Barclays (LON:BARC) Share Prices Have Dropped 59% In The Last Five Years

It is a pleasure to report that the Barclays PLC (LON:BARC) is up 31% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 59% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

View our latest analysis for Barclays

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Barclays became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

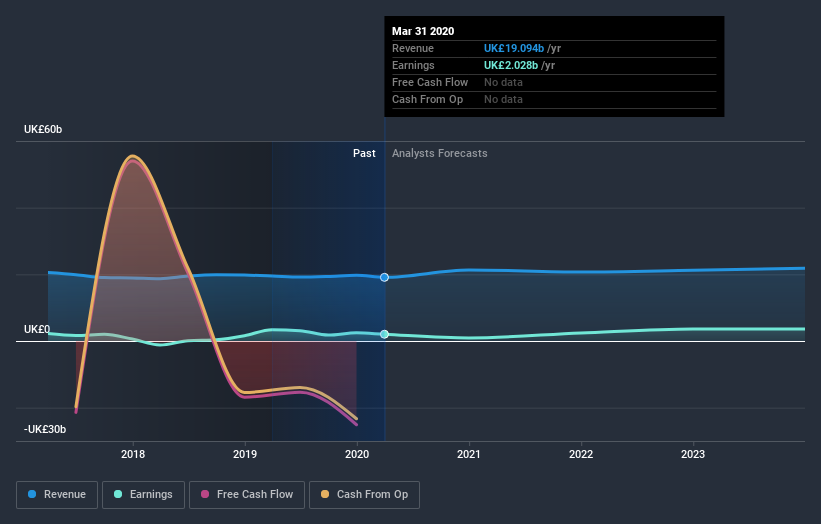

The revenue decline of 0.7% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered Barclays' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Barclays shareholders, and that cash payout explains why its total shareholder loss of 54%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Barclays shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 10%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9.1% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Barclays better, we need to consider many other factors. Take risks, for example - Barclays has 4 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.