank #1 (Strong Buy), Allison carries a Zacks Rank #2 (Buy). Stellantis and General Motors carry a Zacks Rank #3 (Hold) currently. Meanwhile, Ford has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Last Week’s Top Stories

1. General Motors sold 484,200 vehicles in China during the second quarter of 2022. Volumes declined 36% year over year and marked the lowest levels since the first quarter of 2020. Sales recorded double-digit drops at all five GM brands — Buick, Cadillac, Chevrolet, Baojun and Wuling. Overall sales of the Buick brand fell 43.1% to 128,300 units. Chevrolet sales tailed off 36.7% to 40,000 units. Cadillac sales dipped 42.2% to 36,900 units. Sales at SAIC-GM-Wuling — GM’s joint venture responsible for Wuling and Baojun brands — declined 29% percent to 279,000 units, with Wuling brand sales down 22.7% and Baojun sales tanking 78.5%.

The resurgence of coronavirus-induced curbs and devasted supply chain systems hurt the sales volume. During the first six months of 2022, General Motors’ sales in China contracted 28.3% to 1,097,600 units. The company’s CFO Paul Jacobson noted the situation in China as “obviously challenging,” citing “some short-term issues that we’ve had to work through.”

2. Ford sold 120,000 vehicles in China in the second quarter of 2022, indicating a 22% decline on a yearly basis. This marked the lowest sales in the country since the first quarter of 2020, when the company sold close to 89,000 vehicles. Nonetheless, Ford’s June sales improved with the easing of restrictions, as overall sales totaled more than 50,000 units, up 3% and 38% on a yearly and monthly basis, respectively.

Early last week, Ford also reported its US sales data for the quarter under discussion. Ford sold 483,688 vehicles in the United States in the second quarter of 2022, inching up 1.8% year over year. The company exited the second quarter with 297,000 units of gross stock, which was up from about 236,000 in gross stock inventory at the end of May, although many of the new units are in transit.

3. Group 1 announced that it concluded the divesture of its operations in Brazil after operating there for nine years. Group 1’s subsidiary GPI SA completed the sale under the share purchase agreement with Original Holdings. UAB Motors Participações — a wholly-owned subsidiary of GPI — was the intervening party. Per the deal, Original acquired all of the issued and equity interests of UAB from Group 1 for BRL 510 million. UAB operated 16 dealerships as of 2021-end and generated BRL 1.7 billion in revenues last year.

Group 1 also updated investors regarding its share repurchase activity. Year-to-date, GPI bought back 1,437,729 shares at an average price of $176.74 for a total of $254.1 million, which depicts 8.3% of Group 1's outstanding share count at Jan 1, 2022. The company’s return on equity (ROE) of 38.4% compares favorably with the industry’s 36% as well as the auto sector’s 10.3%, underscoring management's efficiency in rewarding shareholders.

4. Stellantis hit a 52-week low last week amid a union report warning that an intensifying semiconductor supply shortage is likely to weigh on Stellantis’ annual production in Italy. The union report by the Italian Federation of Metalworkers (“FIOM”) stated that it expects Stellantis' output during the year to shrink by as much as 220,000 vehicles. Per the union, the projected decrease, led by a tight supply of raw materials and chips fueled by the Russia-Ukraine war and its impacts on European gas supplies, has led to such dire constraints.

The FIOM opined that production was already down by 13.7% in the first half of 2022, with the company producing 351,890 vehicles. The output of commercial vehicles, especially, slumped by more than a third. Stellantis' plant in Melfi, accounting for about 38% of all cars produced by the group in Italy, saw a significant fall in the first-half production. Volumes at the site have fallen 17% from the previous year. The Sevel unit is also likely to record a first-half production decline of more than 37%.

5. Allison announced that it will provide the X1100 TM-5B propulsion solution for the U.S. Army’s new M88A3 HERCULES (Heavy Equipment Recovery Combat Utility Lift and Evacuation System) prototype vehicle. This initiative is in line with the Army’s continued investments in combat preparedness and fleet modernization. The program underlines Allison’s long-term strategic relationship with the Army. The company’s partnership with the Department of Defense dates back to 1946 to develop propulsion solutions that function in the toughest conditions.

Allison is known for engineering and manufacturing reliable and fully customizable propulsion solutions, which reduce customer downtime and increase the ability to accomplish mission objectives. The X1100-5B is a reliable and durable propulsion system based on the renowned Abrams Main Battle Tank drivetrain solution. Also, Allison will provide a new, advanced electronic controls system and new final drive components to meet the needs of the recovery vehicle application.

Price Performance

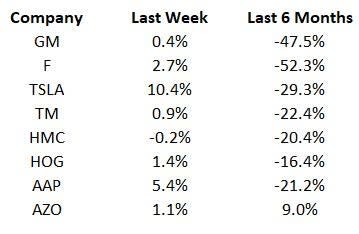

The following table shows the price movement of some of the major auto players over the last week and six-month periods.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on June passenger vehicle registrations to be released by the European Automobile Manufacturers Association soon. Also, stay tuned for any updates on how automakers will tackle the semiconductor shortage — aggravated by the Russia-Ukraine war— and make changes in business operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research