Bed Bath & Beyond Tumbles on 1st-Quarter Sales Decline

Shares of Bed Bath & Beyond Inc. (NASDAQ:BBBY) tumbled as much as 10% in aftermarket trading on Wednesday on the back of reporting a double-digit sales decline during the company's fiscal first quarter.

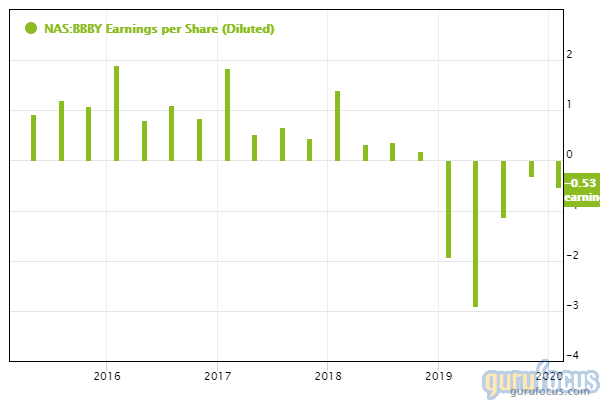

For the quarter ending May 30, the Union, New Jersey-based retail company reported a net loss of $2.44 per diluted share, compared with a net loss of $2.91 per diluted share in the previous quarter. Adjusted net losses of $1.96 per share were worse than the Refinitiv estimate of $1.22 per share.

Coronavirus-related shutdowns slash company sales nearly in half

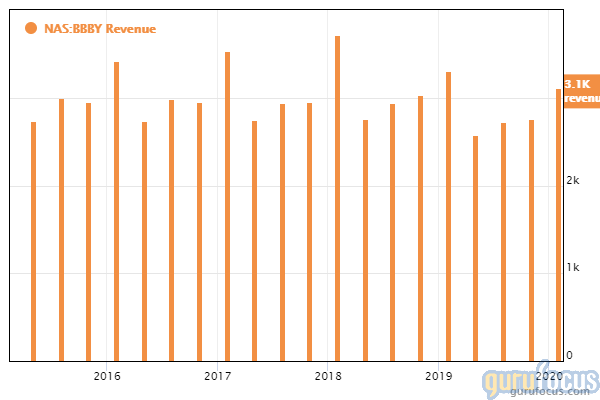

Bed Bath & Beyond CEO Mark Tritton said that the coronavirus outbreak from March through May significantly impacted company operations, including the loss of sales due to temporary store closures and marginal pressure from the substantial channel shift to digital. Although digital sales climbed over 100% during April and May, total sales declined 49%, driven by a 77% decline in store sales.

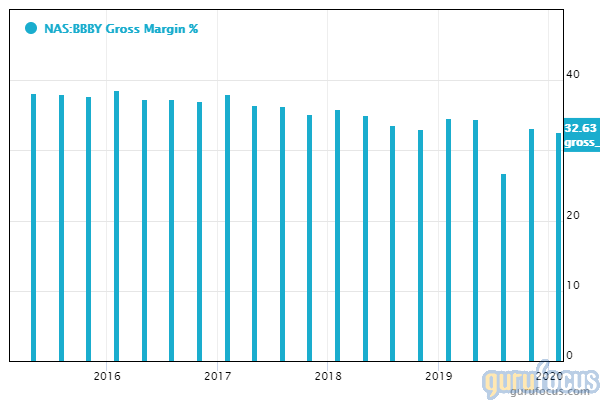

Digital sales accounted for nearly 66% of total sales as the company expanded its buy online, pick up in store and curbside services. Despite this, gross profit margins tumbled 7.80% due to the shift of sales to digital platforms and higher fulfillment costs. GuruFocus warns that Bed Bath & Beyond's gross margins have declined approximately 3.9% per year on average over the past five years, suggesting low profitability.

Company announces closure of 200 stores

Bed Bath & Beyond announced it will close 200 stores over the next two years to rebalance its real estate portfolio. Tritton told CNBC in a phone interview that "there were a number of stores dragging us down." The company also announced efforts to reduce cost of goods sold and drive supply chain transformations to address the gross margin pressures stemming from the switch to digital channels. Bed Bath & Beyond expects these initiatives to generate annualized cost savings of between $250 million and $350 million.

Shares fall on sales decline

Shares of Bed Bath & Beyond plunged to an aftermarket low of $9.28, down 10.80% from the closing price of $10.41 on the sales decline. The company is not providing financial guidance for the year as the coronavirus pandemic could adversely affect the company's store reopening plans.

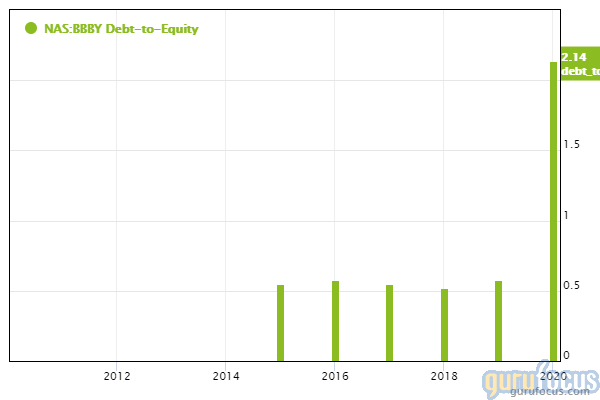

GuruFocus ranks the company's financial strength 5 out of 10: Although it has a solid Altman Z-score of 3.34, Bed Bath & Beyond has a weak Piotroski F-score of 3 and a debt-to-equity ratio that underperforms 82.54% of global competitors.

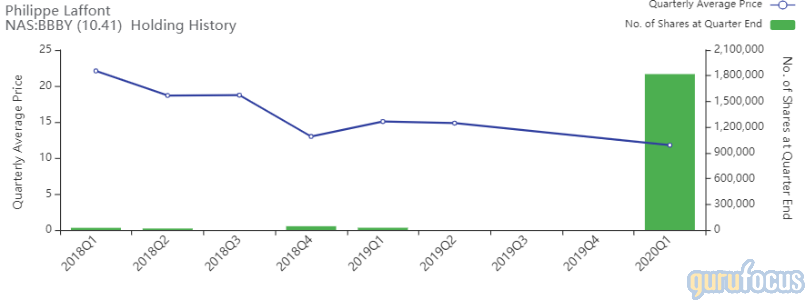

Gurus with holdings in Bed Bath & Beyond include Philippe Laffont (Trades, Portfolio), Hotchkis & Wiley and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

Disclosure: No positions.

Read more here:

5 Greenblatt Magic Formula Biotech Stocks to Weather the Summer Coronavirus Storm

4 High-Quality Companies With Low Shiller Price-Earnings Ratios

Spiros Segalas' Top 5 Buys in the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.