AzValor Iberia's Top 4 Buys in the 1st Quarter

The managers of azValor Iberia FI (Trades, Portfolio) disclosed this week that the fund's top four buys were Altri SGPS SA (XLIS:ALTR), Euskaltel SA (XMAD:EKT), ArcelorMittal SA (LUX:MTL) and Aena SME SA (XMAD:AENA).

The fund, part of azValor Asset Management, invests approximately 75% of its net assets in Spanish and Portuguese companies listed on secondary markets with Spanish securities not exceeding 90% of the fund. The managers seek long-term capital appreciation through securities with an understandable business, sustainable competitive advantages, high return on capital employed and quality company management.

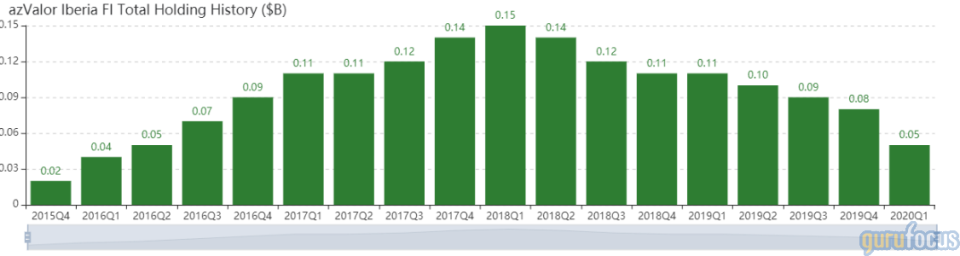

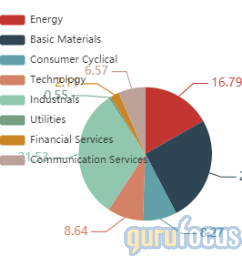

As of quarter-end, the fund's $47 million equity portfolio contains 29 stocks, of which nine represent new holdings. The portfolio has a 19% turnover ratio and over 25% weight in the following two sectors: industrials and materials.

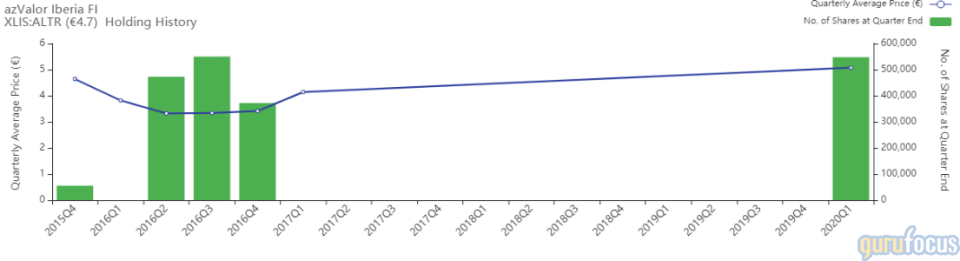

Altri

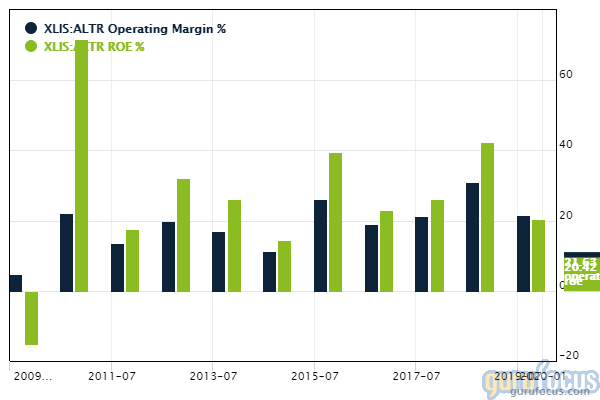

The fund purchased 547,514 shares of Altri, giving the position 4.26% weight in the equity portfolio. Shares averaged 5.07 euros ($5.49) during the first quarter.

The Portuguese forest products company owns and manages eucalyptus forests and harvests timber. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include expanding operating margins, a three-star business predictability rank and a return on equity that outperforms over 91% of global competitors.

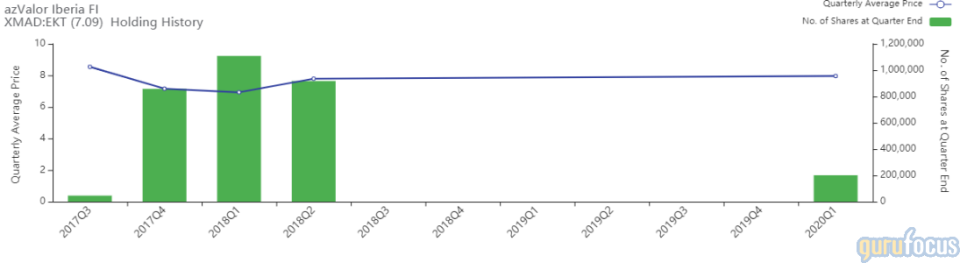

Euskaltel

The fund purchased 200,742 shares of Euskaltel, giving the holding 2.49% weight in the equity portfolio. Shares averaged 7.96 euros during the first quarter.

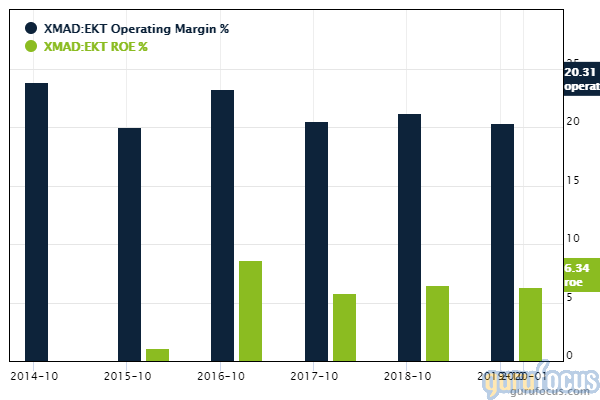

The Spanish telecommunication services company provides fixed and mobile telecom services, broadband and wireless internet, digital television and other services. GuruFocus ranks the company's profitability 5 out of 10: operating margins are outperforming over 80% of global competitors while returns are outperforming just 51% of global telecom services companies.

