Bed Bath & Beyond Skyrockets on Comparable Sales Gain

- By Margaret Moran

Before the market opened on Oct. 1, Bed Bath & Beyond Inc. (NASDAQ:BBBY) reported financial results for its second quarter of fiscal 2020, which ended on Aug. 29.

The home goods retailer reported unexpectedly good results, including comparable sales growth of 0.6%, representing the first comparable sales growth since 2016 in a quarter where analysts had expected a decline of 2.1%.

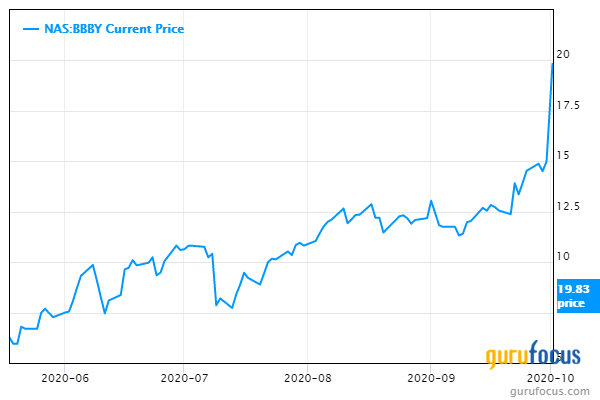

In response to the positive news, investors bid the stock up more than 33% over the course of the morning to trade around $19.83 by midday.

Earnings results

Revenue came in at $2.69 billion for the quarter, down slightly from $2.71 billion in the prior-year quarter. GAAP net earnings per share were $1.75, a positive switch from a net loss of $1.12 per share in the same period of last year. Analysts had been expecting $2.62 billion in revenue and 1 cent in earnings per share.

Highlights for the quarter included an 89% jump in digital sales, a 36% jump in Ebitda and a 1,000 basis points increase in the gross margin to 36.7% compared to the second quarter of 2019. Comparable sales were offset by a 12% decline in comparable store sales as more customers moved to digital channels.

The company said it had 2 million new customers during the quarter, mostly younger customers who purchased more items per trip. Although Wall Street may find this increase confusing, the company's executives explained on the earnings report that its uptick in popularity was to be expected with people spending more time at home.

"When home is everything, we're really poised to be the epicenter of that," CEO Mark Tritton said in an interview with CNBC. "We were agile about getting after that."

The company's cash flow for the quarter was $750 million, including operational earnings and working capital and net of capital investments. It paid down $500 million worth of debt, or 30%, through a bond tender offer and repayment of a bank loan. Bed Bath & Beyond ended the quarter with a total liquidity position of $2.2 billion, including a new $850 million secured asset-based lending facility. In short, the company ended the quarter with a net increase in debt, but said debt is now cheaper on average.

Looking forward

Bed Bath & Beyond is continuing to invest in improvements to its digital channel, announcing earlier this week that its stores would be rolling out a same-day delivery service in partnership with Shipt and Instacart.

Tritton described the company's growth strategy as follows:

"Our growth strategy is unlocking improved financial performance, and the marked improvement in our second quarter financial results reflects the potential of our digital-first, omni-always transformation and our efforts to build a modern, durable platform for success. We've taken direct action to stabilize our business, including reducing our cost structure, enhancing our financial flexibility, and investing where it matters most to our customers. At the same time, we have assembled a world-class and experienced leadership team to rebuild our authority in Home and modernize our operations to deliver a truly customer-inspired and omni-always shopping experience."

The company did not offer guidance numbers.

Valuation

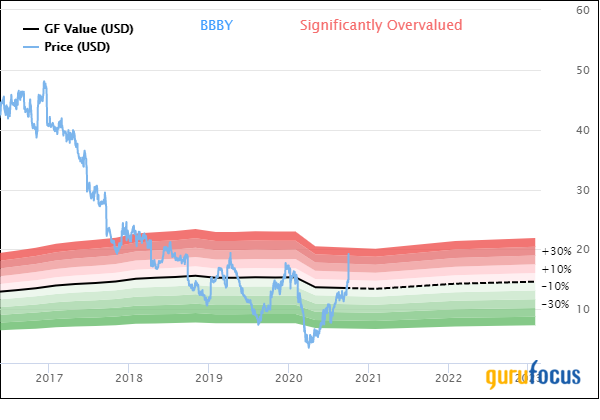

Before the second-quarter earnings report, Bed Bath & Beyond could be said to be "fairly valued," trading right near the intrinsic value calculated by the GuruFocus Value Line. However, over the course of a less than a day, the stock has been catapulted to the "significantly overvalued" range.

The price-book ratio is 1.65 compared to the industry median of 1.44, while the price-sales ratio is 0.24 compared to the industry median of 0.62. The dividend yield stands at 2.66%.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.