Can Baidu Put An End To Shareholder Suffering: Earnings After The Bell

The Google of China is releasing earnings after the bell today and analyst expectations are low. Baidu BIDU continues to disappoint investors with shares having lost more than 53% of their value over the past 52-weeks. Could this earnings mark the end of shareholder suffering?

Earnings estimates for Baidu have dropped significantly over the past 3 months. Full-year EPS projections have fallen 34%, 2020 estimates fell 31%, and 2021 estimates have fallen 38%.

BIDU analysts are estimating a Q2 EPS of $0.94 on $3.77 billion in sales, which would represent declines of 70.4% and 4% respectively. Analysts are projecting the worst June quarter EPS for as far back as I can see (2012).

BIDU is a big mover on quarterly reports with an average share price movement of 8.2% following the last 8 releases. 4 out of the 8 quarterly releases have resulted in negative price action with 3 out of the last 4 reports causing the share price to slide.

The Business

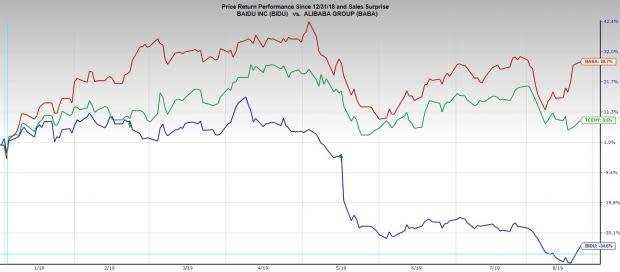

China’s tech powerhouses include Baidu, Alibaba BABA, and Tencent TCEHY spelling out the acronym BAT. Baidu is slowly losing its place with China’s tech defining names. BIDU has lost $65 billion in market value since its peak last year and continues to fall having a market cap of only $33 billion compared to the $400+ billion market cap that both BABA and TCEHY boast. Below illustrates BAT’s performance since the beginning of 2019.

Baidu had experienced a near-monopoly in China’s search engine market when Google departed China in 2010 due to government censorship. BIDU shares soared over 650% into mid-2018. These returns began to retreat once competition started seeping its way into Baidu’s market share.

Baidu still has the majority of the search engine market share in China, but the steep competition is taking a toll on the firm’s ability to profit. The saturating space is causing advertising pricing pressures and deteriorating the business’s margins.

Baidu is scrambling to broaden its mobile product offering as other firms fill in the cracks in China’s social media markets.

Baidu is shifting its focus to AI. Baidu CEO Robin Li commented on its AI segment in last quarter’s earnings saying, “we are leveraging Baidu AI to provide enterprise solutions to businesses and local governments, which significantly expands our total addressable market (TAM).” It might be sometime before its AI initiatives can be monetized. Baidu’s AI investment is a long-term play that could expand its TAM to trillions if they are able to properly execute in high demand categories.

IQiyi IQ is Baidu’s video streaming platform and is currently China’s largest video streaming service in China. This subsidiary was created 9 years ago and went public in the US last year, separately from Baidu.

IQiyi has yet to see a profit as costs rise faster than revenues Some analysts are projecting an inability for IQ ever to turn a profit. The structural differences between iQiyi and video streaming services in the US make this subsidiary challenging to value.

Take Away

Baidu’s earnings this evening could be pivotal for the firm as investors evaluate whether Baidu can revitalize grow and remain profitable. Look margin expansions as well as upwardly adjusted management guidance to drive BIDU’s share price. More color on the AI business and when it expects monetization to occur could be a game-changer for shareholders.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Click to get this free report Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report Baidu, Inc. (BIDU) : Free Stock Analysis Report Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report iQIYI, Inc. Sponsored ADR (IQ) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research