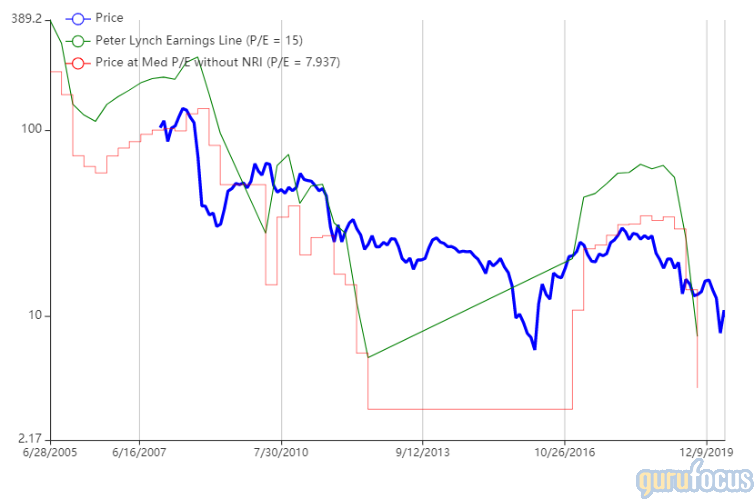

ArcelorMittal

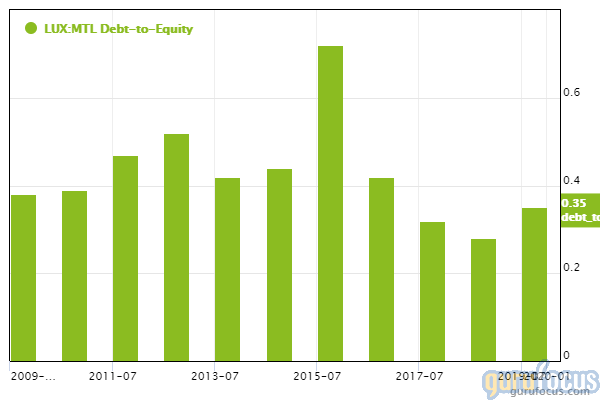

The fund purchased 140,162 shares of ArcelorMittal, giving the position 2.60% weight in the equity portfolio. Shares averaged 12.86 euros during the quarter.

GuruFocus ranks the Luxembourg-based steelmaker's financial strength 5 out of 10 on the back of cash-to-debt and debt-to-equity ratios outperforming just over 53% of global competitors.

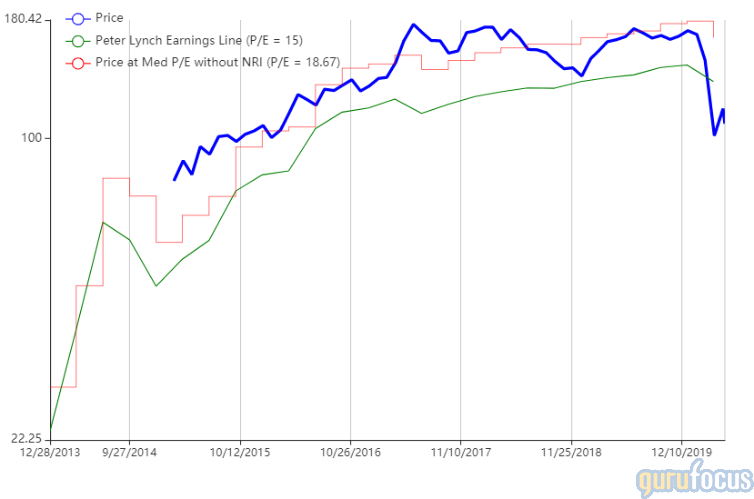

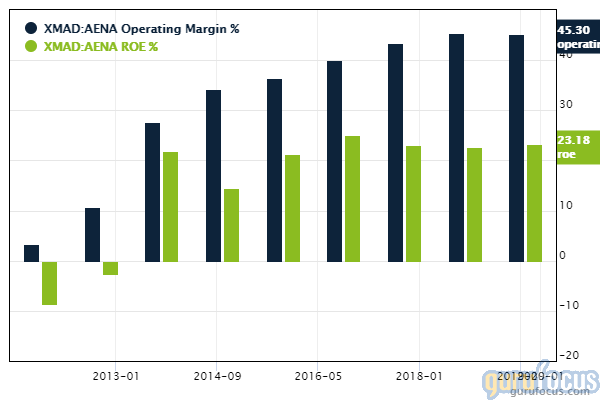

Aena

The fund purchased 9,395 shares of Aena, giving the position 2.01% weight in the equity portfolio. Shares averaged 150.21 euros during the quarter.

Madrid-based Aena manages approximately 46 airports in Spain and participates in the management of 16 additional airports in Europe and America. GuruFocus ranks the company's profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, expanding operating margins and a return on equity that outperforms over 89% of global competitors.

Disclosure: No positions.

Read more here:

Matthews China Fund Buys 4 Stocks in the 1st Quarter

5 Latin American Stocks to Consider in Honor of Cinco de Mayo

Francisco Garcia Parames' Cobas Funds Buys 4 Stocks in the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.