Should Bedmutha Industries (NSE:BEDMUTHA) Be Disappointed With Their 29% Profit?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Bedmutha Industries Limited (NSE:BEDMUTHA) shareholders might be concerned after seeing the share price drop 11% in the last quarter. On the bright side the share price is up over the last half decade. Unfortunately its return of 29% is below the market return of 56%.

Check out our latest analysis for Bedmutha Industries

Because Bedmutha Industries is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

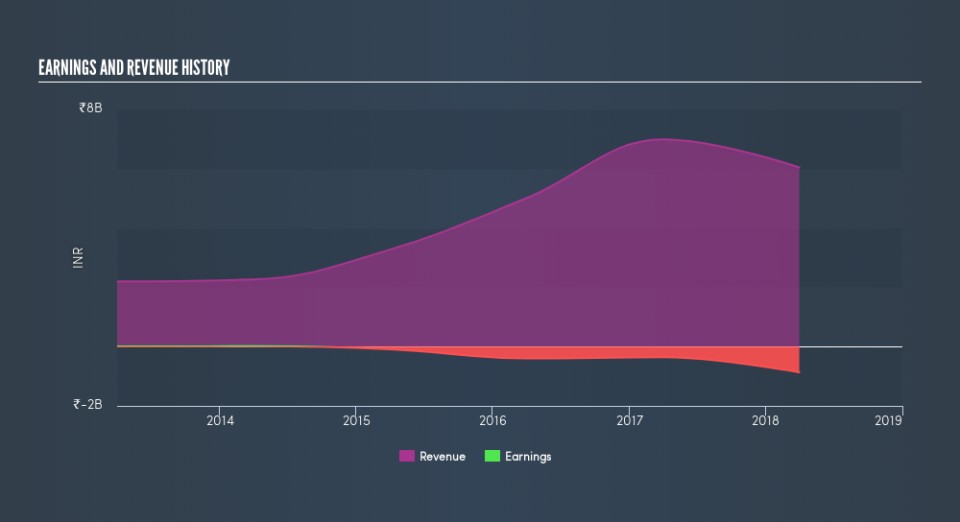

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Take a more thorough look at Bedmutha Industries's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Bedmutha Industries shareholders are down 14% for the year. Unfortunately, that's worse than the broader market decline of 5.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 5.2% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.