Beaufort County property reassessment is coming up. Will you be paying higher property taxes?

For the first time in five years, property taxes will be based on an updated assessment to be mailed out in the first two weeks of September. Additionally, the millage rate will be lowered by 4% to offset a possible tax increases resulting from higher property valuations.

The last time Beaufort County assessed real estate property values for tax purposes was in 2018, before the pandemic and before home prices and property values skyrocketed across the county, especially in the Hilton Head area.

In the first two weeks of September, Beaufort County will assign new fair market value to properties, potentially changing how much property owners pay in property taxes.

“Look at what has distinctively happened with market values over the last five years,” Realtor Chip Collins said. “Everybody generally and pretty much immediately concludes that their assessed value is going to go up. That’s pretty much a given.”

Property tax payments can be made to the County Treasurer starting September 30. Taxes for the current year must be paid by January 15 of the following year.

To help Beaufort County residents better understand the state-mandated county-wide assessment, The Island Packet and Beaufort Gazette spoke with Beaufort County Assessor Ebony Sanders, county councilpersons and real estate agents.

Here is what property owners need to know:

What is a property reassessment?

The state requires that once every five years, all real property — including both land and buildings — be re-evaluated to reflect current fair market value. It includes mobile homes but doesn’t include non-real property such as cars, boats or things that aren’t attached to real estate.

Why does it matter?

It impacts how much homeowners pay in property tax. Property taxes are calculated by multiplying:

Appraised Property Value x Assessment Ratio x Millage Rate

Homeowners whose primary residence is in the county have a four percent assessment ratio; for those with secondary residences, it’s six percent.

The millage is the amount per $1,000 used to calculate taxes on property. One mill equals 1/1000 of a dollar or 1/10 of a cent.

For example, if the tax rate is 51.7 mills, multiply .0517 by the assessed value (Property Value x Assessment Ratio) to determine the amount of property tax due. The County also has a tax calculator to determine what property taxes are: https://apps.beaufortcountysc.gov/tax-calculator/

It’s not updated with next year’s millage rates.

Will property owners be paying more in taxes?

“It really depends on several factors,” District 5 County Councilperson Joseph Passiment said.

Sanders estimates that most of property owners will see a 15% increase in their taxable property value, but that doesn’t always translate into paying higher taxes because of millage rollback and a taxable capped value.

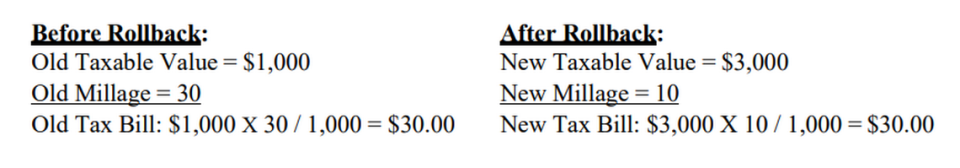

Millage rollback

The county rolls back how much millage each property owner owes to prevent over taxing. This can occur when the overall assessed values increase to be a sum larger than what is needed to meet the county’s budget. The calculation works for the county as a whole and individuals can see increases or decreases in their property taxes depending on whether their assessed value increases or decreases more than the county or district average.

The rollback was already factored into this year’s budget, and the millage rate went down from 53.9 for the 2023 budget to 51.7 for the 2024 budget.

Are there caps on how much taxable property value can go up?

Yes. To help prevent residents from being priced out of Beaufort County, an owner’s taxable value increase more than 15% more than the previous market value. For example, if a property was assessed at $100,000 in 2018, but $200,000 in this reassessment, the most the property owner could be taxed on is $115,000.

How is property assessed?

The Assessor’s Office uses a “mass appraisal process” to determine what the value of each person’s home is. This means that no one is door-knocking or home-visiting to determine a value. Instead, the office runs computer models to determine what each property is worth based on its physical characteristics. The data includes information such as heated square footage, garages, decks, pools, type, quality of construction, land area, water features and several other attributes. From there, it’s grouped by location and market characteristics to determine a value.

What if a property owner doesn’t agree with the assessment?

There will be information on the appeal process provided with assessment notices. Property owners who want to file an appeal must file a written notice to the Assessor’s Office within 90 days of receiving their assessment. In their appeal, they must state why the new value is incorrect and provide supporting documents or facts to back up their claim. The County will either approve or deny the appeal. If denied the property owner can appeal again to the County-Council-appointed Board of Assessment Appeals all the way up to the the South Carolina Supreme Court, according to Sanders.

Supporting documents could include a recent appraisal or evidence of comparable sales. Owners can use the county’s free Property Max tool, which details property sales. They could also reach out to a real estate agent, who will have access to data on comparable property sales for their type of home and neighborhood. It’s important to remember that the evidence must be as of December 31, 2022, not after.

Other examples of supporting documents include:

Closing statement or sales contract reflecting an “arms-length transaction” on the open market.

Recent comparable sales of similar properties in the same neighborhood or a comparable neighborhood.

Estimates for repairs showing structural issues or conditions that affect the house’s market value.

Photos of the structure showing existing structural issues or conditions that a buyer may require a seller to repair before closing.

Statement of construction costs or recent bills demonstrating the value of new construction or additions.

Who can submit an appeal?

Only the following people can make an appeal on behalf of a taxpayer:

Taxpayer

A member of the taxpayer’s immediate family (if they aren’t compensated)

Taxpayers’ full-time employee

Partner of partnership

Attorney

Certified Public Accountant (CPA)

An Internal Revenue Service enrolled agent (refer to the Internal Revenue Service)

A real estate appraiser who is registered, licensed or certified by the South Carolina Real Estate Appraiser’s

Do property owners still have to pay their tax bill if they don’t agree?

If an appeal is pending, a property owner may request to pay a lower amount based on 80% to 99% of the taxable value. The request must be in writing to the Assessor’s Office on or before December 31. If the appeal is unsuccessful, property owners may be charged interest on the amount of the underpayment.

Where can property owners get more information?

Taxpayers can access the Assessor’s Office’s guide at: https://www.beaufortcountysc.gov/assessor/2023-reassessment-guide.pdf

Sanders said the office will announce community events at Beaufort County libraries closer to September.