Autonomous Driving Space Gains Steam: Stocks in Focus

Autonomous vehicles are set to revolutionize the concept of transport while contributing significantly to the global economy. Per a McKinsey research, autonomous vehicles are expected to contribute to 66% of the passenger-kilometers traveled in 2040, while generating $1.1 trillion in mobility services revenues and $0.9 trillion in sales.

Achieving Level 5 autonomy, which is a complete elimination of human intervention, is becoming increasingly achievable courtesy initiatives by automakers like Tesla TSLA, General Motor GM and Volkswagen, globally. While Tesla’s Autopilot and GM’s Cadillac Super Cruise are said to be operating at Level 2+ and Level 2, respectively, 2019 Audi A8L is anticipated to provide Level 3 automation.

The rapid development in the self-driving vehicle space can primarily be attributed to breakthroughs in technology, with the integration of robust AI and ML capabilities in advanced driver-assistance systems (ADAS).

Moreover, improving neural networking capabilities and advancements in digital mapping and obstacle recognition functionalities are expected to lead to safer navigation, reduction in accidents, and commuter comfort.

Technology companies like Alphabet GOOGL, NVIDIA NVDA, Intel INTC and Velodyne are partnering automotive players to drive innovation in simulation software, automotive sensors, cameras, and LiDars, to facilitate driverless transport.

Growth Prospects Massive

Increasing popularity of mobility as a service (MaaS) solutions and accelerated deployment of 5G are anticipated to be tailwinds. According to Kenneth Research data, self-driving car market is expected to hit $173.15 billion by 2023 at a CAGR of 36.2%.

Further, per a report by Grand View Research, autonomous cars and trucks market is projected to hit 4,223 thousand units by 2030 at a CAGR of 63.1%.

The prospects are attracting both automakers and tech companies to this domain. The optimism in this space can be gauged from notable performance of Global X Autonomous & Electric Vehicles ETF (DRIV), which has gained 16.4% year to date.

Notably, automakers and tech companies like Tesla, Chyrsler, Volvo, Volkswagen, General Motors, Alphabet, NVIDIA, Intel and Apple AAPL can be considered as the pioneers of this industry.

Tech Companies Leading the Way

Alphabet’s Google is striving to enhance its self-driving business, Waymo, which already boasts of significant milestones. Waymo has also crossed 10 million miles and driven over 10 billion virtual miles, per TechCrunch.

Moreover, Waymo's robust simulation testing is expected to enable its self-driving technology to learn without the risk of causing or encountering road traffic accidents. Waymo has transported 6,299 passengers of robotaxi pilot program based in California in the recent past, per TechCrunch. Notably, Waymo, Zoox, among others, are developing technologies to facilitate Level 5 automation, which instills confidence in the stock.

Additionally, General Motors recently signed up for Google’s embedded technology for navigation, voice activated controls and other vehicle infotainment functions starting 2021 for all the cars excluding the ones for China.

Meanwhile, NVIDIA’s steady focus on developing more updated AI tech for self-directed cars by enhancing capabilities of its DRIVE AP2X Level 2+ automated driving solutions is noteworthy. The GPU-giant has unveiled DGX SuperPOD with an aim to accelerate its autonomous-vehicle deployment program.

Notably, NVIDIA expects its automotive TAM (Total Addressable Market) to be $30 billion by 2025, comprising $25 billion for driving, $3 billion for training/development of deep neural networks and $2 billion for validation and testing. These projections buoy optimism regarding the prospects of NVIDIA in the space.

However, NVIDIA is expected to face significant challenge from Intel’s initiatives post Mobileye acquisition. Notably, Intel estimates “Passenger Economy” to reach $7 trillion market by 2050 as self-driving gains popularity.

The low power consumption of Mobileye chips and ability to create maps for self-driving systems via its Road Experience Management platform are key catalysts. Intel has secured a deal to supply EyeQ5 chip in 8 million driverless vehicles to a leading European automaker recently.

Moreover, Intel is focused on enhancing safety measures of its self-driving technology. Mobileye currently supports Level 2 automation and is integrated in Nissan's ProPILOT 2.0 and NIO's pilot vehicles.

Further, Apple’s driverless car initiative, Project Titan, has been in talks for quite some time. The iPhone-maker recently acquired self-driving shuttle firm, Drive.ai. Reportedly, the company is focused on developing driverless vehicle software. It has also been rumored that the company is currently working on an electric van (EV).

Further, Apple filed a self-driving car disengagement report with the California DMV in February. Per the filing, the company logged 871.65 disengagements (the number of times a human driver has to take over control of an ADS) per 1,000 miles, making it 1.1 miles per disengagement, which is a testament to the accuracy of its technology. The company is now expected to launch its driverless EV/car in 2021.

Zacks Rank

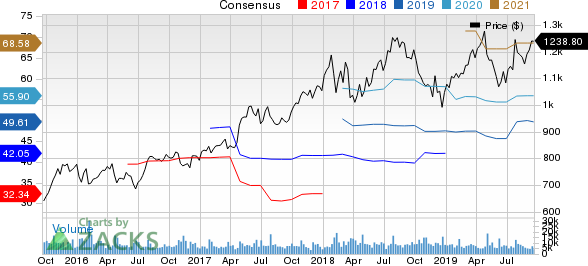

Currently, Alphabet carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Meanwhile, Intel, Apple and NVIDIA carry a Zacks Rank #3 (Hold).

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Click to get this free report Alphabet Inc. (GOOGL) : Free Stock Analysis Report General Motors Company (GM) : Free Stock Analysis Report Tesla, Inc. (TSLA) : Free Stock Analysis Report Apple Inc. (AAPL) : Free Stock Analysis Report Intel Corporation (INTC) : Free Stock Analysis Report NVIDIA Corporation (NVDA) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research