The Bandhan Bank (NSE:BANDHANBNK) Share Price Has Gained 15% And Shareholders Are Hoping For More

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the Bandhan Bank Limited (NSE:BANDHANBNK) share price is up 15% in the last year, clearly besting than the market return of around -0.7% (not including dividends). That's a solid performance by our standards! We'll need to follow Bandhan Bank for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Bandhan Bank

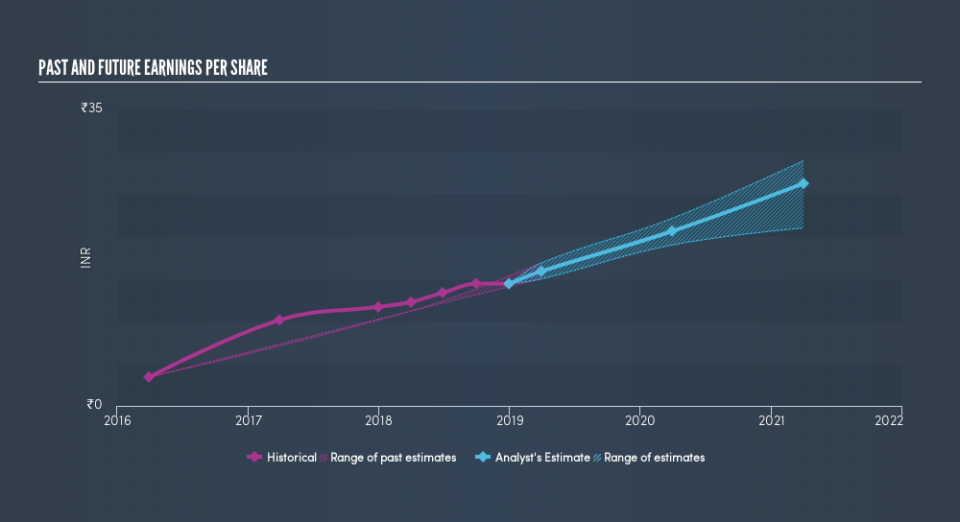

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Bandhan Bank grew its earnings per share (EPS) by 23%. This EPS growth is significantly higher than the 15% increase in the share price. So it seems like the market has cooled on Bandhan Bank, despite the growth. Interesting.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Bandhan Bank's earnings, revenue and cash flow.

A Different Perspective

Bandhan Bank shareholders should be happy with the total gain of 15% over the last twelve months, including dividends. And the share price momentum remains respectable, with a gain of 33% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Bandhan Bank may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.